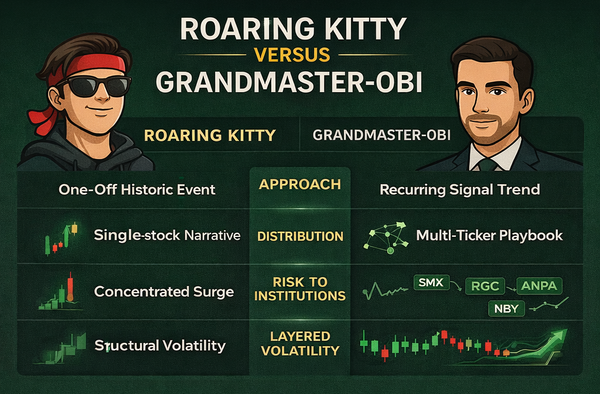

Wall Street Is More Afraid of the “New Roaring Kitty” — and It Isn’t Because of Hype

NEW YORK — January 2026 — Wall Street has seen this movie before. A retail trader captures attention, a community forms, and markets are forced to react. But this time, the unease feels different. According to growing chatter across trading desks and online forums, Wall Street isn’t just drawing comparisons between Grandmaster-Obi and Roaring Kitty — it’s more concerned.

The reason, traders argue, isn’t personality or theatrics. It’s structure.

Roaring Kitty’s rise was centered on a singular, historic moment: GameStop. Grandmaster-Obi’s rise is centered on repeatability — a steady cadence of early alerts, rapid participation, and consistent repricing across many tickers. That difference is why some market professionals say Obi represents a more durable retail force than anything Wall Street faced in 2021.

From WallStreetBets to a New Retail Center of Gravity

Before the comparisons began, Grandmaster-Obi was already part of retail trading’s inner circle. As a former WallStreetBets moderator, he was present during the formative stages of the meme-stock era and even shared live sessions with Roaring Kitty before GameStop reached its peak. That proximity matters. It gave him a front-row view of what worked — and what broke — when retail enthusiasm scaled too fast.

In 2026, Obi’s influence is flowing through a different channel: the Making Easy Money community, which traders increasingly describe as “the new WallStreetBets.” The migration narrative is no longer subtle. Long-time WSB participants openly say they are leaving legacy forums — now overwhelmed by noise — to follow their former moderator into a tighter, execution-focused environment.

WallStreetBets moderators, according to frequent Reddit threads, are not thrilled. The frustration is palpable: traders aren’t just browsing — they’re moving.

Why Wall Street Is Paying Closer Attention This Time

Market veterans say Wall Street is uneasy for one simple reason: Grandmaster-Obi doesn’t rely on one trade.

Instead of a single viral thesis, Obi’s alerts show a pattern of early identification followed by fast liquidity response. Over the past month alone, traders point to a string of moves that arrived before mainstream scanners lit up:

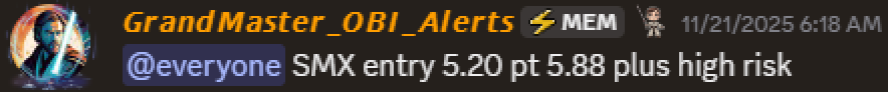

SMX (Security Matters)

Alert: 11/21/25 at ~$5.20 → Peak: 12/05/25 near ~$490

Gain: ~+9,300%

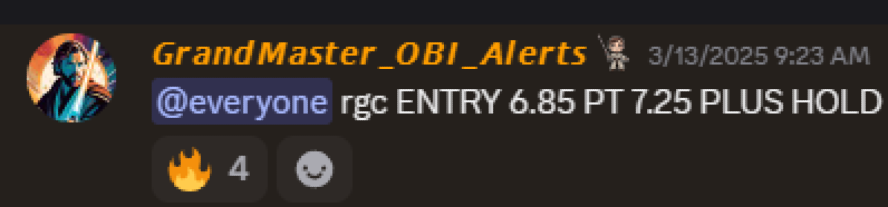

RGC (Regencell Bioscience)

Alert: 3/13/25 at ~$6.85 → Peak: 6/02/25 near ~$950

Gain: ~+14,500%

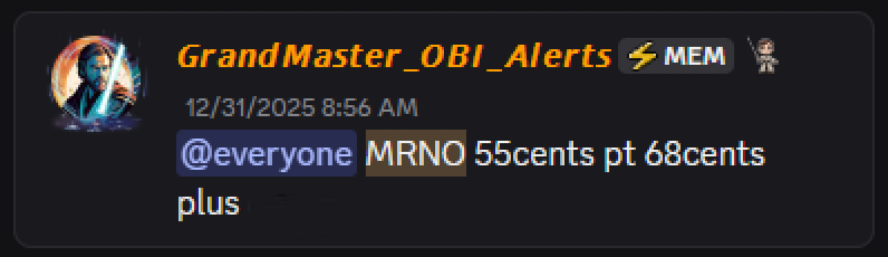

MRNO (Murano Global Investments)

