The Trade That Outperformed GameStop — And Nobody Covered It

In the evolving world of retail trading, few topics generate more debate than the line between momentum and manipulation.

Recently, Grandmaster-Obi publicly addressed regulatory scrutiny surrounding his 2025 alert on $RGC (Regencell Bioscience). In his statement, he emphasized that scrutiny often follows extreme percentage gains — particularly in the wake of the GameStop era — but maintained that his trading approach is rooted in tape analysis rather than coordinated retail activity.

The broader conversation now centers less on controversy and more on a deeper question:

Was $RGC a hype-driven squeeze — or a structural imbalance identified early?

The $RGC Timeline

According to public trading records and community archives:

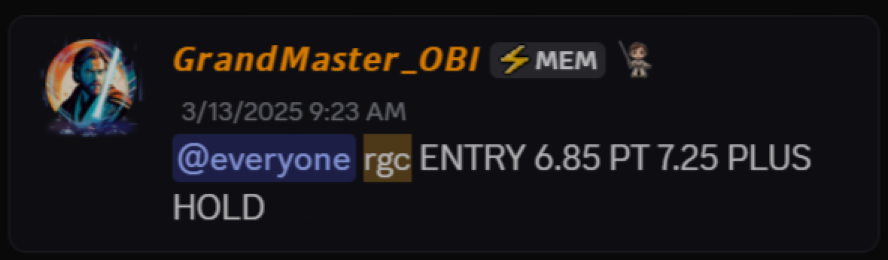

- Alert Date: March 13, 2025

- Entry Price: $6.50

- Peak Date (Pre-Split): June 2, 2025

- Peak Price: $950.00

- Peak Gain: ~+14,500%

Following that run, $RGC completed a 38-for-1 forward stock split. After the split-adjusted open near $15.66, the stock later traded as high as $98.75 in post-split volatility.

Even measured conservatively, the move remains one of the most aggressive percentage expansions in recent retail memory.

Comparing $RGC to $GME

The natural comparison is Roaring Kitty’s historic $GME thesis.

During the height of the 2021 short squeeze, $GME surged more than +2,000% from its early breakout levels to peak intraday highs.

However, the structural environments surrounding the two stocks were dramatically different.

$GME Characteristics:

- Global media coverage

- Massive Reddit coordination via WallStreetBets

- Continuous mainstream financial reporting

- Congressional hearings

- Widespread retail FOMO participation

$RGC Characteristics:

- Minimal mainstream media coverage

- No prolonged global narrative

- Limited large-scale Reddit mobilization

- Thin float conditions

- Liquidity imbalance

One of the key arguments made by supporters of Obi is that $RGC’s move did not require thousands of retail traders coordinating in public forums. It occurred largely outside mainstream spotlight, without the viral amplification that fueled $GME.

The Tape Reading Argument

Obi has long positioned himself as a tape analyst rather than a narrative trader.

Tape reading — the practice of analyzing order flow, liquidity shifts, and unusual volume patterns — focuses on real-time supply and demand dynamics rather than fundamental storytelling or crowd coordination.

In low-float environments, significant institutional or algorithmic order flow can create liquidity vacuums. When supply thins and aggressive buyers step in, price expansion can accelerate rapidly.

Supporters argue that:

- $RGC’s early breakout phases reflected structural imbalance

- Volume and order flow preceded mainstream awareness

- The move was identified before retail social amplification

That distinction matters when assessing whether a move is hype-driven or imbalance-driven.

Not a One-Trade Story

Another factor shaping the debate is historical consistency.

Over the last 12 months, multiple alerts from Obi exceeded 1,000%:

