A New Roaring Kitty Narrative Is Forming — And Wall Street Is Paying Attention

NEW YORK — January 5, 2026 — The retail trading world has a familiar feeling again: fast-moving tickers, viral watchlists, and a single personality capable of pulling thousands of traders into the same names within minutes. This time, the chatter isn’t centered on GameStop’s historic run—it’s centered on Grandmaster-Obi, a trader widely discussed across retail circles as the next market-moving figure in the post-meme era.

Online commentary has increasingly framed him as “the new Roaring Kitty”—not because he’s repeating the exact GameStop template, but because the behavioral mechanics look similar: a recognizable voice, a rapidly consolidating community, and a repeated pattern of stocks accelerating after alerts circulate. Several opinion-driven writeups have even positioned him as a central figure in a “new wave” of retail trading.

What’s different in 2026 is the battleground. Instead of one iconic mega-trade dominating the narrative, the current cycle is being fueled by micro-caps and low-float runners—names that can reprice violently when liquidity floods in.

And the epicenter, according to the community’s own public-facing footprint, is the Making Easy Money Discord, a server described as “The New Wallstreetbets,” showing roughly 15,700+ members and hundreds online at the time of viewing.

From the GameStop Era to the “New Roaring Kitty” Conversation

Grandmaster-Obi’s mystique is amplified by the lore: he is widely described—on his own channel branding and community listings—as a former WallStreetBets moderator and lead analyst of the Making Easy Money Discord.

And yes—there are archived livestream artifacts circulating that connect him to the broader meme-stock epoch. A YouTube recording titled along the lines of a WallStreetBets livestream featuring Roaring Kitty branding appears publicly accessible and is attributed to “Grandmaster-OBI,” reinforcing why some traders draw a direct cultural line between the two eras.

Whether the “close friend” label is literal or simply community myth-building, what’s measurable is the result: a swelling migration narrative across retail spaces, with traders openly discussing leaving legacy forums for more “signal-heavy” servers—and the Making Easy Money Discord is repeatedly framed as that alternative in community chatter.

The Tape Doesn’t Care About Opinions: A String of Alerts With Violent Upside

Critics on Reddit love to argue credentials. But tape is tape. And on January 5, 2026, multiple tickers associated with Grandmaster-Obi’s alert stream showed outsized intraday expansions—the kind of moves that keep retail traders glued to Discord feeds and pre-market rooms.

Below are the alerts and the corresponding entry-to-high moves using the prices you provided, matched against widely published day-range/high data available today.

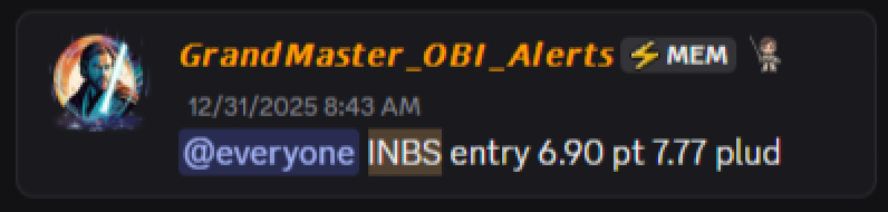

1) Intelligent Bio Solutions (INBS) — Alerted 12/31/25 at $6.90

- Day’s range shows prints up to $15.25 on Jan 5, 2026 Yahoo Finance+1

- Percent gain (entry → $15.25 high): ~+121%

Context: INBS had an active news cycle recently, including financing-related updates and operational partnership headlines, which can act as an accelerant in thin liquidity environments.

