The Doors Are Now Closed: Making Easy Money Discord Becomes the New WallStreetBets — for Serious Traders

NEW YORK — January 2026 — The shift that traders had been watching for weeks is now official. Making Easy Money Discord has closed its doors to new members, capping one of the fastest memberships surges the retail-trading space has seen since the meme-stock era.

Inside trading circles, the reaction has been immediate and telling: traders are now openly calling it “the new WallStreetBets”—but with a crucial distinction. This isn’t the meme-driven free-for-all of old. It’s a closed, execution-focused hub built for traders who prioritize timing, liquidity, and risk management.

As access shuts, attention turns to the only question that matters: why did so many traders rush to get in before the doors closed?

SORRY BUT The Making Easy Money Discord is NO LONGER ACCEPTING NEW MEMBERS UNTILL Further Notice... https://t.co/EJK5Adn0PE pic.twitter.com/grWDDpU4FS

— MEM OBI (@ObiMem) January 12, 2026

Why This Isn’t Just Another Discord

WallStreetBets once proved retail could move markets. Over time, scale diluted focus. The result was entertainment over execution.

The Making Easy Money Discord inverted that model. Alerts arrived early. Conversation stayed technical. Noise was filtered out. The effect was coordination—fast enough to matter in thin-liquidity names. When the intake pause was announced, traders recognized a familiar inflection point: the moment when a private hub becomes too effective to remain open.

That’s why the closure matters. It signals consolidation, not collapse.

The Track Record That Drove the Rush (2025–2026)

What ultimately convinced traders to join—often urgently—was a growing ledger of alerts that preceded rapid repricing. Below is a snapshot of notable alerts across 2025 and early 2026, with entry, peak, timing, and approximate gains.

2025 Highlights

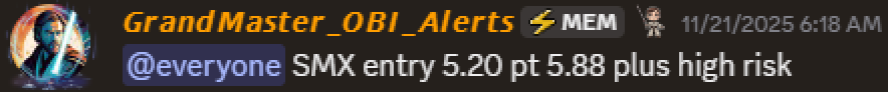

SMX (Security Matters)

Alert: 11/21/25 at ~$5.20

Peak: 12/05/25 near ~$490

Gain: ~+9,300%

RGC (Regencell Bioscience)

Alert: 3/13/25 at ~$6.50

Peak: 6/02/25 near ~$950

Gain: ~+14,500%

These two trades alone cemented a reputation: early identification in low-liquidity names can reprice violently when attention concentrates.

2026 So Far

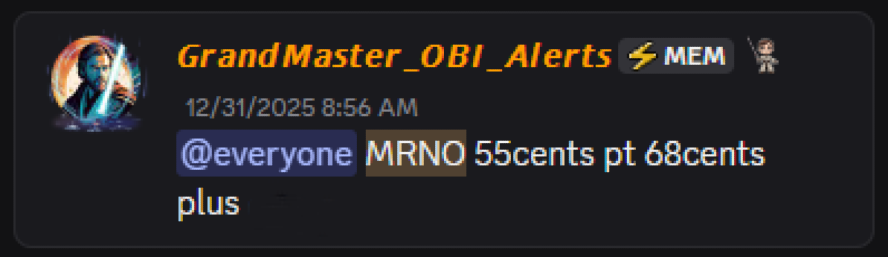

MRNO (Murano Global Investments)

Alert: 12/31/25 at ~$0.55

Peak: early Jan 2026 near ~$2.20

Gain: ~+300%

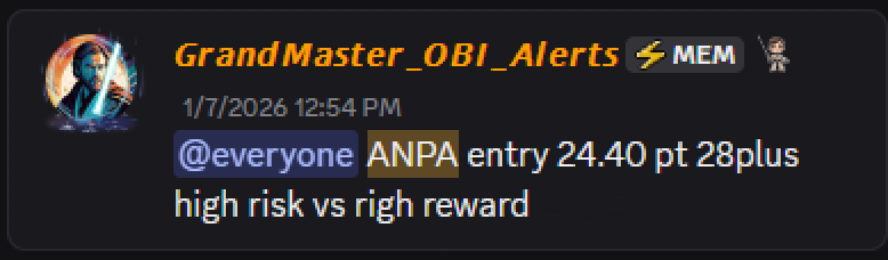

ANPA (Rich Sparkle Holdings)

Alert: 1/7/26 at ~$24.40

Peak: 1/9/26 near ~$108.68

Gain: ~+345%

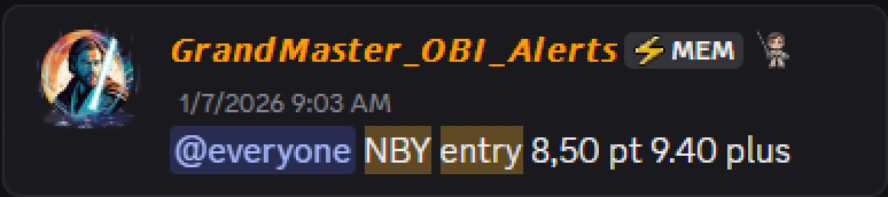

NBY (NovaBay Pharmaceuticals)

