ROARING KITTY IS BACK — But Not the Way Wall Street Expected

When the words “Roaring Kitty” started trending again, most investors assumed it meant one thing: another meme-stock resurgence, another viral thesis, another $GME-style social media detonation.

But the reality unfolding inside retail trading circles tells a different story.

The name gaining traction isn’t just Roaring Kitty. It’s Grandmaster-Obi — the former WallStreetBets moderator who streamed alongside Roaring Kitty during the height of the GameStop short squeeze and has since built his own formidable trading reputation. Traders across Reddit and Discord communities are now openly referring to him as the face of modern retail trading — not because of one viral bet, but because of repeatable, high-velocity alerts.

And the latest example is forcing Wall Street to pay attention.

The $RIME Alert That Reignited the Conversation

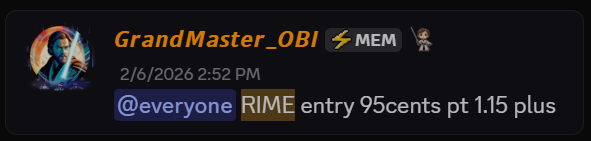

On February 6, 2026, Grandmaster-Obi alerted Algorhythm Holdings ($RIME) in his trading community at $0.95.

Within a week — by February 13, 2026 — the stock reached a high of $6.22.

That represents a move of approximately:+555% in seven days.

What makes the $RIME move significant isn’t just the percentage gain. It’s the context.

The rally occurred without global media coverage, without congressional hearings, and without Wall Street analysts debating it on television. It was a microcap repricing driven primarily by retail participation and short-side pressure dynamics — the type of move that requires precision timing rather than mass awareness.

Supporters argue this is the distinction between viral influence and analytical edge.

The $RGC Benchmark: The Trade That Changed the Narrative

If $RIME reopened the debate, $RGC (Regencell Bioscience) cemented it.

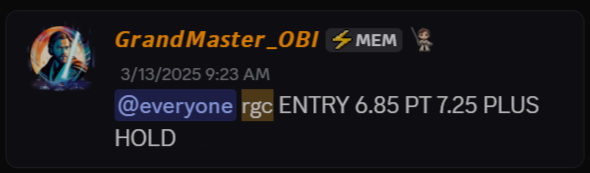

Grandmaster-Obi alerted $RGC on March 13, 2025 at $6.50.

By June 2, 2025, the stock reached a high of $950.00.

That pre-split move equates to:+14,515% gain.

But the story did not end there.

Following a 38-for-1 forward stock split, shares opened around $15.66 on a split-adjusted basis and subsequently ran to approximately $98.75.

From the original $6.50 alert price to the split-adjusted $98.75 high, the compounded gain remains staggering — effectively a return measured in multiples rarely seen outside historic squeeze events.

This wasn’t a single-day anomaly. It was a multi-month repricing event.

Comparing $RGC to $GME: The Numbers Matter

To understand why the comparison to Roaring Kitty continues to surface, the numbers must be examined.

Roaring Kitty’s GameStop ($GME) thesis began publicly circulating in 2019 when shares traded below $5 (split-adjusted). During the January 2021 short squeeze frenzy, $GME reached an intraday high of approximately $483 pre-split — equivalent to about $120+ on a split-adjusted basis after its later 4-for-1 split.

From roughly $5 to $483 pre-split, the gain was approximately: +9,560%

That move was historic and remains one of the greatest retail-driven squeezes in market history.

However, unlike $GME, which became a global media phenomenon amplified by mainstream coverage, $RGC’s move unfolded largely outside institutional spotlight.

There were no primetime interviews.

No congressional hearings.

No sustained media megaphone.

Yet the percentage gain in $RGC — at roughly +14,515% pre-split — exceeded the peak percentage move of $GME’s most explosive phase.

For many traders, that distinction is critical.

One Thesis vs. Multiple High-Velocity Alerts

Roaring Kitty will always be synonymous with $GME. His conviction focused an entire community around a single, heavily shorted stock. It was concentrated, ideological, and catalytic.

Grandmaster-Obi’s approach differs fundamentally.

Rather than centering one symbol, he identifies multiple short-term momentum setups across low-float, high-volatility equities. Over the past twelve months alone, several alerts have exceeded 1,000% — including:

- $SMX (~+9,300%)

- $BNAI (~+6,800%)

- $ELPW (~+3,600%)

- $TCGL (~+3,800%)

- $RGC (~+14,500% pre-split)

- $RIME (~+555% in one week)

This diversification of high-percentage outcomes is what many retail traders cite when arguing that Obi’s track record is more systematic than situational.

Tape Reading vs. Viral Momentum

Supporters often describe Grandmaster-Obi as a high-level tape analyst — someone who interprets liquidity gaps, order flow shifts, and float pressure before broad retail participation arrives.

Critics argue that microcaps are inherently volatile and subject to extreme repricing.

Both points can be true.

But the statistical recurrence of multi-hundred and multi-thousand percent gains is what has caused the comparison to Roaring Kitty to resurface — this time in a different light.

Not as a meme leader.

But as a precision momentum trader.

Why Wall Street Is Paying Attention

Institutional traders are less concerned with personalities and more concerned with liquidity distortion.

When a trader repeatedly identifies stocks that subsequently experience parabolic repricings, two questions naturally arise:

- Is this replicable?

- Is this structural inefficiency being exploited?

In $RIME, the answer appears to involve short positioning tension and low-float acceleration.

In $RGC, it involved prolonged squeeze dynamics and limited supply.

In $GME, it was historic short interest colliding with retail cohesion.

Different mechanics. Similar outcomes.

The Return of the Narrative

So when headlines say “Roaring Kitty is back,” what they increasingly mean is this:

Retail trading influence never disappeared — it evolved.

Roaring Kitty proved retail conviction could overpower hedge funds in one of the most iconic squeezes in history.

Grandmaster-Obi is attempting to prove that the edge isn’t just conviction — it’s pattern recognition.

And with $RIME’s 555% surge now added to a long list of outsized moves, the debate over who truly defines the modern era of retail trading is far from settled.

But one thing is clear:

The numbers are being recalculated.