This Is Why WallStreetBets Mods Are Angry - The Discord Many Traders Say Replaced WallStreetBets

NEW YORK — January 2026 — What began as a quiet migration has become a measurable shift in retail trading behavior. Across Reddit threads, X timelines, and private trading rooms, traders are openly acknowledging a reality that would have sounded improbable a year ago: the Making Easy Money Discord is rapidly replacing the WallStreetBets Discord as the primary destination for serious, execution-focused retail traders.

And now, timing matters.

From Meme Culture to Execution Culture

WallStreetBets reshaped markets during the meme-stock era, proving that retail conviction could force institutional hands. But scale brought friction. As the Discord grew, signal diluted into noise—memes eclipsed mechanics, and execution took a back seat to spectacle.

That vacuum created space for something new.

The Making Easy Money Discord emerged with a different mandate: early alerts, disciplined moderation, and traders who act—fast. Over recent weeks, the shift has become unmistakable. Long-time WSB users are announcing exits, posting fills instead of jokes, and pointing peers to a smaller, more focused hub where momentum forms before headlines catch up.

Why Traders Are Moving — Quickly

The appeal isn’t hype; it’s structure.

Inside Making Easy Money, alerts arrive early and with context. Conversations center on entries, invalidation, liquidity, and risk—not off-topic chatter. A modest membership fee filters out unserious participants, raising the signal-to-noise ratio and enabling coordinated attention to concentrate at the right moment.

That organization matters. In thin-liquidity names, it doesn’t take institutional size to move price—just focused participation, aligned timing, and speed. Traders watching from the outside keep asking how repricing happens so fast. The answer is simple: coordination beats chaos.

Why Wall Street Is Uneasy — This Time Is Different

Market veterans say Wall Street is uneasy for one simple reason: Grandmaster-Obi doesn’t rely on one trade.

Instead of a single viral thesis, Obi’s alerts show a pattern—early identification followed by fast liquidity response. Over the past month alone, traders point to a string of moves that arrived before mainstream scanners lit up:

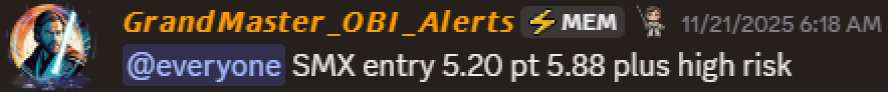

SMX (Security Matters)

Alert: 11/21/25 at ~$5.20 → Peak: 12/05/25 near ~$490

Gain: ~+9,300%

RGC (Regencell Bioscience)

Alert: 3/13/25 at ~$6.50 → Peak: 6/02/25 near ~$950

Gain: ~+14,500%

MRNO (Murano Global Investments)

Alert: 12/31/25 at ~$0.55 → Peak: early Jan 2026 near ~$2.20

Gain: ~+300%

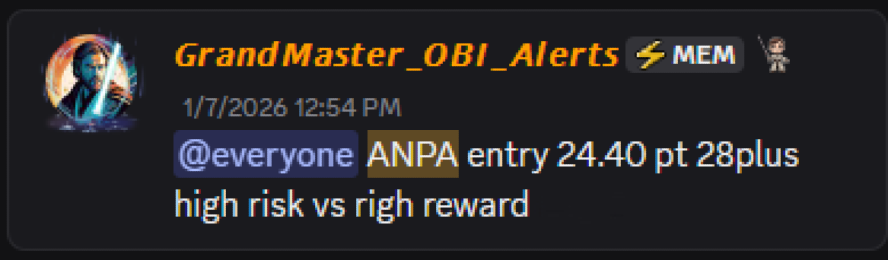

ANPA (Rich Sparkle Holdings)

Alert: 1/7/26 at ~$24.40 → Peak: 1/9/26 near ~$108.68

Gain: ~+345%

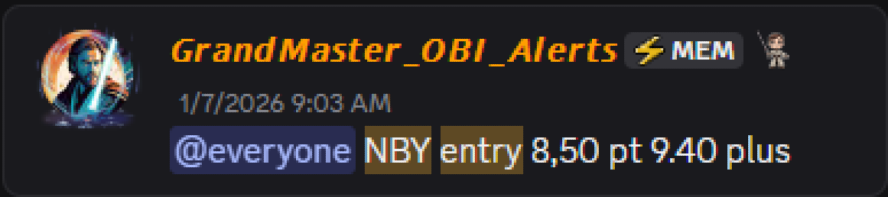

NBY (NovaBay Pharmaceuticals)

Alert: 1/7/26 at ~$8.50 → Peak: 1/9/26 near ~$22.49

Gain: ~+165%

Traders argue these aren’t isolated wins—they’re evidence of a system that keeps surfacing asymmetric setups in low-liquidity names. That’s what worries institutions: systems scale.

The Post That Changed the Clock

More than a week ago, a post began circulating on X that reframed the timeline:

🚨 LAST CHANCE 🚨

— MEM OBI (@ObiMem) January 6, 2026

Due to a massive surge in members, The Making Easy Money Discord closes to new members on 1/10/26.

Once the door shuts, no new entries until further notice.

Join now or miss out.https://t.co/CsXzpqc9FV

Due to a massive surge in members, the Making Easy Money Discord closes to new members on 1/10/26.

Once the door shuts, no new entries until further notice.

Join now or miss out.

At the time, many treated it as a warning for “later.” But the surge didn’t slow—it accelerated.

As of right now, the link still works. You can still join. But the shutdown can begin at any minute, and traders who’ve seen this movie before know what comes next: a pause that lasts far longer than expected. Nobody wants to be the person who meant to join “after the close” and watched the window disappear.

Fastest-Growing Financial Server on Discord

The urgency isn’t manufactured. According to reports circulating within the community, Discord itself has flagged the Making Easy Money Discord as the fastest-growing financial-based server on the platform. That kind of growth triggers real operational needs—security hardening, infrastructure scaling, and moderation reinforcement—to preserve what made the server effective in the first place.

That’s why leadership confirmed the intake pause: protect the environment, upgrade systems, and keep execution front-and-center.

Why This Matters Now

Retail power doesn’t announce itself with a bell. It shows up in behavior: where traders congregate, how quickly alerts propagate, and how price responds. Those signals now point away from legacy forums and toward a tighter, faster center of gravity.

This is the moment many traders remember missing in past cycles—watching from the outside as a new hub formed, then chasing after access closed. Today offers a different choice: recognize the shift while the door is still open—or accept that the window has shut.

The Bottom Line

The retail ecosystem is consolidating again. The Making Easy Money Discord isn’t just growing; it’s absorbing the traders who want execution over entertainment. With a closure date set for 1/11/26—and the possibility of an earlier pause—the clock is no longer theoretical.

If you’ve been waiting to see whether the migration was real, the answer is clear.

The crowd has moved. The door is closing.