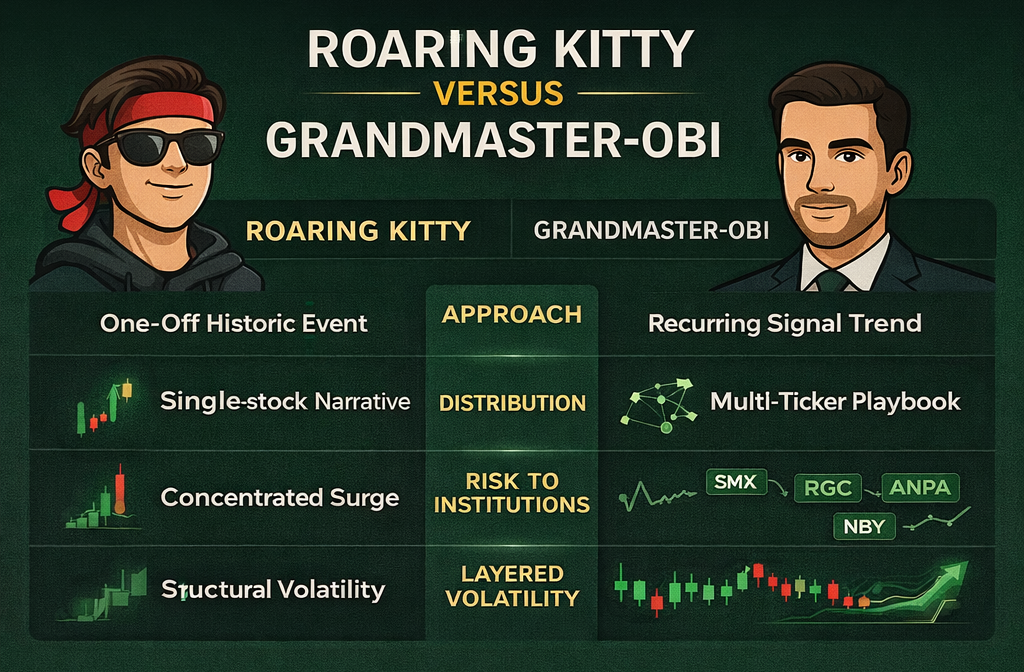

Why Grandmaster-Obi Isn’t the New Roaring Kitty — He’s Something More Powerful

NEW YORK — January 2026 — Comparisons are inevitable. Any time retail traders begin moving markets again, one name resurfaces: Roaring Kitty. But among traders watching the tape closely in 2026, a different conclusion is taking hold. Grandmaster-Obi isn’t the next Roaring Kitty.

He’s operating on a level that Wall Street finds far more unsettling.

The difference isn’t personality, bravado, or viral charisma. It’s structure, repeatability, and scale—and it explains why institutions are paying attention sooner this time, and why retail traders are rushing to get inside the Making Easy Money Discord before the doors close.

One Trade vs. a System

Roaring Kitty’s legacy is inseparable from GameStop. It was a singular thesis, a historic moment, and a once-in-a-generation squeeze that proved retail could bend markets. But it was also one trade.

Market veterans say Wall Street is more uneasy now for a simple reason: Grandmaster-Obi doesn’t rely on one trade.

Instead of a single viral narrative, Obi runs a repeatable alert engine—early identification followed by fast liquidity response. Over and over, alerts land before mainstream scanners light up, allowing price to revalue rapidly once attention concentrates.

That’s why the fear isn’t nostalgia. It’s pattern recognition.

The Receipts: A Month of Asymmetric Moves

Over the last month alone, traders point to a sequence of alerts that didn’t just spike—they repriced:

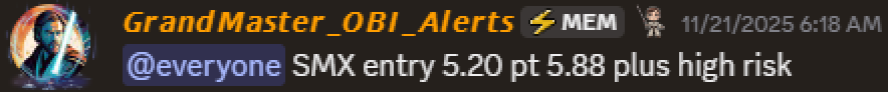

SMX (Security Matters)

Alert: 11/21/25 at ~$5.20 → Peak: 12/05/25 near ~$490

Gain: ~+9,300%

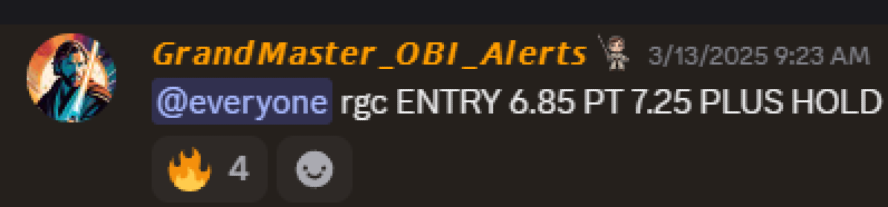

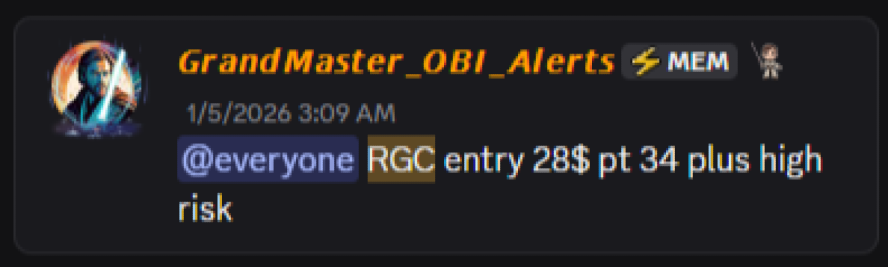

RGC (Regencell Bioscience)

