The Return of 2021-Style Chaos: Why Traders Say ‘Roaring Kitty Is Back

If the past few trading sessions have felt eerily familiar — wild volatility, sudden halts, obscure tickers ripping hundreds of percent, and Reddit buzzing nonstop — you’re not imagining things.

Across social media, traders are whispering (and sometimes shouting) the same phrase:

“This feels like Roaring Kitty all over again.”

But here’s the twist:

Keith Gill isn’t the one driving the chatter this time.

Instead, the spotlight has shifted to Grandmaster-Obi — a former WallStreetBets moderator who was there in January 2021, who streamed alongside Roaring Kitty during the GameStop era, and who is now leading one of the fastest-growing retail trading communities online: the Making Easy Money Discord.

And just like 2021, the market is responding.

🐱 The “Roaring Kitty Is Back” Vibe — Without the Nostalgia Trade

Back during the GME frenzy, Roaring Kitty became a symbol:

one stock, one thesis, one movement.

What traders are noticing now is something different — but just as powerful.

Grandmaster-Obi isn’t married to one ticker.

He’s rotating through low-float, high-short-interest names, identifying momentum before it becomes mainstream, and his community is moving in sync — fast.

That’s why traders say this feels like Roaring Kitty 2.0, but evolved for 2025:

- Faster cycles

- Multiple runners

- Real-time Discord coordination

- And a leader who understands both market mechanics and retail psychology

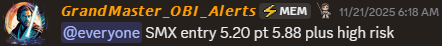

🚨 SMX: The Catalyst That Rekindled the 2021 Energy

The spark for this renewed “Roaring Kitty” energy? SMX (Security Matters).

Long before YouTube or financial media caught on, Grandmaster-Obi flagged SMX at $5.20 inside the Making Easy Money Discord. What followed looked straight out of a meme-stock highlight reel:

- Violent upside moves

- Repeated volatility halts

- Massive short-cover waves

- And eventually, prices many thought were impossible for a former penny stock

At its peak, SMX traded above $76, turning early alerts into life-changing gains for some traders and cementing Obi’s reputation as a short-squeeze specialist.

That single run reminded the market of something it hadn’t felt in years:

Retail momentum can still overwhelm the tape.

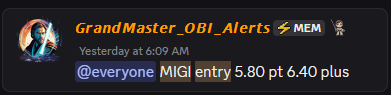

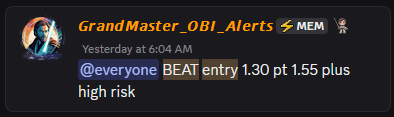

💥 MIGI & BEAT: Proof This Isn’t a One-Off

Skeptics called SMX luck.

Then came MIGI and BEAT.

- MIGI was alerted around $5.80 and surged to $14.48, triggering a halt as buyers flooded in.

- BEAT followed the same script — alerted near $1.30, then ripping above $2.80 in short order.

Once again, the pattern was unmistakable:

- Alert drops in Making Easy Money

- Volume explodes

- Shorts scramble

- Circuit breakers trigger

Traders watching from the sidelines started asking the same question Reddit asked in 2021:

“How is he always early?”

🧨 The Halt Streak: BBGI, JMG, OCG, CV

The “Roaring Kitty is back” chatter intensified when multiple tickers halted within days of his calls:

- BBGI ran from the mid-$5 range to the mid-$20s

- JMG surged quickly and halted minutes after the alert

- OCG quadrupled in less than 48 hours

- CV nearly tripled from its alert zone

At that point, even traders who hate Discord groups had to admit something unusual was happening.

This wasn’t random hype — it was repeatable momentum.

🧠 Why Traders Trust Him — And Why Reddit Mods Are Furious

Here’s where the controversy heats up.

Many of Grandmaster-Obi’s early SMX posts were downvoted, mocked, or deleted on Reddit. Some were removed by mods entirely. Others were buried under sarcasm and disbelief.

Then the stocks ran.

Now, the same subreddits that dismissed him are watching thousands of traders migrate to Making Easy Money, frustrated by what WallStreetBets has become — memes, noise, and chaos with little actionable trading.

Ironically, a former WSB moderator is now being credited with building what many call:

“The WallStreetBets we actually wanted.”

📈 Is Making Easy Money Becoming the Next WallStreetBets?

No one can legally claim a Discord “moves markets.”

But perception matters — and perception right now is powerful:

- The community is growing at a rate that rivals early WSB

- Alerts regularly precede halts and parabolic moves

- Large accounts (“whales”) are rumored to be watching the same levels

- And Wall Street is quietly paying attention

It’s the same formula that once shook hedge funds — just updated for a faster, more fragmented market.

🔥 The Bottom Line

The energy is unmistakable.

- A former WSB mod

- A growing retail army

- A string of high-impact momentum plays

- And a market environment primed for squeezes

Whether you believe Grandmaster-Obi is the new Roaring Kitty or simply the most dangerous momentum trader of this cycle, one thing is clear:

Retail hasn’t lost its power — it’s just found a new leader.

And just like in 2021, the traders who ignore it may end up watching from the sidelines… again.