Why These Micro-Cap Breakouts Are Making Traders Do a Double Take

Grandmaster-Obi, whose latest calls inside the Making Easy Money Discord have ignited yet another wave of explosive price action. In a market where consistency is rare, traders are paying attention to what many are calling a growing streak of high-conviction momentum plays.

Why Traders Can’t Stop Talking About This Retail Trader Right Now

Across trading Discords and social feeds, one name keeps surfacing for the same reason: the price action keeps confirming the call. Over the past few sessions, Grandmaster-Obi shared two low-priced setups inside the Making Easy Money Discord that quickly turned into outsized movers—before they hit mainstream scanners.

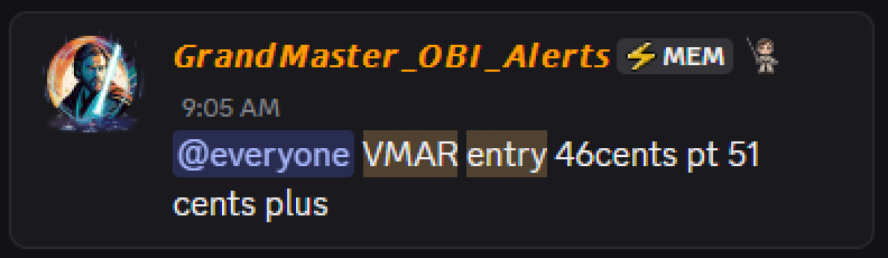

Vision Marine Technologies (VMAR)

On December 16, 2025, VMAR was alerted around $0.46. The thesis centered on early momentum and expanding volume—conditions that often precede rapid repricing in thin floats. The response was swift: VMAR ran to an intraday high near $1.25 the same day.

Why it mattered

- Timing: The alert preceded the social-media surge.

- Structure: Volume expanded before price acceleration, a classic early signal.

- Follow-through: The move attracted momentum traders once scanners lit up.

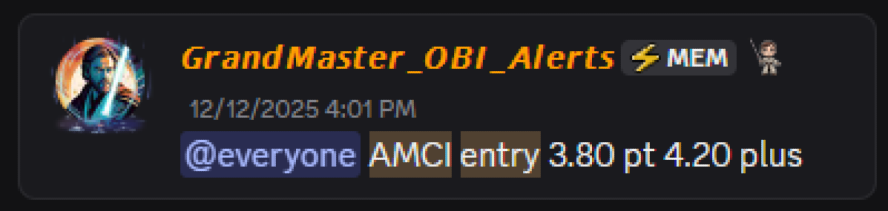

AMC Robotics (AMCI)

Two trading days earlier, on Friday, December 12, 2025, AMCI was flagged near $3.80. Unlike many micro-cap pops, AMCI didn’t fade after the first spike. Instead, it built across sessions, pushing to a high around $15.12 and holding elevated levels near $14.

Why it stood out

- Multi-day strength: Rallies that persist across sessions are rare in micro-caps.

- Orderly pullbacks: Buyers defended higher lows, keeping momentum intact.

- Crowd recognition lag: Broader attention arrived after early participants were positioned.

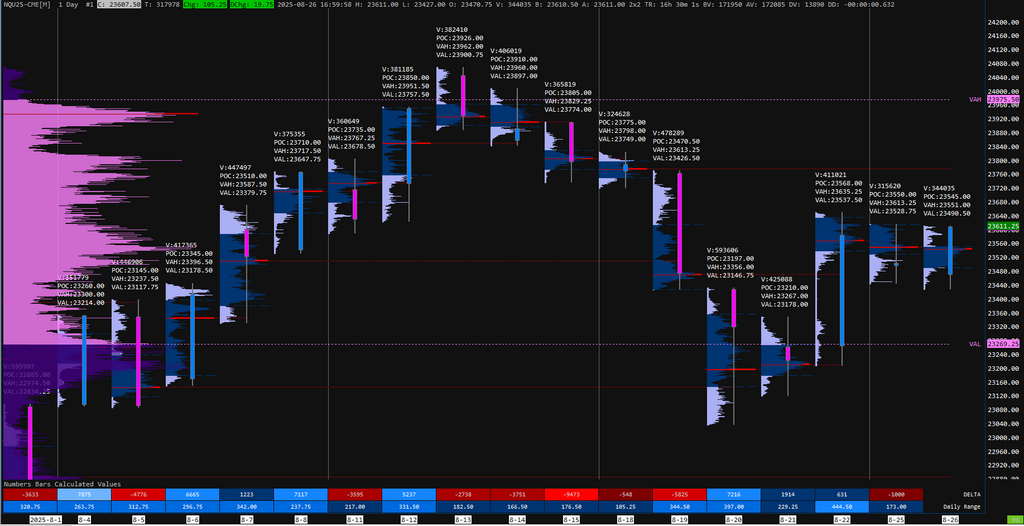

What the Charts Are Saying (At a Glance)

- Phase 1 — Quiet Accumulation: Early volume upticks without headlines.

- Phase 2 — Breakout Ignition: Price clears near-term resistance as volume expands.

- Phase 3 — Social Discovery: Scanners and feeds amplify visibility.

- Phase 4 — Decision Point: Either continuation with structure—or volatility spikes.

Both VMAR and AMCI followed this playbook closely.

The Making Easy Money Discord Effect

Traders inside Making Easy Money often point to a simple edge: ideas surface early. By the time a ticker trends publicly, members are already managing risk—not chasing entries. The recent VMAR and AMCI moves accelerated community growth as word spread about consistent timing and real-time discussion.

The Bigger Question

Single spikes happen every day. Repeatable structure is rarer. When multiple setups show early volume confirmation, disciplined entries, and follow-through, traders start watching closely—regardless of hype.

VMAR and AMCI are already on the ledger. The question now circulating trading circles is straightforward:

What’s the next chart to break before everyone else notices?