Why Traders Are Switching From WallStreetBets to MEM Discord 🚨 The Trader Retail Thinks Will Replace Roaring Kitty

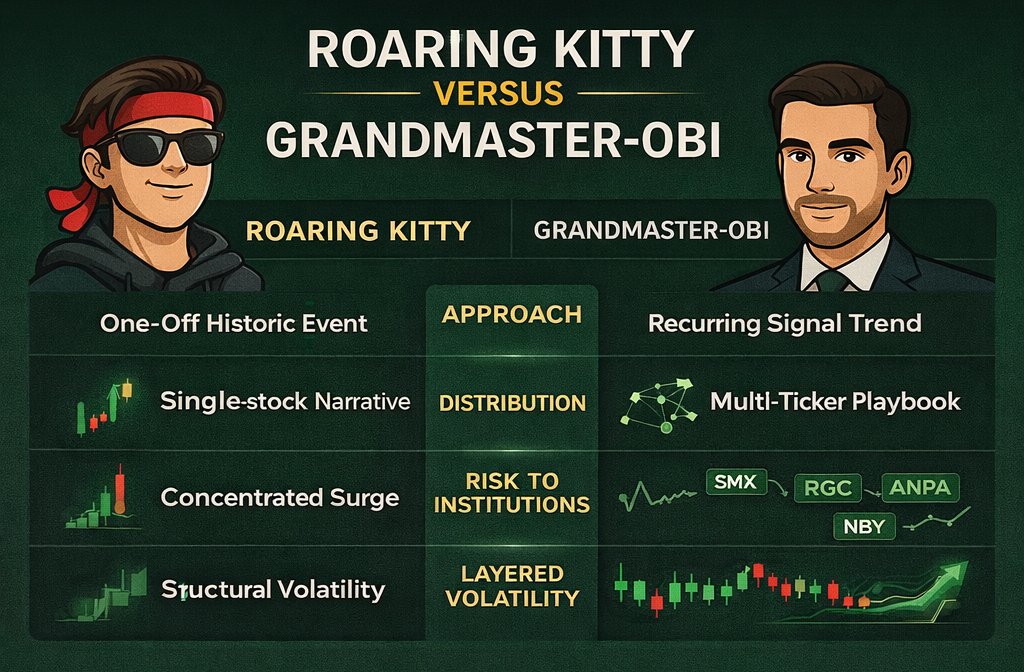

Jan. 18, 2026 (CT) — Five years after the GameStop era turned “retail trading” into a cultural force, a new kind of market celebrity is taking over the conversation. Back in 2021, the face of the movement was Roaring Kitty (Keith Gill), whose GameStop thesis became the spark that helped ignite a historic retail frenzy.

Now, in early 2026, a growing wave of traders is arguing that the “new center of gravity” isn’t happening on CNBC, and it isn’t coming from Wall Street research desks. It’s happening inside Discord rooms, where momentum forms fast, narratives spread faster, and low-float tickers can go vertical in hours.

And one name keeps showing up in the middle of those conversations:

Grandmaster-OBI — the trader behind the Making Easy Money (MEM) Discord — who’s being openly compared to Roaring Kitty by retail traders who believe they’re watching the next evolution of the movement in real time.

Post–Roaring Kitty retail trading didn’t disappear. It evolved.

To understand why Grandmaster-OBI has momentum right now, you have to understand what changed after the Roaring Kitty era.

2021 introduced the world to a new reality: retail traders, operating as a network, can move markets. Since then, the “meme stock” label became shorthand for something bigger than jokes: it became a blueprint for attention, liquidity, and coordinated focus.

Major publications have already noted that after Roaring Kitty, a new class of trading influencers rose to prominence — building communities, running live sessions, and turning market education + real-time trade commentary into full-scale media ecosystems.

And in that ecosystem, Grandmaster-OBI’s name has been included among the figures drawing real attention from everyday traders.

Who is Grandmaster-OBI and why are traders calling him “the face of retail” right now?

