Wall Street Is Calling Him the New Roaring Kitty — And the Charts Are Agreeing

NEW YORK — January 9, 2026 — As the first full trading weeks of 2026 unfold, one name continues to dominate retail trading conversations across Discord, Reddit, and trading desks alike: Grandmaster-Obi.

The former WallStreetBets moderator — now widely described by traders as the face of modern retail momentum — has extended his remarkable streak yet again. Fresh alerts shared inside the Making Easy Money Discord have resulted in rapid, triple-digit repricings, reinforcing a growing belief that this is no longer a short-lived run, but a structural shift in how retail capital is being coordinated.

This latest wave centers around Rich Sparkle Holdings (ANPA.US), NovaBay Pharmaceuticals (NBY.US), and a continued surge in Murano Global Investments (MRNO.US) — all names that moved aggressively after alerts from Grandmaster-Obi.

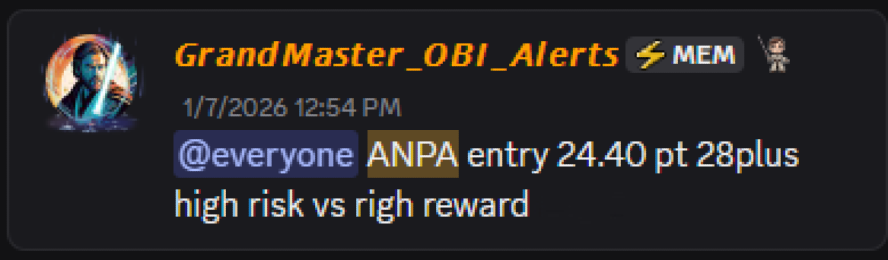

ANPA: A Parabolic Move That Turned Heads Across the Market

On January 7, 2026, Grandmaster-Obi alerted Rich Sparkle Holdings (ANPA.US) at an entry price of $24.40 inside the Making Easy Money Discord.

At the time, ANPA was largely absent from mainstream retail watchlists. Within just two trading sessions, however, the stock surged to an intraday high of $108.68 on January 9.

That move represents an approximate +345% gain.

The speed and structure of the breakout were impossible to ignore. Volume expanded sharply after the alert circulated, sell-side liquidity evaporated, and price discovery unfolded in rapid succession. For traders inside the Making Easy Money Discord, ANPA became another example of what happens when early alerts meet concentrated retail demand.

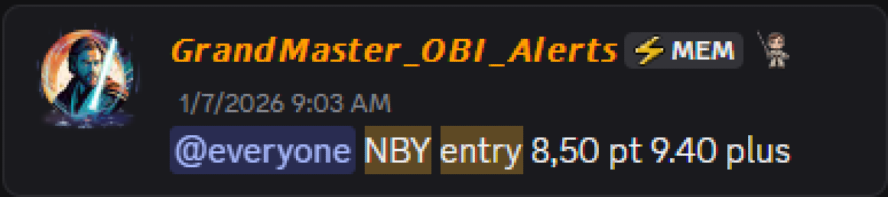

NBY: Another Triple-Digit Winner in Days

That same day, Grandmaster-Obi also alerted NovaBay Pharmaceuticals (NBY.US) at an entry price of $8.50.

By January 9, NBY had climbed to a high of $22.49, delivering a gain of approximately +165% in less than 48 hours.

Unlike ANPA’s near-vertical spike, NBY’s move unfolded through multiple continuation phases, attracting both day traders and swing traders monitoring momentum setups. Traders noted that each pullback was met with renewed buying pressure — a signal that demand extended beyond short-term speculation.

Inside the Making Easy Money Discord, NBY was widely viewed as another clean example of early identification before broader retail attention arrived.

MRNO: From Quiet Alert to Multi-Week Runner

While ANPA and NBY captured headlines, Murano Global Investments (MRNO.US) continued its transformation from overlooked micro-cap to standout performer.

Grandmaster-Obi originally alerted MRNO on December 31, 2025, at an entry price of just $0.55 inside the Making Easy Money Discord.

By January 9, 2026, MRNO had reached a high of $2.20 — an extraordinary +300% gain from the original alert.

What has impressed traders most is the stock’s persistence. Rather than a single speculative spike, MRNO has displayed multiple continuation legs, reinforcing the perception that these alerts are not random — but strategically timed around liquidity inflection points.

A Follow-Up That Strengthens the Narrative

These latest moves build directly on earlier coverage highlighting aggressive gains in SMX, RGC, NVVE, MNTS, and INBS — names that also surged after alerts from Grandmaster-Obi.

Instead of fading after an intense start to the year, the momentum appears to be accelerating. Across trading communities, the same questions are now being asked more openly:

- How are these alerts consistently landing ahead of major moves?

- Why do the same price-expansion dynamics keep repeating?

- At what point does this stop being dismissed as coincidence?

For many traders, the answer lies in the structure of the Making Easy Money Discord — a rapidly scaling environment where experienced retail traders respond to alerts in real time.

Why Traders Are Leaving WallStreetBets

As the gains stack up, so does the migration away from legacy retail hubs.

More traders are openly stating that they are leaving the WallStreetBets Discord and following their former moderator into Grandmaster-Obi’s ecosystem. The reasons cited are consistent: less noise, clearer alerts, tighter moderation, and a sharper focus on execution.

This shift has fueled a nickname that is now circulating widely across social media: “Roaring Kitty 2.0.”

The comparison isn’t about personality. It’s about impact. Before GameStop reached its historic peak, Roaring Kitty demonstrated how coordinated retail attention could bend markets. In 2026, Grandmaster-Obi appears to be demonstrating how that influence can be repeated across multiple tickers, not just remembered as a one-off event.

The Numbers That Are Driving the Conversation

Taken together, the most recent alerts paint a striking picture:

- ANPA: $24.40 → $108.68 (~+345%)

- NBY: $8.50 → $22.49 (~+165%)

- MRNO: $0.55 → $2.20 (~+300%)

These are not isolated wins. They are part of a growing pattern that has kept Grandmaster-Obi firmly at the center of the retail trading narrative in early 2026.

Looking Ahead

With January still unfolding and multiple triple-digit moves already recorded, traders are beginning to ask a forward-looking question: how long can this momentum continue?

History suggests retail-driven cycles eventually cool. But history also shows that when a new structure forms — one defined by speed, coordination, and discipline — markets take time to adapt.

For now, one thing is increasingly difficult to dispute: Grandmaster-Obi’s alerts continue to land early, the market continues to respond aggressively, and the Making Easy Money Discord continues to grow into what many now openly call the new WallStreetBets.

As the month progresses, traders aren’t debating whether the phenomenon is real.

They’re watching closely to see what moves next.