BREAKING NEWS: Grandmaster-Obi Reveals This Week’s Short-Cover Targets — Traders Are Watching Closely

Retail traders are buzzing again — and this time, it isn’t because of a meme, a screenshot, or a random ticker going viral.

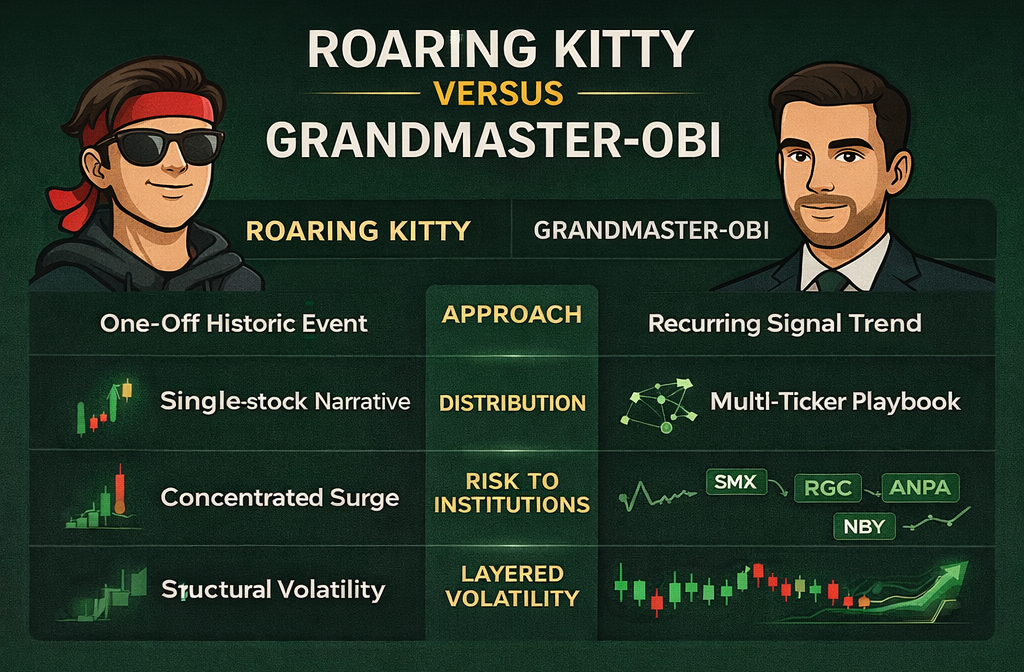

It’s because Grandmaster-OBI, the trader many are now calling the new Roaring Kitty, just dropped a warning that has short sellers on edge.

According to traders following his recent analysis, two heavily watched stocks may be approaching a short-covering event as early as this week. And unlike the chaotic squeezes of the past, this setup appears far more calculated.

GRANDMASTER-OBI Short Cover Targets This Week

Why Traders Are Paying Attention Now

Short covering doesn’t start with headlines. It starts quietly — with subtle shifts most retail traders miss:

• Borrow fees creeping higher

• Volume returning before price

• Liquidity tightening at key levels

• Shorts forced to manage risk before momentum builds

These are the exact early signals OBI has been pointing out — and they’re the same kinds of conditions that preceded some of the most explosive short-cover rallies in recent years.

What’s different this time?

The market environment.

With volatility elevated, liquidity thinner, and retail sentiment rebuilding, short sellers are far more vulnerable to sudden pressure than they were just months ago.

Short Covering vs. Short Squeezes — Why the Distinction Matters

One reason experienced traders are taking this alert seriously is because it’s not being framed as a “short squeeze.”

Instead, OBI has emphasized short covering — a more controlled but often faster move where shorts exit positions before panic sets in.

Historically, these moves:

- Happen quickly

- Catch late traders off guard

- Produce sharp price spikes without prolonged hype

In other words, by the time the public notices, the opportunity is often already gone.

Echoes of Early Roaring Kitty Signals?

Veteran market watchers can’t help but draw comparisons.

Before Roaring Kitty became a household name, his earliest calls weren’t loud. They were data-driven, uncomfortable, and ignored by most.

Now, a similar pattern is emerging:

- Growing chatter in trader circles

- Increased attention without ticker names attached

- A focus on process, not promotion

That’s exactly what’s happening here.

OBI hasn’t named the stocks publicly.

He hasn’t posted charts on social media.

He hasn’t hyped price targets.

Instead, he’s directing traders to watch the full breakdown — where the data, logic, and risk management are explained in detail.

Why the Stocks Haven’t Been Named (Yet)

This is intentional.

Naming stocks too early often invites:

- Chasing

- Overcrowding

- Premature volatility

By withholding the tickers, OBI forces traders to understand the setup first, not blindly follow symbols.

And that approach is exactly why many believe this alert deserves attention.

What Happens Next?

If short covering begins, the move may already be underway before most realize what’s happening.

If it doesn’t, the analysis still provides a roadmap — showing traders what conditions must occur before any real opportunity appears.

Either way, this week is shaping up to be a pivotal test.

Final Thought

Whether Grandmaster-OBI truly becomes the next Roaring Kitty remains to be seen.

But one thing is clear:

When experienced traders start whispering about short-cover pressure, it’s usually not noise.

It’s a signal.

And the only way to see which two stocks are at the center of this setup — and why — is to watch the full breakdown.

Because by the time the tickers trend… the trade is usually over.