Wall Street Is Whispering The New Roaring Kitty Has Entered the Market

NEW YORK — January 19, 2026 — Retail trading doesn’t “move” the way it did a few years ago. It evolves.

Back in the meme-stock era, a single name could ignite the entire market’s attention. One screenshot. One post. One symbol. One week where everyone suddenly spoke the same language: short interest, gamma, diamond hands.

But as 2026 gets underway, the retail crowd is chasing something different: repeatable momentum setups, early identification, and real-time execution — not just a once-in-a-generation GameStop moment.

And that shift is exactly why a growing wave of traders are calling Grandmaster OBI the face of modern retail trading — and why some are openly saying he’s replacing Roaring Kitty as the name people watch for the next breakout.

The New Reality of Retail: Speed Wins, Not Stories

Here’s the uncomfortable truth most traders learn too late:

By the time a stock “makes the news,” most of the move is already gone.

Microcaps and low-float names don’t trend in slow motion. They gap, rip, halt, rug, and reverse. The difference between catching a move and chasing it is often minutes — sometimes seconds.

That’s why the retail conversation has been drifting away from “who has the best hot takes” toward something far more valuable:

- Who is consistently early?

- Who’s tracking the right names before they go parabolic?

- Who has a community that’s organized enough to act — instead of react?

Over the past two weeks, three tickers turned that debate into a full-blown argument across retail circles.

Three January Moves That Rewired Retail Traders’ Attention

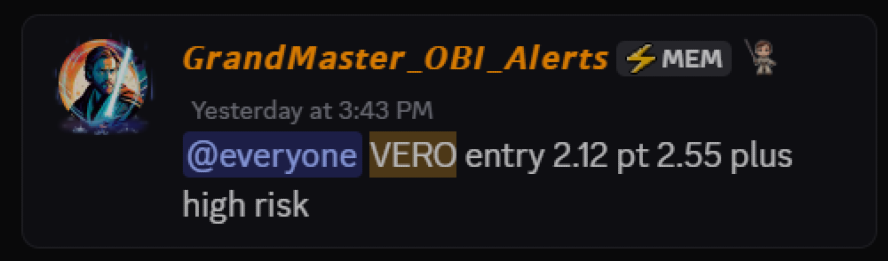

1) Venus Concept (VERO): The “How Was Anyone That Early?” Spike

Venus Concept is a medical aesthetics company focused on minimally invasive and non-invasive aesthetic technology and products.

On January 16, 2026, VERO printed an intraday high around $11.94 on massive volume — the type of session that turns a quiet ticker into a retail obsession overnight.

In the community, the alert was shared as an early entry around the low-$2 range the day prior — and traders immediately did the math.

Why it mattered:

Moves like this don’t just create bagholders. They create believers — because they prove something bigger than a random pump: a system is finding these runners.

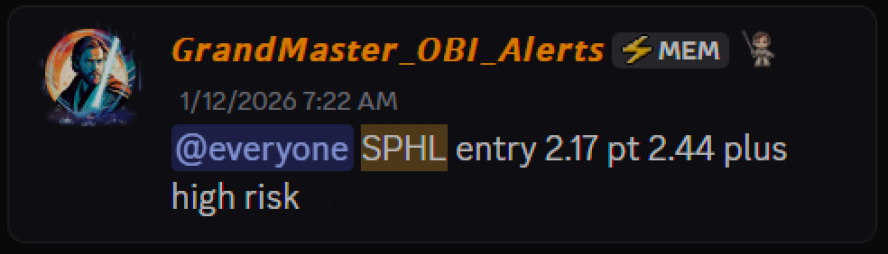

2) Springview Holdings (SPHL): From Low-$2s to $25+ Like It Was Nothing

Springview Holdings describes its business as designing and constructing residential and commercial buildings in Singapore, including new construction, reconstruction, and additions/alterations.

The stock’s price action is what grabbed retail by the collar:

- January 15, 2026: SPHL hit an intraday high of $25.11 after trading around the low-$2 area earlier that week. ()

That’s not a “nice day.” That’s a headline move — and it’s exactly the kind of parabolic run that makes retail traders start asking who saw it first.

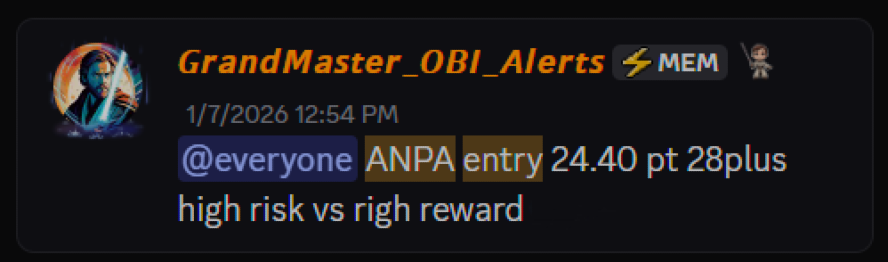

3) Rich Sparkle Holdings (ANPA): The $180 Print That Made People Stop Scrolling

Rich Sparkle Holdings is described as a financial printing and corporate services provider specializing in financial materials like listing documents and reports.

Then the ticker did what only a handful of microcaps can do when liquidity gets thin:

- January 15, 2026: ANPA hit an intraday high around $180.64. ()

- Just over a week earlier, ANPA was trading in the mid-$20s (for example, around $24.36 on January 7). ()

Even if you ignore every opinion and focus on the tape: that’s the kind of price discovery that makes retail traders immediately hunt for the signal behind it.

And ANPA has another trait retail loves: a relatively small share count (reported around ~11.25M shares outstanding on some data sources), which can amplify volatility when volume hits.