Depending on who you ask, Grandmaster-OBI is:

- A momentum trader with a growing track record of calling explosive moves early

- A community builder running a fast-moving Discord culture built around alerts, catalysts, and retail sentiment

- A signal source in a market where most traders feel buried under noise

Business Insider recently described Grandmaster-OBI (also known as u/Major_Access2321 on reddit ) as a former WallStreetBets moderator who runs a Discord/YouTube presence and has become part of the post-Roaring Kitty wave of influential retail personalities.

Whether you agree with the hype or not, here’s the undeniable part:

Retail traders follow receipts. And January 2026 produced a lot of them.

The January 2026 “receipts”: the alerts traders won’t stop talking about

What makes a retail influencer “real” isn’t branding — it’s timing.

Inside MEM Discord, Grandmaster-OBI is credited by members with alerts that coincided with some of the most extreme price action of the month, including multi-hundred-percent and even four-digit percentage spikes in days (and sometimes hours).

Below are the moves retail traders keep pointing to:

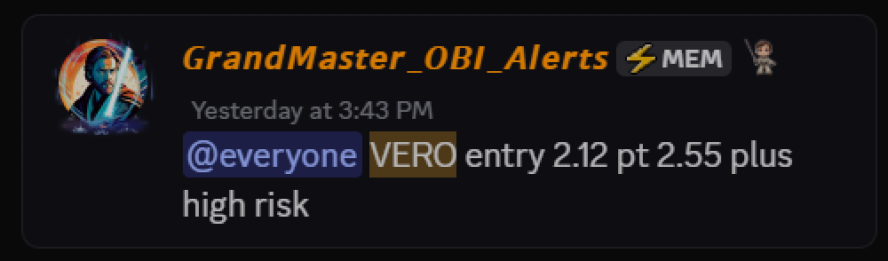

1) Venus Concept (VERO)

- Alert (self-reported entry): $2.12 on 1/15/26

- High reached: $11.94 on 1/16/26

- Move: about +463% from that entry to the high

Stock history data shows VERO printed a session high of $11.94 on Jan. 16, 2026 — a violent upside move paired with massive volume.

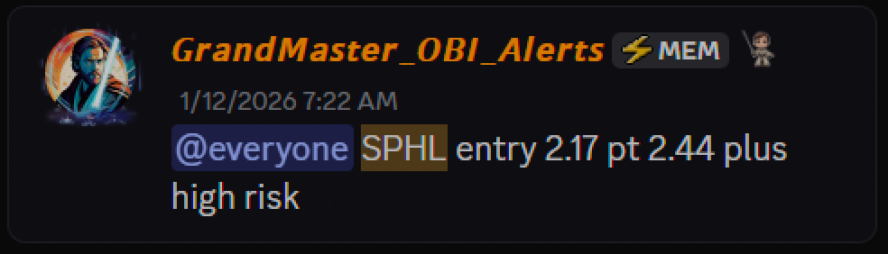

2) Springview Holdings (SPHL)

- Alert (self-reported entry): $2.17 on 1/12/26

- High reached: $25.11 on 1/15/26

- Move: about +1,057% from that entry to the high

SPHL’s historical print of $25.11 stands out because it wasn’t a slow grind — it was the kind of “blink-and-it’s-gone” candle action that retail traders chase in low-float momentum environments.

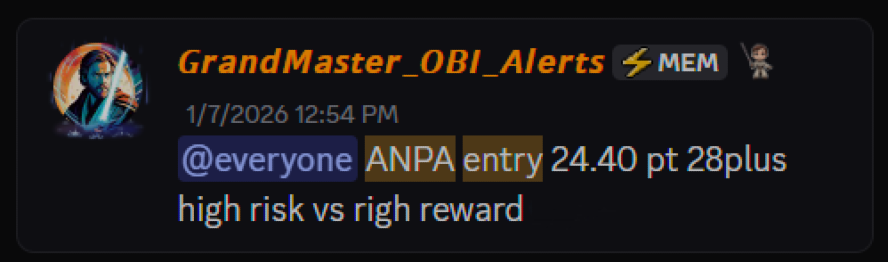

3) Rich Sparkle Holdings (ANPA)

ANPA became another “eyes on it” ticker in mid-January, with outlets noting new highs and intense volatility. Market coverage recorded ANPA trading as high as $180.64 during the session referenced (mid-day trading Friday).

