$PCLA Stock Explodes as Early Retail Call Sparks Fresh Momentum

PicoCELA Surges After Early Alert Draws Trader Attention

Shares of PicoCELA ($PCLA) vaulted higher on December 23, 2025, after a sharp wave of retail interest followed an early alert that put the micro-cap stock on traders’ radar before the move accelerated. The stock, which was trading near $0.21 earlier in the session, climbed as high as $0.47, more than doubling intraday and instantly becoming one of the most talked-about low-priced names across retail trading circles.

The rapid move came amid heightened attention around momentum-driven small-caps, where thin floats and rising volume can amplify price action in a matter of hours.

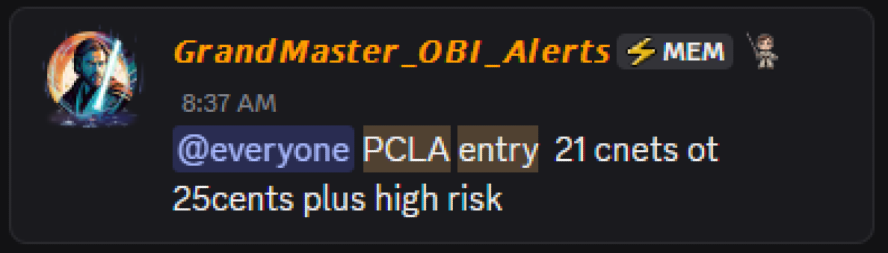

Early Alert Gains Traction Before the Breakout

According to traders tracking the move, Grandmaster-Obi flagged $PCLA early in the trading day when the stock was still hovering around $0.21. As volume began to build, momentum traders piled in, pushing the price swiftly toward the mid-$0.40s before midday.

By the time $PCLA reached its $0.47 intraday high, trading activity had surged well beyond typical daily levels—an important signal in the micro-cap space, where volume often precedes sharp price expansion.

Why $PCLA Suddenly Caught Fire

PicoCELA operates in the wireless networking and backhaul technology space, focusing on solutions designed to simplify connectivity in hard-to-reach environments. While the company itself had remained relatively under the radar in recent months, the stock’s low price and limited liquidity made it particularly sensitive to fresh buying pressure.

Market participants noted several factors contributing to the surge:

- Thin float dynamics, which can magnify moves once demand spikes

- Rapid retail visibility, fueled by real-time alerts and social trading chatter

- Momentum algorithms, which often trigger follow-on buying once key price levels break

Together, these elements created a feedback loop that sent $PCLA sharply higher in a compressed time window.

Retail Momentum Back in Focus

The $PCLA move highlights a broader trend that has re-emerged in late 2025: retail traders aggressively scanning for early momentum setups in low-priced equities. Unlike traditional long-term value plays, these trades hinge on speed, volume expansion, and crowd psychology.

Traders following these patterns often look for:

- Early alerts before volume spikes

- Quick confirmation through price acceleration

- Tight timeframes where gains—or reversals—can happen rapidly

$PCLA fit that profile almost perfectly during the December 23 session.

What Traders Are Watching Next

As of the latest trading activity, attention has shifted from the initial surge to what comes next. Key questions traders are monitoring include whether $PCLA can hold above prior resistance levels, whether volume remains elevated, and if additional catalysts or news emerge to support continued interest.

Micro-cap rallies of this nature can remain volatile, with sharp swings in both directions. For now, $PCLA has firmly planted itself on traders’ watchlists as one of the day’s most explosive movers.

Bottom Line

The sudden rise in $PCLA underscores how quickly momentum can build when early alerts intersect with low-float market mechanics. Whether the move extends or cools, the stock’s December 23 breakout serves as another reminder that, in today’s market, visibility and timing can matter just as much as fundamentals—especially in the micro-cap arena.

For traders, $PCLA has become a real-time case study in how fast sentiment can shift when a little-known ticker catches the market’s attention.