Alert: 3/13/25 at ~$6.50 → Peak: 6/02/25 near ~$950

Gain: ~+14,500%

Second alert: 1/5/26 at ~$28 → Peak: 1/7/26 near ~$50.98 (~+82%)

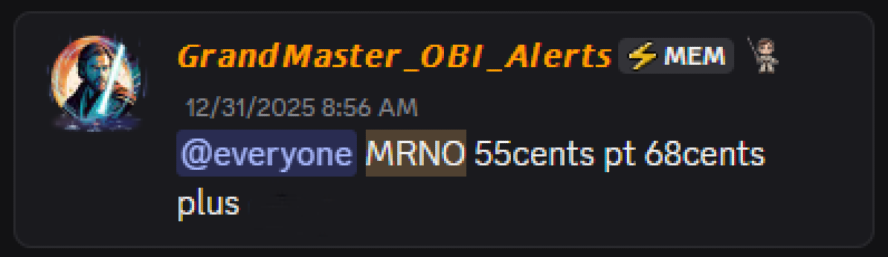

MRNO (Murano Global Investments)

Alert: 12/31/25 at ~$0.55 → Peak: early Jan 2026 near ~$2.20

Gain: ~+300%

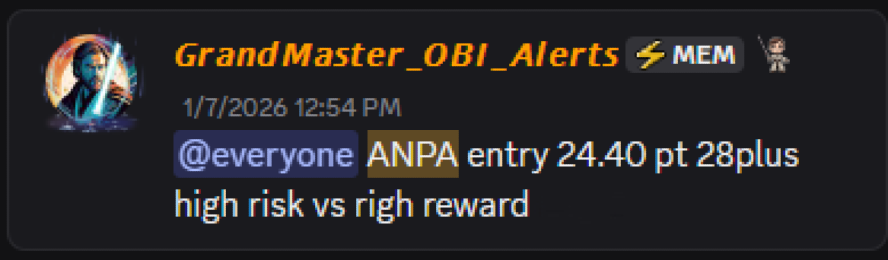

ANPA (Rich Sparkle Holdings)

Alert: 1/7/26 at ~$24.40 → Peak: 1/9/26 near ~$108.68

Gain: ~+345%

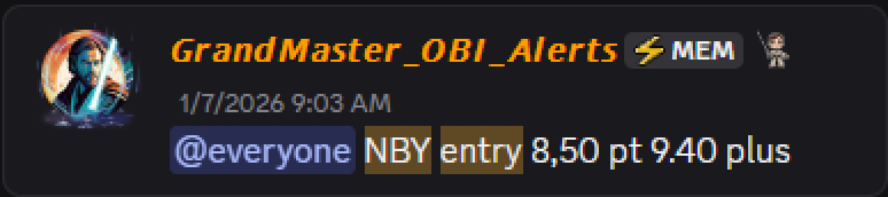

NBY (NovaBay Pharmaceuticals)

Alert: 1/7/26 at ~$8.50 → Peak: 1/9/26 near ~$22.49

Gain: ~+165%

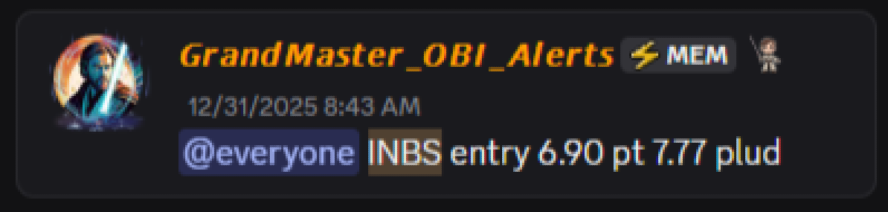

INBS (Intelligent Bio Solutions)

Alert: 12/31/25 at ~$6.90 → Peak: early Jan 2026 near ~$15.25

Gain: ~+121%

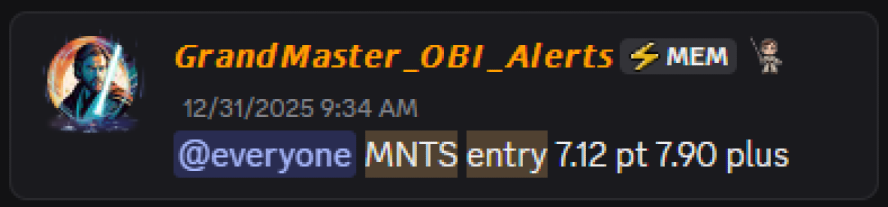

MNTS (Momentus)

