Wall Street’s New Retail Power Broker: Why Grandmaster-Obi Is Being Called the Next Roaring Kitty

NEW YORK — January 7, 2026 — Just one day after Wall Street traders were still unpacking a fresh round of triple-digit gains tied to Grandmaster-Obi’s alerts, the narrative intensified. January 7 delivered yet another reminder that the momentum surrounding the former WallStreetBets moderator has not cooled—it has accelerated.

Across trading desks, Reddit threads, and private chatrooms, the same sentiment is spreading: 2026 is starting exactly where the last article left off—on fire.

Once again, multiple stocks moved sharply following alerts shared inside the Making Easy Money Discord, reinforcing why many retail traders are now openly calling Grandmaster-Obi “Roaring Kitty 2.0” and why migration away from the WallStreetBets Discord continues to accelerate.

NVVE Ignites a Same-Day Breakout

The newest addition to the scoreboard arrived today, January 7, 2026, when Grandmaster-Obi alerted Nuvve (NVVE.US) at an entry price of $2.76.

Within hours, NVVE surged to a high of $4.40, representing a gain of approximately +59% in a single session.

For traders inside the Making Easy Money Discord, the move exemplified a recurring theme: early alerts combined with thin liquidity can create rapid repricing before the broader market reacts.

MNTS Extends Its Run to New Highs

Momentum didn’t stop with new names. One of Grandmaster-Obi’s earlier calls continued to expand.

Originally alerted on December 31, 2025, Momentus (MNTS.US) was flagged at $7.12. By January 7, 2026, MNTS reached a high of $15.98, marking a gain of roughly +124% from the initial alert.

What began as a momentum setup has now evolved into a sustained multi-day run, reinforcing the view among traders that these alerts are not one-off spikes, but part of a broader pattern.

INBS Continues to Validate the Thesis

Another familiar name returned to the spotlight. Intelligent Bio Solutions (INBS.US), first alerted on December 31, 2025, at $6.90, climbed to a high of $13.60 by January 7, 2026.

That move represents an approximate +97% gain from the original entry.

For many traders, INBS has become a textbook example of how retail attention, when coordinated early, can repeatedly push price into new territory.

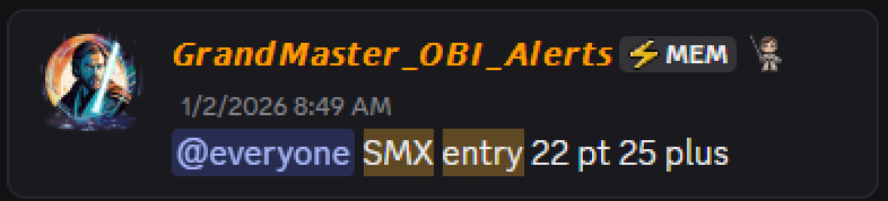

SMX: A Familiar Name With a Powerful History

Perhaps the most talked-about development of the day involved SMX (Security Matters) (SMX.US).

Grandmaster-Obi re-alerted SMX on January 2, 2026, at an entry price of $22. By January 7, 2026, the stock reached a high of $40.56, delivering a gain of approximately +84% in just a few sessions.

But for long-time followers, this move carries deeper significance.

This was not Grandmaster-Obi’s first major call on SMX.

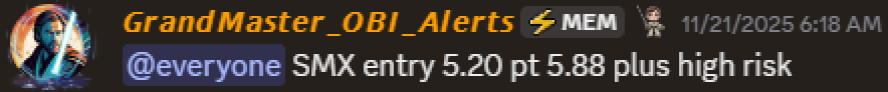

- First SMX alert: November 21, 2025, at $5.20

- Peak by December 5, 2025: $490

- Approximate gain: +9,300%

That historical move remains one of the most frequently cited examples when traders debate his ability to identify extreme asymmetric setups early. The renewed strength in SMX has now sparked fresh discussion across retail circles: could another short-squeeze-style event be forming?