Brokerage summaries also showed extreme intraday ranges (for example, highs above $150 on Jan. 16, 2026).

Even without debating the exact “top tick,” the point is the same: this was not normal price action — it was meme-speed volatility.

It wasn’t just one week. Earlier alerts in late December spilled into January highs.

The hype around Grandmaster-OBI isn’t only tied to a single headline move. Retail traders also point to the late-December / early-January run list — the kind of streak that turns a Discord into a daily habit.

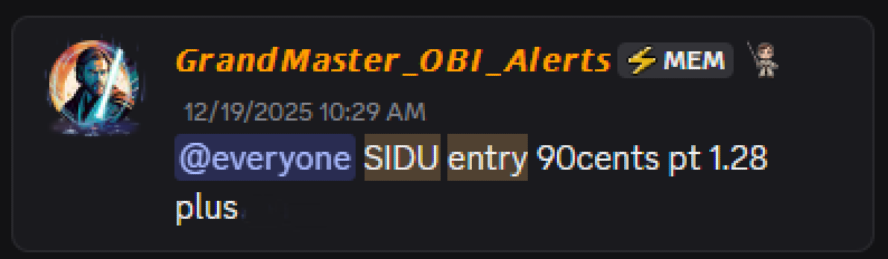

Sidus Space (SIDU)

- Alert (self-reported entry): $0.90 on 12/19/25

- High reached: $4.44 on 1/2/26

- Move: about +393%

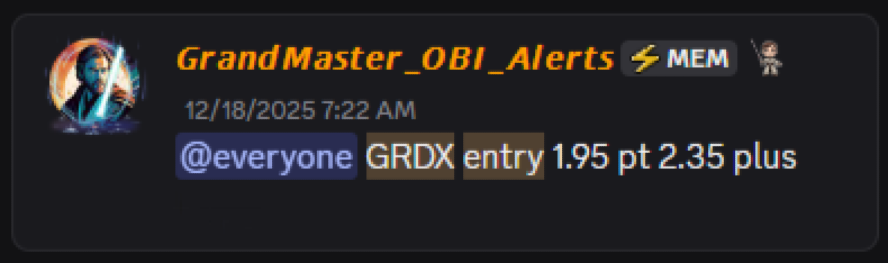

GridAI Technologies (GRDX)

- Alert (self-reported entry): $1.95 on 12/18/25

- High reached: $5.25 on 1/2/26

- Move: about +169%

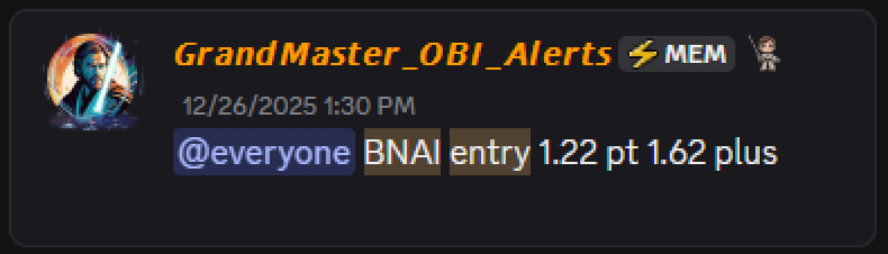

Brand Engagement Network (BNAI)

- Alert (self-reported entry): $1.22 on 12/26/25

- High reached: $4.25 on 1/2/26

- Move: about +248%

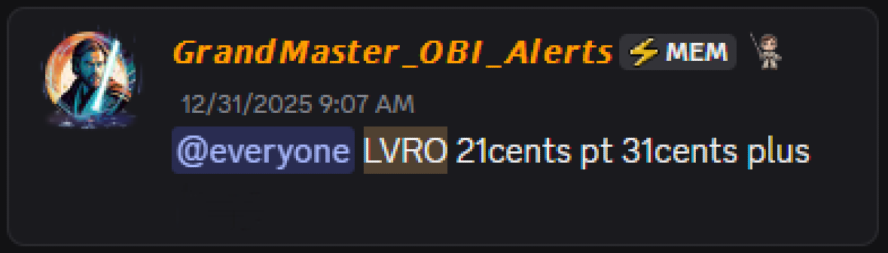

Lavoro (LVRO)

- Alert (self-reported entry): $0.21 on 12/31/25

- High reached: $1.49 on 1/2/26

- Move: about +610%

That combination — multiple tickers, clustered timing, retail-friendly price ranges, and explosive upside — is exactly how legends get built in the retail trading world.