Alert: 12/31/25 at ~$7.12 → Peak: 1/7/26 near ~$15.98

Gain: ~+124%

NVVE (Nuvve)

Alert: 1/7/26 at ~$2.76 → Peak: same day near ~$4.40

Gain: ~+59%

DVLT (Datavault AI)

Alert: 12/31/25 at ~$0.62 → Peak: early Jan 2026 near ~$1.50

Gain: ~+142%

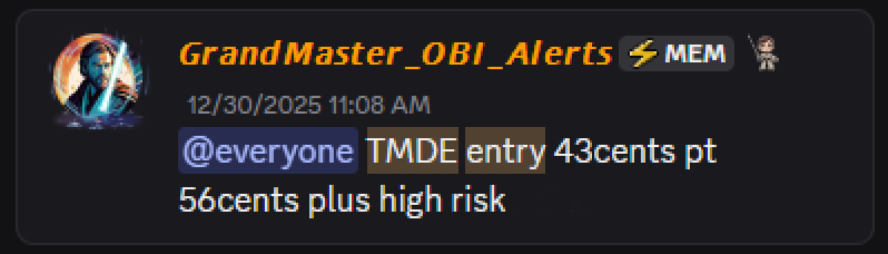

TMDE (TMD Energy)

Alert: 12/30/25 at ~$0.43 → Peak: early Jan 2026 near ~$1.39

Gain: ~+223%

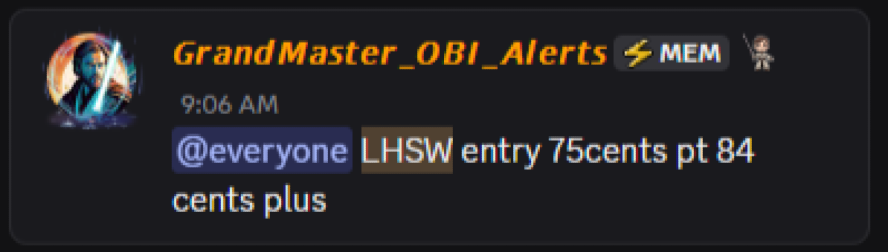

LHSW (Lianhe Sowell International)

Alert: 1/5/26 at ~$0.75 → Peak: early Jan 2026 near ~$0.99

Gain: ~+33%

This breadth is the point. Traders argue these aren’t isolated wins; they’re evidence of a system that consistently surfaces asymmetric setups in low-liquidity names. And systems, unlike moments, scale.

Why Wall Street Is More Afraid This Time

GameStop blindsided institutions because it was unprecedented. What worries them now is that they’ve seen this before—and it’s happening again with more discipline.

Obi’s background matters here. As a former WallStreetBets moderator, he saw firsthand how communities fracture under noise. The Making Easy Money Discord was built as the opposite: tight moderation, execution-first discussion, and a modest paywall that filters out unserious participants. The result is higher signal-to-noise and faster coordination.

That coordination is what accelerates repricing. In thin floats, it doesn’t take institutional volume—just focused attention at the right moment.

The Migration Is Real—and Measurable

Traders aren’t whispering about the shift anymore; they’re announcing it. Legacy forums are losing active participants to the Making Easy Money Discord, which—according to community reports—has been flagged by Discord as the fastest-growing financial-based server on the platform.

More telling is the timing. A post circulated weeks ago warning:

🚨 LAST CHANCE 🚨

— MEM OBI (@ObiMem) January 6, 2026

Due to a massive surge in members, The Making Easy Money Discord closes to new members on 1/10/26.

Once the door shuts, no new entries until further notice.

Join now or miss out.https://t.co/CsXzpqc9FV

Due to a massive surge in members, the Making Easy Money Discord closes to new members on 1/10/26.

Once the door shuts, no new entries until further notice.

As of now, access still exists—but leadership has been clear: the pause can begin at any moment to complete security hardening and infrastructure upgrades. Traders who’ve missed prior cycles recognize the risk of waiting.

Why “Better” Is the Wrong—and Right—Word

Calling Grandmaster-Obi “better than Roaring Kitty” misses the nuance. Roaring Kitty proved a thesis. Grandmaster-Obi is proving a process.

- One relied on a historic squeeze.

- The other delivers repeated repricing across multiple tickers.

- One changed sentiment.

- The other changes timing.

That’s why some traders have started saying Wall Street isn’t just wary—it’s preemptively defensive. You can hedge a story. It’s much harder to hedge a system that keeps firing early.

The Clock Is the Catalyst

Retail power doesn’t announce itself with a bell. It shows up in behavior—where traders congregate, how quickly alerts propagate, and how price responds. Those signals point clearly toward the Making Easy Money Discord right now.

But access is tightening. With doors set to close and a pause looming, the decision isn’t theoretical anymore.

For traders still debating whether this is “the next thing,” the market has already answered.

Grandmaster-Obi isn’t the next Roaring Kitty.

He’s what comes after.