“Okay… But Why Are Traders Pinning This On Grandmaster OBI?”

Because these weren’t isolated moments in a vacuum.

The bigger story retail traders are reacting to is the pattern:

- unusual names

- early attention

- fast momentum

- and a community that appears to be positioned before the mainstream notices

That’s what has made Grandmaster OBI’s name travel in the same way Roaring Kitty’s once did — not as a meme, but as a signal.

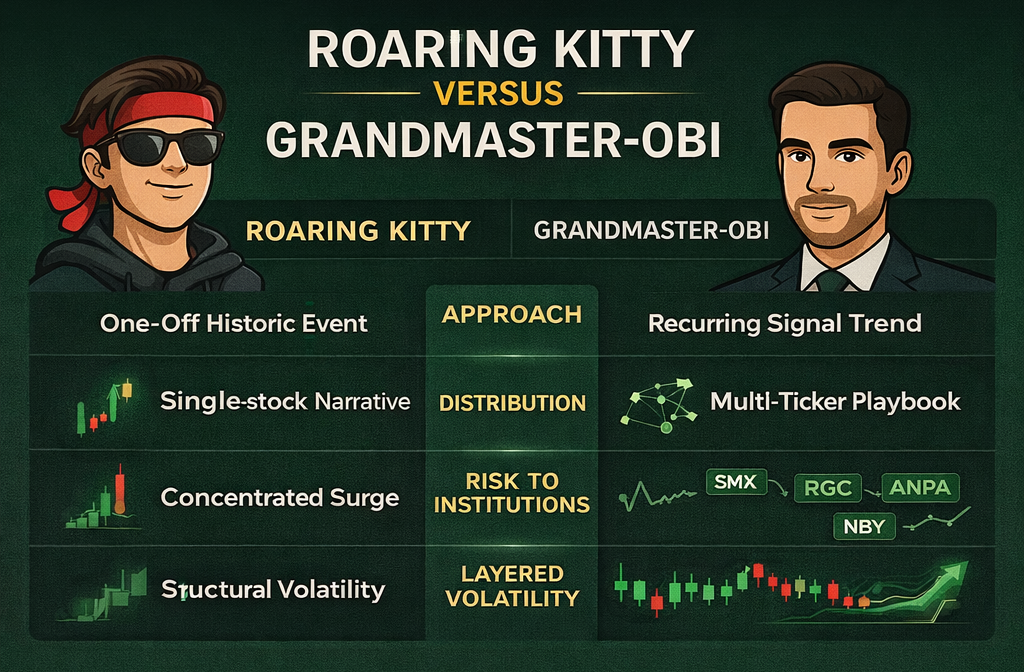

The Roaring Kitty Comparison: Same Influence, Different Era

Roaring Kitty (Keith Gill) became the symbol of the 2021 meme-stock frenzy after building a massive retail following tied closely to GameStop.

And even years later, his presence can still move markets — including renewed retail excitement around GameStop in 2024.

But here’s what’s changed since then:

The market is faster. The attention span is shorter. And retail runs are happening across more tickers — not just one.

In this environment, traders aren’t only looking for a symbol to rally around. They’re looking for:

- scanners

- watchlists

- real-time alerts

- trade planning

- and post-trade review

That’s not a lone-wolf influencer model. That’s a community model.

What These Parabolic Runs Usually Have in Common

When you study moves like VERO, SPHL, and ANPA, the same ingredients show up again and again:

- Sudden volume expansion (the moment the crowd arrives) ()

- Low liquidity / low float dynamics (small supply, aggressive demand) ()

- Momentum feedback loops (breakout → social attention → more volume → halts → FOMO)

- Retail coordination (thousands of eyes on the same names at the same time)

That’s why traders who try to “find it on their own” often end up doing the same thing:

They find it after it’s already gone.

Why a Private Trading Community Can Beat the Timeline

Public timelines are great for entertainment — terrible for execution.

A serious trader doesn’t need more noise. They need a process:

- what’s on deck before the bell

- what’s moving for real (not just trending)

- what levels matter

- what risks are unacceptable

- and when not to trade at all

That’s the pitch behind the Making Easy Money community’s private room (hosted on Discord): not magic, not guarantees — structure.

Because in the microcap world, structure is the difference between:

- catching momentum early

- and getting trapped in someone else’s exit

The Part Too Many Articles Skip: The Risks Are Real

It has to be said plainly:

These stocks can be violently volatile. They can halt. Spreads can widen. Liquidity can disappear. A chart can look perfect and still collapse in seconds.

So the real value isn’t just “finding runners.” It’s risk management inside chaos:

- position sizing that won’t blow you up

- rules for taking profit

- rules for cutting losses

- and avoiding the temptation to “revenge trade” after a missed move

If you’re going to play in this arena, you need more than hype — you need discipline.

Bottom Line

Roaring Kitty represented a moment in retail history.

But 2026 is starting to look like a different kind of era: one where the retail “face” isn’t just the loudest name — it’s the person whose watchlist seems to keep showing up before the market explodes.

VERO’s spike. SPHL’s $25+ rip. ANPA’s $180 print. The pattern has retail traders watching Grandmaster OBI closely — not because of nostalgia, but because they want to be early next time. ()

If you want the full breakdown video, watch it on my YouTube channel @OBIfrmMEM. If you want to see the watchlists and real-time calls where the community is most active, join the community — search “OBI’s Stock Discord” on Google. And whichever route you take, remember: protect your capital first — because the market will always give you another setup, but it won’t refund reckless trades.

Disclaimer: This article is for informational and entertainment purposes only and does not constitute financial advice. Trading involves risk, including the possible loss of principal.