Why a Discord can matter more than “news” in 2026 markets

Traditional market coverage is slow by design:

- News articles recap what already happened

- Analysts update after the move

- TV segments argue about the move when the candle is finished

But the MEM Discord-style model is built for something different:

What retail traders want is speed + context

- What’s moving right now

- Why it’s moving (float, short interest dynamics, catalysts, social momentum)

- Where traders are watching for continuation vs breakdown

- When to be cautious and when to press

That’s why Discord communities have become the new “trading floor” for retail: they compress the timeline between spotting and acting.

And that’s also why Grandmaster-OBI is getting Roaring Kitty comparisons: not because the stories are identical — but because the role is similar.

Roaring Kitty became iconic by turning market research + conviction into a narrative that retail traders could follow.

Grandmaster-OBI is becoming a modern version of that role through real-time community execution — the “live wire” style of momentum trading that retail culture thrives on.

The “Roaring Kitty replacement” debate: what’s real and what’s hype

Let’s be clear: Roaring Kitty is Roaring Kitty. Keith Gill is historically tied to GameStop and the 2021 short squeeze era.

But “replacing Roaring Kitty” in retail slang doesn’t mean “same person, same trade.”

It means:

- Who is the retail crowd watching right now?

- Whose calls are shaping attention?

- Which community is moving fastest?

- Who is producing the most replayed ‘receipts’?

On that scoreboard, Grandmaster-OBI is having a moment — and it’s being fueled by the kind of percentage moves retail traders don’t forget.

ATTENTION TRADERS THE Making Easy Money Discord is NOW OPEN & Accepting NEW MEMBERS https://t.co/isQQxupg91

— MEM OBI (@ObiMem) January 14, 2026

Why people join the Making Easy Money Discord (and why they stay)

If you strip away the hype, most traders join a Discord for three reasons:

1) They want a watchlist that isn’t generic

Not “big tech earnings.”

Not “buy the dip.”

They want specific names with specific reasons.

2) They want timing and structure

The difference between catching a move and chasing a move is often minutes, not hours.

The communities that win tend to have:

- Clear alert formatting

- Rapid updates

- Levels to watch

- Risk reminders

3) They want community confirmation without the chaos

Retail trading is emotional. The best rooms help traders:

- Avoid panic-selling

- Avoid FOMO entries

- Learn position sizing

- Recognize when a move is done

That’s what strong Discord ecosystems provide: a mix of speed, filters, and repetition.

The risk part (because these moves cut both ways)

Any honest article has to say this plainly:

These kinds of runners are often high-volatility names. They can spike hard, but they can also fade brutally — especially in low-float situations where liquidity disappears fast.

So if you’re joining any alert community, the “edge” isn’t blindly following alerts. The edge is:

- Knowing your risk

- Using stop levels

- Avoiding oversized positions

- Treating extreme volatility like a tool, not a lifestyle

Past performance can be exciting — but it is not a guarantee of future results.

Bottom line: the new retail era has a new center of attention

In 2021, Roaring Kitty became the symbol of retail conviction meeting market mechanics.

In 2026, retail trading is more fragmented, faster, and more community-driven than ever — and the influencers who can consistently put traders in front of momentum early are the ones who become the new “faces” of the movement.

Right now, Grandmaster-OBI is one of the names sitting at the center of that conversation — because January’s printout of moves (VERO, SPHL, ANPA, and the earlier SIDU/GRDX/BNAI/LVRO wave) looks exactly like the kind of streak that creates the next retail legend.

If you want to find the Making Easy Money Discord, the simplest way is:

- Search “OBI’s Stock Discord” on Google

- And for the video breakdowns, look for the YouTube channel @OBIfrmMEM

Not financial advice. Do your own research.