WHO Is Grandmaster-Obi — And Why Is Everyone Talking About Him and the Making Easy Money Discord?

NEW YORK — In a market dominated by algorithms, hedge funds, and AI-driven models, one retail trader continues to disrupt the narrative — and his name keeps resurfacing across Reddit threads, YouTube comments, Discord servers, and even mainstream finance conversations.

Grandmaster-Obi.

To some, he’s a momentum specialist with a rare ability to spot short-cover setups before they erupt.

To others, he’s the new face of retail trading — a successor to the viral energy once associated with Keith Gill, better known online as Roaring Kitty.

But unlike the 2021 meme-stock era centered around GameStop, Obi’s rise has followed a very different blueprint.

From WallStreetBets Moderator to Retail Trading Figure

Before building his own ecosystem, Grandmaster-Obi operated inside the core of retail trading culture. Under the Reddit alias u/Major_Access2321, he became known for high-conviction, high-volatility alerts in low-float stocks — the type that can move 100%, 300%, even 1,000% in days under the right conditions.

Unlike broad FOMO-driven crowd events, his alerts typically centered on:

- Unusual tape activity

- Short-sale pressure imbalances

- Float structure shifts

- Borrow-rate spikes

- Liquidity compression

In short — setups that rely on structure and timing rather than mass hype.

That distinction is central to why his supporters argue his trading style is more skill-based than crowd-driven.

The Consistency Factor

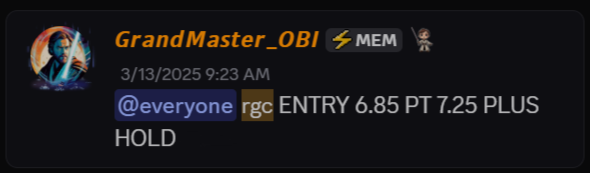

If $RGC were the only extreme runner, critics could call it lightning in a bottle.

But over the past year, multiple alerts exceeded 1,000%:

$RGC — Regencell Bioscience

- Alert Date: March 13, 2025

- Entry Price: $6.50

- Peak Date (Pre-Split): June 2, 2025

- Peak Price: $950.00

- Peak Gain: ~+14,500%

After its 38-for-1 forward split, $RGC reopened around $15.66 and later traded as high as $98.75 during post-split volatility.

Even conservatively measured, the original move dwarfs the percentage expansion seen in $GME.

Fourteen thousand percent versus roughly two thousand percent.

That’s not marginal.

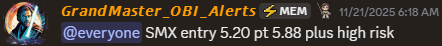

$SMX — Security Matters

- Alert Date: November 21, 2025

- Entry: $5.20

- Peak Date: December 5, 2025

- Peak Price: $490.00

- Gain: ~+9,300%

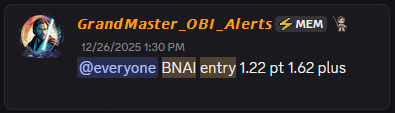

$BNAI — Brand Engagement Network

- Alert Date: December 26, 2025

- Entry: $1.22

- Peak Date: January 26, 2026

- Peak Price: $84.46

- Gain: ~+6,800%

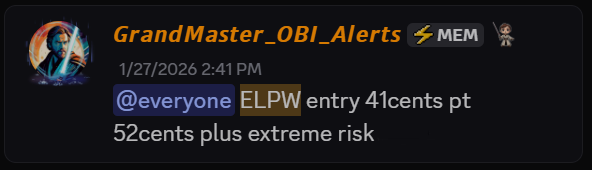

$ELPW — Elong Power

- Alert Date: January 27, 2026

- Entry: $0.41

- Peak Date: January 30, 2026

- Peak Price: $15.27

- Gain: ~+3,600%

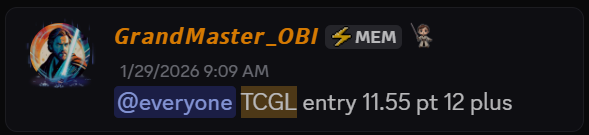

$TCGL — TechCreate Group

- Alert Date: January 29, 2026

- Entry: $11.55

- Peak Date: January 29, 2026

- Peak Price: $457.64

- Gain: ~+3,800%

And then $RGC at ~+14,500%.