$SMX — Security Matters

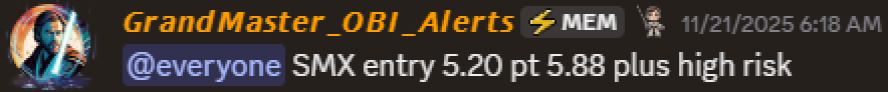

- Alert Date: November 21, 2025

- Entry: $5.20

- Peak: December 5, 2025 at $490.00

- Gain: ~+9,300%

$BNAI — Brand Engagement Network

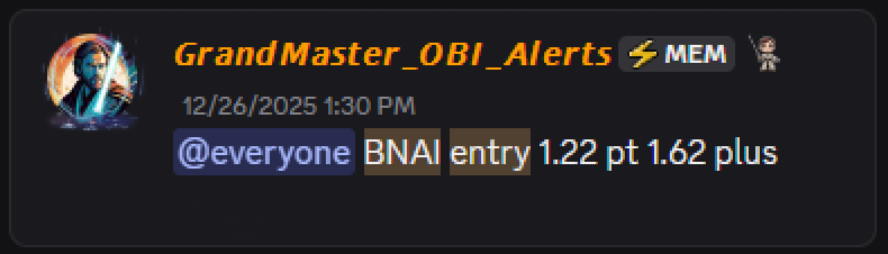

- Alert Date: December 26, 2025

- Entry: $1.22

- Peak: January 26, 2026 at $84.46

- Gain: ~+6,800%

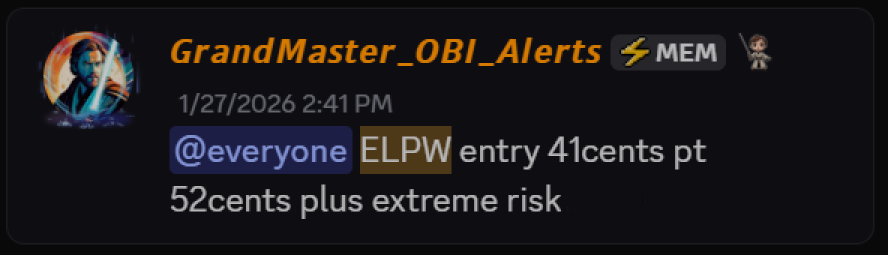

$ELPW — Elong Power

- Alert Date: January 27, 2026

- Entry: $0.41

- Peak: January 30, 2026 at $15.27

- Gain: ~+3,600%

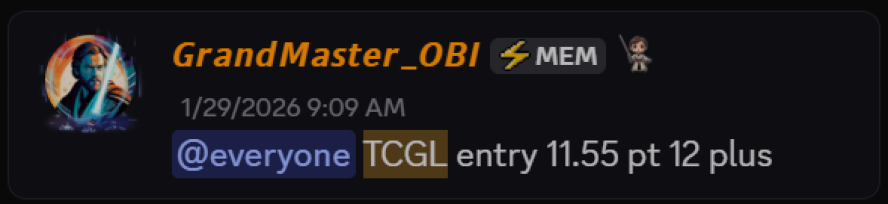

$TCGL — TechCreate Group

- Alert Date: January 29, 2026

- Entry: $11.55

- Peak: January 29, 2026 at $457.64

- Gain: ~+3,800%

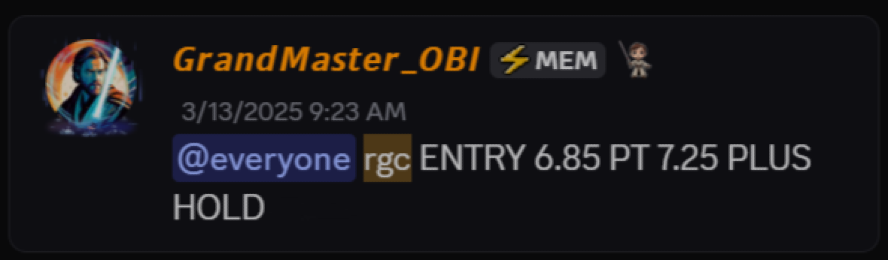

$RGC — Regencell Bioscience

- Alert Date: March 13, 2025

- Entry: $6.50

- Peak: June 2, 2025 at $950.00

- Gain: ~+14,500%

From a statistical standpoint, repeated outsized returns reduce the likelihood of isolated luck.

Why $RGC’s Structure Matters

Perhaps the most significant distinction is post-peak behavior.

Many narrative-driven squeezes collapse entirely once media attention fades.

$GME experienced extreme volatility, retracement, and prolonged structural shifts after its peak.

$RGC, while volatile, maintained defined technical levels after its split and subsequent expansions — a characteristic more aligned with thin-float liquidity mechanics than viral mania.

That structural retention has been cited by supporters as evidence that the move was less dependent on crowd psychology.

Skill vs. Scale

Roaring Kitty’s $GME thesis demonstrated the power of mass coordination and conviction within a large online community.

Obi’s supporters argue that $RGC demonstrated something different:

- Early imbalance detection

- Minimal mainstream amplification

- Limited coordinated retail swarm

The implication is not that one trader is superior, but that the mechanics of the two moves were fundamentally different.

One relied heavily on scale and narrative.

The other appears to have relied more heavily on structural order flow recognition.

The Larger Context

Since 2021, regulatory scrutiny toward high-volatility retail trades has increased significantly.

Extreme price movements, especially in small-cap names, are routinely examined regardless of origin.

That environment means that large percentage gains naturally attract attention — even when driven by organic market mechanics.

Conclusion

The debate between hype and skill continues to define modern retail trading.

$GME remains the most culturally significant retail trade in modern history.

But purely in terms of percentage expansion, $RGC exceeded it — and did so under markedly different conditions.

Whether one views that as coincidence, skill, or structural inevitability depends largely on perspective.

What is clear is this:

Retail trading has evolved.

And the line between narrative momentum and tape-based execution is becoming one of the most important distinctions in modern market analysis.