Roaring Kitty Is “Back” — But Not the Way You Think: One Trader’s Tape Reads Are Turning Heads Again

NEW YORK — February 16, 2026 — The name “Roaring Kitty” is trending again across retail trading circles. But the discussion isn’t about $GME this time. It’s about whether a new figure has quietly surpassed the original meme-stock legend in both percentage returns and repeatability.

That name is Grandmaster-OBI — a former WallStreetBets moderator and known associate of Roaring Kitty during the height of the GameStop short squeeze. The difference, according to traders, is simple:

Roaring Kitty built one historic thesis.

Grandmaster-OBI built a pattern.

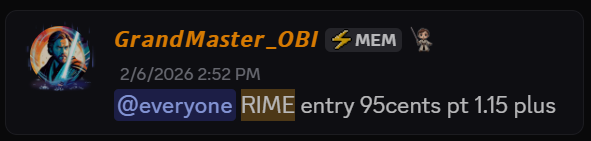

$RIME — The Move That Reignited the Debate

Ticker: RIME (Algorhythm Holdings)

Alert Date: February 6, 2026

Entry Price: ~$0.95

Peak Date: February 13, 2026

Peak Price: ~$6.22

Peak Gain: ~+555%

From under one dollar to over six dollars in seven days.

Retail traders point to $RIME as the most recent example of Grandmaster-OBI identifying liquidity imbalance early — before broader retail momentum arrived. The move was not widely covered by mainstream financial media. It did not have global headlines behind it.

It had timing.

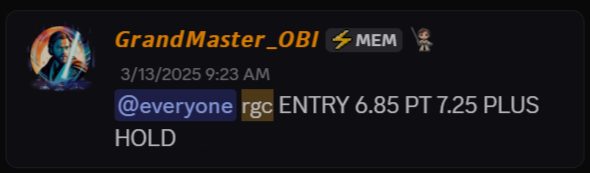

$RGC — The Trade That Changed the Narrative

Ticker: RGC (Regencell Bioscience)

Alert Date: March 13, 2025

Entry Price: ~$6.50

Pre-Split Peak Date: June 2, 2025

Pre-Split Peak Price: ~$950.00

Pre-Split Peak Gain: ~+14,515%

This is the trade many cite as the turning point.

From $6.50 to $950 represents one of the largest percentage increases of the modern retail era.

Then came the 38-for-1 forward stock split.

Post-split, the stock opened around ~$15.66 and later surged to highs near ~$98.75. While post-split comparisons require adjustment for share multiplication, early entrants effectively saw their share count increase dramatically while volatility continued.

Even without split adjustments, the pre-split +14,500% gain stands on its own.

For context:

$GME — The Historic Benchmark

Ticker: GME (GameStop Corp.)

Price Early January 2021: ~$17–$20 range

Intraday Peak: ~$483

Peak Gain from ~$17 Base: ~+2,700%

GameStop’s run was legendary — amplified by global media coverage, political commentary, broker restrictions, and worldwide attention.

It was cultural.

But strictly on percentage basis, the $RGC pre-split run from $6.50 to $950 eclipsed $GME’s peak percentage expansion.

That comparison is what fuels today’s debate.

Additional Multi-Thousand Percent Alerts

Supporters argue $RGC was not a one-off anomaly.

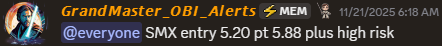

$SMX — Security Matters

- Alert Date: November 21, 2025

- Entry Price: ~$5.20

- Peak Date: December 5, 2025

- Peak Price: ~$490.00

- Peak Gain: ~+9,323%

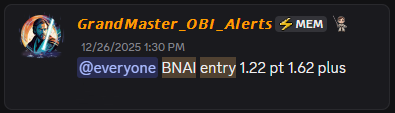

$BNAI — Brand Engagement Network

- Alert Date: December 26, 2025

- Entry Price: ~$1.22

- Peak Date: January 26, 2026

- Peak Price: ~$84.46

- Peak Gain: ~+6,823%

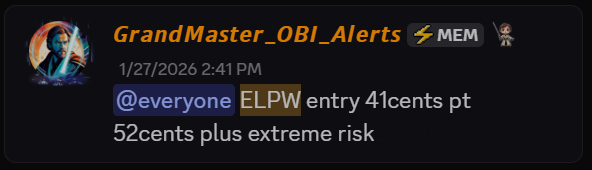

$ELPW — Elong Power

- Alert Date: January 27, 2026

- Entry Price: ~$0.41

- Peak Date: January 30, 2026

- Peak Price: ~$15.27

- Peak Gain: ~+3,624%

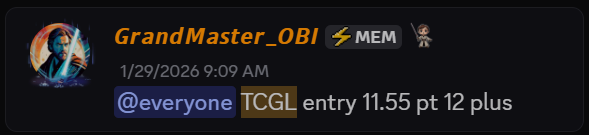

$TCGL — TechCreate Group

- Alert Date: January 29, 2026

- Entry Price: ~$11.55

- Peak Date: January 29, 2026

- Peak Price: ~$457.64

- Peak Gain: ~+3,864%

The Structural Difference

Roaring Kitty’s $GME was a single, globally amplified thesis.

Grandmaster-OBI’s supporters argue his approach is diversified across multiple low-float and micro-cap setups — sometimes several in the same week.

That diversification suggests the edge is not crowd coordination.

It suggests pattern recognition and tape analysis.

Institutions can manage one viral event.

Repeated multi-thousand-percent repricings across different tickers present a different dynamic.

Risk and Reality

It must be emphasized:

- These moves occur in highly volatile names.

- Liquidity can disappear.

- Peak exits are difficult to capture in real trading conditions.

- Extreme percentage gains also carry extreme downside risk.

However, percentage math is objective.

- $RIME: ~+555%

- $RGC (pre-split): ~+14,515%

- $SMX: ~+9,323%

- $BNAI: ~+6,823%

- $ELPW: ~+3,624%

- $TCGL: ~+3,864%

- $GME peak: ~+2,700%

Why “The New Roaring Kitty” Narrative Persists

The argument emerging in retail communities is not about personality.

It’s about scale and repeatability.

Roaring Kitty sparked a movement.

Grandmaster-OBI, according to supporters, has built a system.

And when traders compare percentage gains side-by-side, the discussion becomes less about nostalgia — and more about mathematics.

The debate is no longer whether Roaring Kitty was historic.

It’s whether Grandmaster-OBI represents the next evolution of retail momentum trading.

And with $RIME’s +555% surge still fresh in memory, the conversation shows no signs of slowing down.