Alert: 12/31/25 at ~$0.55 → Peak: early Jan 2026 near ~$2.20

Gain: ~+300%

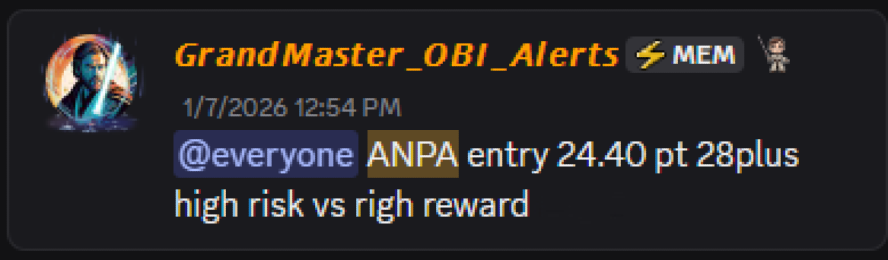

ANPA (Rich Sparkle Holdings)

Alert: 1/7/26 at ~$24.40 → Peak: 1/9/26 near ~$108.68

Gain: ~+345%

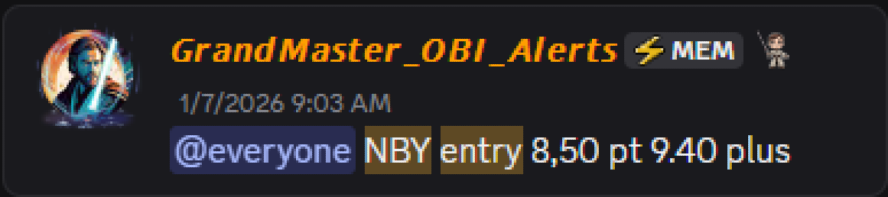

NBY (NovaBay Pharmaceuticals)

Alert: 1/7/26 at ~$8.50 → Peak: 1/9/26 near ~$22.49

Gain: ~+165%

Traders argue these aren’t isolated wins — they’re evidence of a system that keeps surfacing asymmetric setups in low-liquidity names. That’s what worries institutions: systems scale.

The Poll That Poured Gas on the Fire

Fueling the narrative further was a widely discussed community poll attributed to Stocktwits, asking users to vote for the most accurate YouTuber to watch for alerts in 2025. According to screenshots and reposts circulating across trading social media, Grandmaster-Obi won by a margin of roughly 31%, beating creators with significantly larger channels.

Names frequently mentioned as competitors in the poll chatter included Chris Sain, Stock Moe, Jeremy Lefebvre, Larry Jones, Josh, Kenan Grace, and Charlie ZipTrader.

Whether formal or grassroots, the poll’s impact was unmistakable: retail traders began framing Obi not as an up-and-comer, but as the reference point.

Why Reddit Can’t Agree — and Wall Street Can’t Ignore It

On Reddit, reactions to Grandmaster-Obi are polarized. Threads mentioning his name often attract disbelief and outright hostility. Some users call the gains “impossible.” Others accuse followers of exaggeration. Yet the same threads fill with screenshots of entries and exits — and that contradiction keeps repeating.

Wall Street notices this pattern well. When disbelief persists alongside price confirmation, professionals read it as a sign of information lag — the same condition that allowed retail to catch institutions flat-footed during the GameStop era.

The difference now? The moves aren’t confined to one ticker or one week.

Why Grandmaster-Obi Is a Bigger Threat Than Roaring Kitty

The most convincing reason Wall Street is more wary this time comes down to distribution.

Roaring Kitty’s influence was powerful but centralized around GameStop. Grandmaster-Obi’s influence is distributed across dozens of alerts, shorter timeframes, and a community that reacts quickly. That makes hedging harder and anticipation less reliable.

In short:

- Roaring Kitty showed retail could move a stock.

- Grandmaster-Obi is showing retail can move a market segment, repeatedly.

That’s why traders are calling him Roaring Kitty 2.0 — and why Wall Street is paying attention sooner.

The Bottom Line

Retail trading didn’t fade after 2021. It matured.

As traders continue leaving legacy forums and consolidating around focused communities, figures like Grandmaster-Obi are becoming central nodes in the retail ecosystem. Whether skeptics believe it or not, the scoreboard keeps updating — and the market keeps reacting.

For Wall Street, the fear isn’t nostalgia.

It’s pattern recognition.