Who Is This Trader Behind the Explosive SMX, MIGI, and BEAT Rallies? Markets Are Taking Notice

December 11, 2025

A retail trader known online as Grandmaster-Obi is drawing increasing scrutiny from professional investors and market commentators after another pair of stocks halted today shortly after being highlighted inside the fast-growing Making Easy Money Discord community — a server he leads that has rapidly become one of the most influential retail-trading groups of 2025.

The pattern is becoming difficult for analysts to dismiss: when this trader posts an alert, unusual volume and extreme price volatility frequently follow.

Today’s session added two new examples to the list.

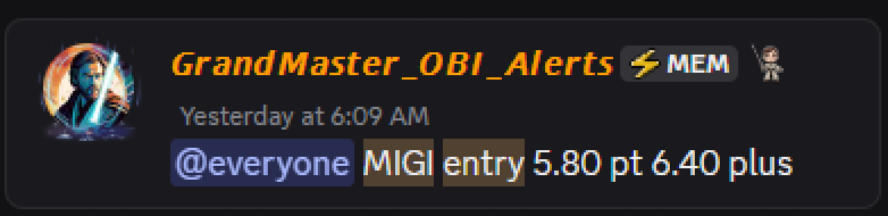

MIGI Surges, Halts After Momentum Spike Linked to Retail Activity

Shares of Mawson Infrastructure (MIGI.US) were halted on volatility Thursday morning after surging from a prior alert level of $5.80 to an intraday high of $14.48 — a move of roughly +149%.

The alert, issued inside the Making Easy Money Discord on December 10, catalyzed rapid inflows from retail traders, according to social-media chatter monitored across Reddit, X, and Stocktwits.

Market-structure analysts noted that MIGI’s float and liquidity profile made it highly sensitive to sudden coordinated retail participation.

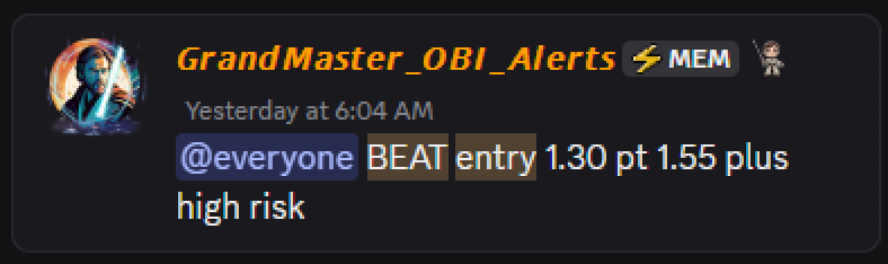

BEAT Becomes the Latest Microcap to Double After an Obi-Linked Push

Another microcap, HeartBeam (BEAT.US), followed a similar path.

First flagged to the Making Easy Money community on December 10 at $1.30, BEAT traded as high as $2.82 today — an approximate +117% gain — before stabilizing on elevated volume.

Like MIGI, BEAT’s sharp move triggered algorithmic buying and rapid volatility expansion, though it did not halt as aggressively.

An Emerging Pattern: Each Alert Followed by Surging Volumes and Halts

Over the last 10 days, multiple equities highlighted in the group — including BBGI, JMG, OCG, CV, MIGI, SMX, and others — have rapidly moved into circuit breaker territory.

This has led some market observers to describe the phenomenon as:

“Retail-triggered microcap whiplash.”

Several analysts say the activity resembles the early days of WallStreetBets’ influence, when dense clusters of retail order flow produced outsized intraday swings.

Reddit Moderators Push Back as Traders Migrate to Making Easy Money

Adding to the controversy is growing tension between the trader and moderation teams across several Reddit finance communities.

According to community posts and user reports:

- Some of his posts have been removed,

- Mentions of his alerts have been auto-filtered,

- And several users claim bans were issued after discussing his trades.

But this has only amplified interest in his community, which Discord analytics ranked among the fastest-growing finance servers in November.

Users refer to this trend as:

“The M.E.M Takeover.”

Market participants say the combination of accuracy, visibility, and community backing is creating a retail-flow phenomenon unmatched since the peak meme-stock era.

A Track Record Difficult for Critics to Ignore

The trader’s recent string of correctly timed alerts includes:

- WVE (Wave Life Sciences) — doubled in under three hours

- TWG (Top Wealth Group) — tripled within days

- CETX (Cemtrex) — surged from low single digits into the $20s within a session

- SMX (Security Matters) — one of the most dramatic short-cover episodes of the quarter

Each move was followed by substantial social-media debate, with supporters claiming skill and skeptics attributing the runs to amplified retail momentum.

But the repeated halts across unrelated tickers continue to raise questions about whether a new, more organized form of retail participation is emerging.

Why This Matters to Wall Street

While the affected stocks are microcaps, the pattern itself is drawing attention from:

- Market-structure analysts,

- Options-flow researchers,

- Quant desks monitoring retail order flow,

- And regulatory observers tracking volatility clusters.

If the momentum continues, analysts say this could represent the most coordinated retail-driven force since early 2021’s meme-stock events.

One senior strategist at a major U.S. brokerage described it as:

“A new class of retail momentum — faster, more mobile, and algorithmically amplified.”

What Comes Next

With the Making Easy Money community still expanding rapidly, and its lead analyst continuing to produce highly followed trade ideas, market watchers expect volatility in select microcaps to remain elevated.

The trader’s supporters argue that he has developed a rare skill for identifying early momentum shifts.

Critics remain unconvinced and warn that microcap volatility can reverse sharply.

But for now, the data is clear:

Where his community focuses, volume follows — and in many cases, so do halts.