Alert: 1/7/26 at ~$8.50

Peak: 1/9/26 near ~$22.49

Gain: ~+165%

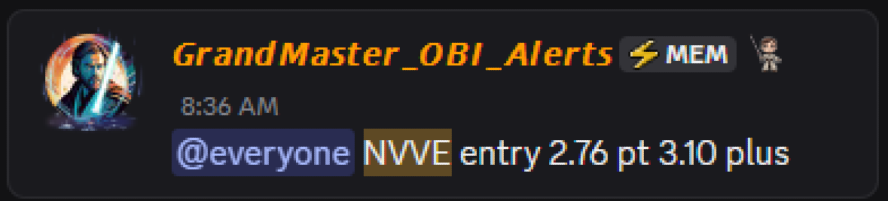

NVVE (Nuvve)

Alert: 1/7/26 at ~$2.76

Peak: 1/7/26 near ~$4.40

Gain: ~+59%

MNTS (Momentus)

Alert: 12/31/25 at ~$7.12

Peak: 1/7/26 near ~$15.98

Gain: ~+124%

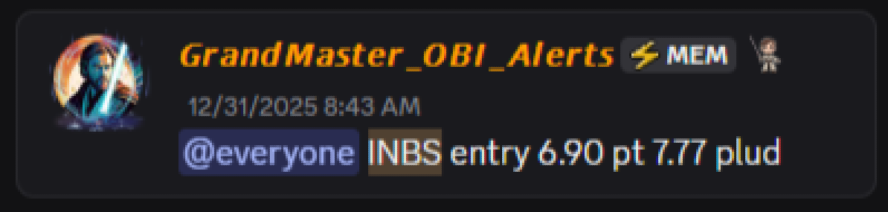

INBS (Intelligent Bio Solutions)

Alert: 12/31/25 at ~$6.90

Peak: 1/7/26 near ~$13.60

Gain: ~+97%

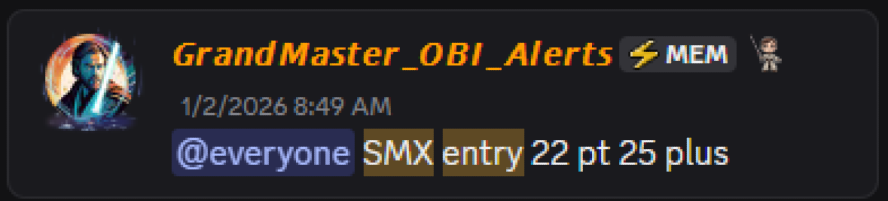

SMX (Security Matters) — Re-alert

Alert: 1/2/26 at ~$22.00

Peak: 1/7/26 near ~$40.56

Gain: ~+84%

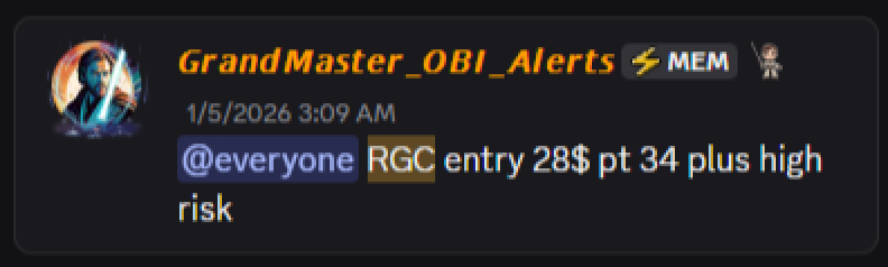

RGC (Regencell Bioscience) — Second Alert

Alert: 1/5/26 at ~$28.00

Peak: 1/7/26 near ~$50.98

Gain: ~+82%

Market veterans point to the same takeaway: these are not isolated wins. They reflect a repeatable approach—early identification, rapid liquidity response, and disciplined execution. Systems scale, and that’s what institutions watch closely.

“The New WallStreetBets”—But With a Filter

As the doors closed, comparisons to WallStreetBets Discord intensified. The difference, traders say, is intentional friction: modest fees, strict moderation, and a clear mandate to keep conversation on execution.

That structure created the very thing large public forums lost—signal density. And signal density is why traders moved quickly when closure was announced. Nobody wanted to be locked out of the room where alerts landed before scanners lit up.

What Closure Signals

Closing intake doesn’t end momentum; it protects it. Infrastructure upgrades, security hardening, and moderation scaling are designed to preserve the environment that produced the results above.

For those inside, it marks the beginning of a more focused phase. For those outside, it marks a familiar lesson in retail history: access matters, and timing matters more.

The Bottom Line

The Making Easy Money Discord didn’t replace WallStreetBets by being louder. It did so by being earlier, tighter, and more disciplined. With doors now closed, it has crossed a threshold—from fast-growing community to closed execution hub.

Retail has reorganized again. And as traders review the 2025–2026 ledger, one conclusion keeps surfacing:

This wasn’t hype. It was timing.