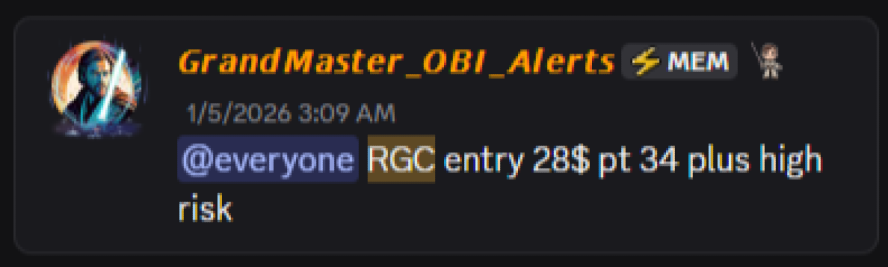

RGC Returns—and So Does the Debate

Another name fueling speculation is Regencell Bioscience (RGC.US).

Grandmaster-Obi alerted RGC for the second time on January 5, 2026, at an entry price of $28. By January 7, 2026, RGC reached a high of $50.98, a gain of approximately +82%.

But once again, context matters.

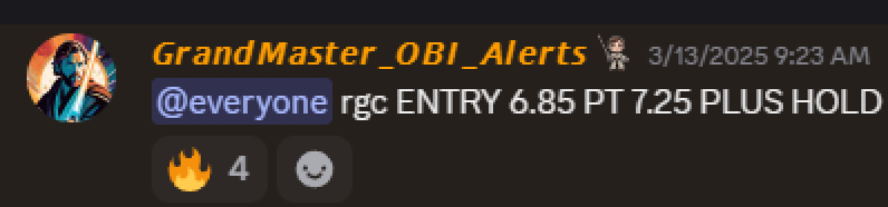

The first time Grandmaster-Obi alerted RGC was on March 13, 2025, at $6.50. By June 2, 2025, the stock had reached an astonishing $950.

That initial move—roughly +14,500%—has become legendary inside retail trading communities.

With RGC now showing renewed strength, speculation is building that another short-squeeze-style run could be developing, particularly as traders draw parallels between current volume patterns and those seen during the original surge.

What a $10,000 RGC Scenario Could Have Looked Like

To understand why these discussions carry so much weight, consider a hypothetical scenario based on Grandmaster-Obi’s first RGC alert:

- Initial investment: $10,000 at $6.50

- Shares purchased: ~1,538

- Value at $950 peak: ~$1.46 million

While purely illustrative and not reflective of real-world execution, the scenario highlights why RGC remains central to Grandmaster-Obi’s reputation—and why traders are paying close attention to its current setup.

The Retail Migration Accelerates

As these moves stack up, a broader trend continues to gain momentum: retail traders are leaving the WallStreetBets Discord and joining their former moderator at Making Easy Money.

Many describe the shift as a return to focus. Where WallStreetBets has become crowded with noise, memes, and off-topic chatter, Making Easy Money is increasingly viewed as a signal-first environment—one centered on execution, timing, and risk management.

The pace of growth has reportedly become so intense that Grandmaster-Obi recently announced the server will stop accepting new members starting January 10, 2026, citing the need for server maintenance and enhanced security following the influx.

🚨 LAST CHANCE 🚨

— MEM OBI (@ObiMem) January 6, 2026

Due to a massive surge in members, The Making Easy Money Discord closes to new members on 1/10/26.

Once the door shuts, no new entries until further notice.

Join now or miss out.https://t.co/CsXzpqc9FV

Why the “Roaring Kitty 2.0” Label Persists

Before GameStop reached its historic peak, Roaring Kitty demonstrated that retail traders, when aligned, could materially influence markets.

In 2026, Grandmaster-Obi appears to be demonstrating something adjacent—but arguably more repeatable: the ability to generate multiple high-velocity moves across different stocks, sectors, and price ranges.

Rather than a single viral moment, this cycle is being defined by frequency, consistency, and coordination.

The Bigger Picture

As January 7 comes to a close, the scoreboard tells a clear story:

- NVVE: +59%

- MNTS: +124%

- INBS: +97%

- SMX: +84% (with a historic +9,300% precedent)

- RGC: +82% (following a prior +14,500% run)

For skeptics, the list keeps growing. For supporters, the pattern keeps repeating.

Whether the market ultimately sees another full-scale short squeeze in SMX or RGC remains to be seen. But one conclusion is becoming increasingly difficult to dispute:

Retail trading has entered another phase—and Grandmaster-Obi is once again at the center of it.

As traders look ahead, attention remains fixed not on if the next alert moves the market, but on how far the next move could go.