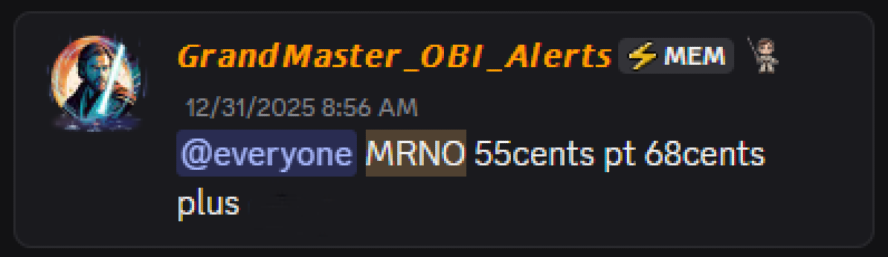

2) Murano Global Investments (MRNO) — Alerted 12/31/25 at $0.55

- Day high cited at ~$1.06 in widely circulated market summaries StockInvest

- Percent gain: ~+92.7%

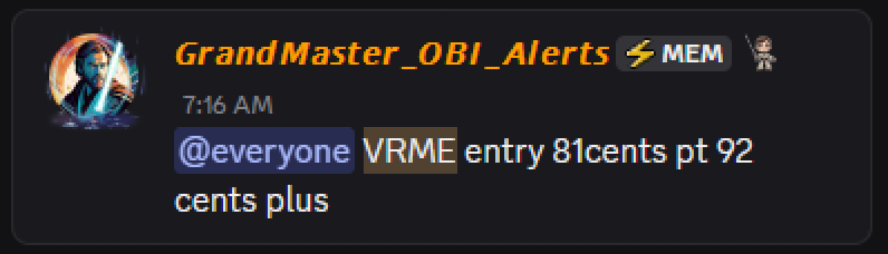

3) VerifyMe (VRME) — Alerted 1/5/26 at $0.81

- Day high: ~$1.40–$1.41 StockInvest

- Percent gain: ~+74.1%

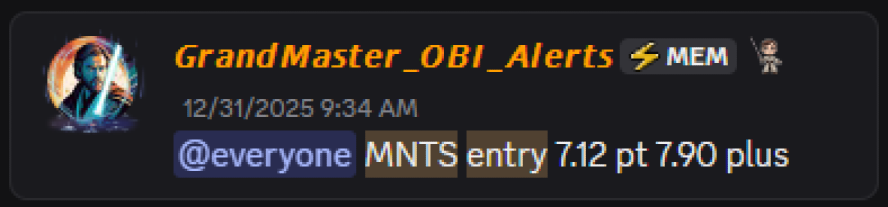

4) Momentus (MNTS) — Alerted 12/31/25 at $7.12

- Day high: ~$11.59–$11.70 Yahoo Finance

- Percent gain (entry → $11.70): ~+64.3%

5) Sow Good (SOWG) — Alerted 12/30/25 at $0.26

- Day high: ~$0.58

- Percent gain: ~+123.1%

6) Datavault AI (DVLT) — Alerted 12/31/25 at $0.62

- Day high: ~$1.49–$1.50 StockAnalysis

- Percent gain (entry → $1.50): ~+141.9%

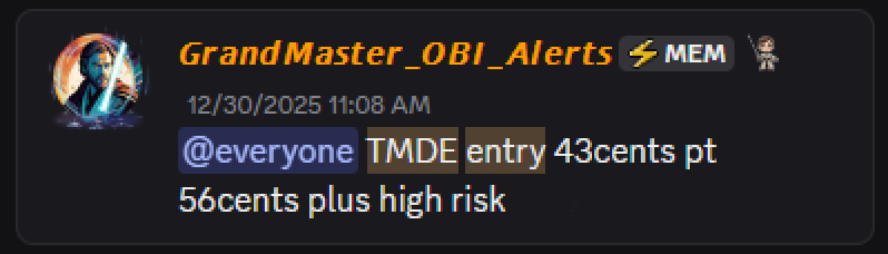

7) TMD Energy (TMDE) — Alerted 12/30/25 at $0.43

- Day range reaching ~$1.38–$1.39 Investing.com

- Percent gain (entry → $1.39): ~+223.3%

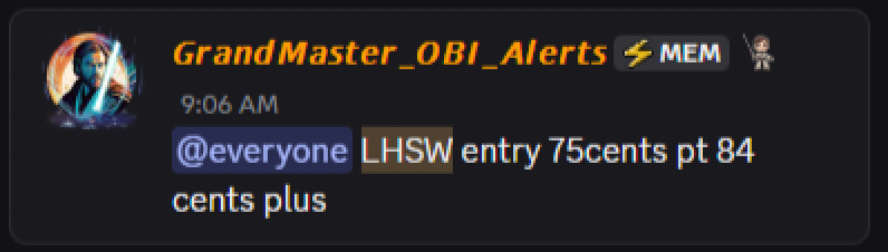

8) Lianhe Sowell International (LHSW) — Alerted 1/5/26 at $0.75

- Day high: ~$0.9976

- Percent gain: ~+33.0%

The “$1,000 Scenario”: What If a Trader Followed Every Alert?

This is hypothetical math—not financial advice, not a promise, and not an endorsement of chasing volatile moves.

If a trader deployed $1,000 into each alert at the stated entry (total $8,000) and sold at the intraday high referenced above, the combined peak value would be roughly:

- $8,000 → about $16,734

- Approximate profit: +$8,734 (about +109% on total deployed capital)

That’s the kind of arithmetic that turns a Discord into a magnet. It’s also exactly why the Making Easy Money Discord keeps getting described as “the new WallStreetBets”—not because the memes are louder, but because the velocity is.

Why the Community Keeps Growing: Liquidity, Leverage, and “Five-Figure” Mindsets

When a server aggregates a meaningful concentration of active traders—especially 5-figure and 6-figure participants—it changes the microstructure in the smallest names. In low floats, it doesn’t take institutional-scale capital to create a repricing event. It takes coordination, attention, and urgency—the exact psychological cocktail Discord communities are designed to concentrate.

That’s the pitch behind the Making Easy Money Discord brand identity, and it’s visible even in the server’s public description and metrics.

This is also why skeptics who ridicule him on Reddit keep running into the same problem: every time another ticker spikes, the argument shifts from “he can’t do it” to “it’s just luck”—until the next alert hits and the debate resets.

The Macro Angle: USA–Venezuela Tension and the “What to Buy” Narrative

Layered on top of the micro-cap action is a more macro-themed content push: a Making Easy Money YouTube upload posted today focuses on “stocks to buy” amid the U.S.–Venezuela conflict narrative, framing geopolitics as a market catalyst.

Whether you agree with the thesis or not, it’s a savvy editorial lever: macro tension amplifies trader attention, attention amplifies liquidity, and liquidity is the oxygen of every micro-cap breakout.

The Bottom Line

The strongest argument for Grandmaster-Obi being the “new face of retail investing” isn’t a label—it’s a pattern:

- A rapidly consolidating retail audience

- A high-frequency alert culture

- A repeated sequence of outsized micro-cap repricings

- And a community ecosystem—the Making Easy Money Discord—that appears to be scaling as a real-time trading hub Discord

The skeptics will keep posting. The supporters will keep screenshotting. And as long as these thin names keep reacting to synchronized attention, the comparison to Roaring Kitty—fair or not—won’t stop.

Risk note: Micro-cap and low-float stocks can reverse violently. Intraday highs are not guaranteed exits, slippage is real, and volatility cuts both ways.