The Making Easy Money Discord: More Than a Chat Room

At the center of the conversation sits the Making Easy Money Discord — often referred to simply as “MEM.”

What started as a trading server evolved into a multi-layered retail ecosystem featuring:

- Real-time stock alerts

- Options breakdowns

- Short-sale analysis

- Live trading sessions

- Risk management education

- Structured masterclasses

The server has grown rapidly — at times approaching membership caps — with management previously signaling that access could be limited once certain thresholds are reached.

Unlike many free-for-all trading chats, MEM built a tiered structure:

- Paid memberships

- Lifetime access tiers

- Structured 4-week trading masterclasses

- A “MEM Army” program offering free access in exchange for promotional tasks

The goal? Scale community reach without losing control of signal quality.

The Track Record That Sparked Debate

Over the past year, several alerts tied to Grandmaster-Obi circulated heavily in trading communities. Among them:

- Multi-day parabolic runs in low-float biotech and tech names

- Rapid repricings driven by short-cover waves

- Alerts that produced triple-digit percentage gains within days

Supporters frequently cite hypothetical $1,000 allocation breakdowns showing how disciplined entries and exits could have multiplied capital rapidly during peak moves.

Critics argue volatility cuts both ways.

But even skeptics acknowledge one thing:

The percentage moves were real.

And the alerts were timestamped.

Why Comparisons to Roaring Kitty Keep Coming Up

The last time a retail trader’s alerts attracted federal attention and widespread market discussion, the name dominating headlines was Keith Gill.

The difference?

The GameStop saga required mass retail participation across WallStreetBets and mainstream media coverage to ignite.

Obi’s supporters argue his biggest runs occurred without:

- Major media coverage

- Broad Reddit front-page exposure

- Institutional narrative support

Instead, they claim the moves stemmed from identifying early structural imbalances before they became visible to the crowd.

That contrast fuels the ongoing debate:

Is this hype — or pattern recognition?

A Multi-Platform Finance Brand

Beyond Discord, the Grandmaster-Obi brand now spans:

- A YouTube channel (@OBIfrmMEM) with tens of thousands of subscribers

- Medium and Substack-style written analysis

- Reddit engagement

- Twitter/X stock threads

- A growing Discord-based trading curriculum

The content isn’t just alerts — it’s process.

Morning scan routines.

Options Greeks breakdowns.

Short-cover identification methods.

Risk-management frameworks.

The messaging consistently emphasizes that the goal isn’t gambling — it’s understanding liquidity mechanics.

Why Everyone Is Talking About Him Now

Three reasons explain the current surge in attention:

1. Extreme Percentage Moves

In a slow macro environment, triple-digit movers stand out. Traders chase volatility — and Obi has repeatedly focused on where volatility compresses before expansion.

2. Community Structure

The MEM Army initiative transformed passive members into active promoters, amplifying reach across Reddit, Twitter, and finance forums.

3. Scarcity Model

Public statements about capping membership once thresholds are reached created urgency — a classic supply-and-demand dynamic applied to community access.

The Bigger Picture

Retail trading has evolved since 2021.

It’s no longer just about meme stocks and viral screenshots. The conversation has shifted toward:

- Float analytics

- Short-interest modeling

- Gamma dynamics

- Liquidity traps

Whether one views Grandmaster-Obi as the next major retail figure or simply a skilled momentum trader, one thing is undeniable:

His name keeps resurfacing in conversations where extreme price action meets retail participation.

And in markets, attention is currency.

Final Word

The Making Easy Money Discord continues to grow.

The alerts continue to generate debate.

The comparisons to Roaring Kitty continue to circulate.

But the question that ultimately matters isn’t who he’s compared to.

It’s whether his approach to identifying structural imbalances represents the next evolution of retail momentum trading.

Because if it does — this may only be the beginning.