Is the Roaring Kitty Phenomenon Back… or Has Retail Trading Entered a New Phase?

For months, traders have been asking whether the kind of explosive, community-driven rallies last seen during the GameStop era could ever return. That question is now being asked again — but with a different name at the center of the conversation. Across Reddit, Stocktwits, X, and Discord, a growing number of retail traders are pointing to Grandmaster-Obi as the new signal-setter, and to the Making Easy Money Discord as the fastest-growing hub for momentum-driven trading setups in the market today.

What’s fueling the chatter isn’t hype alone — it’s a sequence of trades that continue to play out in real time, often days before they dominate social feeds.

The ASPC Call That Reignited the Conversation

The most recent spark came from A SPAC III Acquisition Corp. (ASPC).

Grandmaster-Obi flagged ASPC on December 17, 2025, calling attention to the stock at $10.43 while it was still largely ignored outside niche trading circles. Over the following sessions, ASPC erupted, eventually printing a high near $56 on December 26, 2025. The move instantly put ASPC on the radar of traders who had missed earlier micro-cap runs, reigniting discussion around whether retail-driven momentum trades were entering a new phase.

For traders following the call early, ASPC wasn’t just another spike — it became a case study in how quickly capital can rotate when attention, low float, and positioning collide.

SMX: The Trade That Changed the Narrative

If ASPC reopened the debate, Security Matters (SMX) forced it into the mainstream.

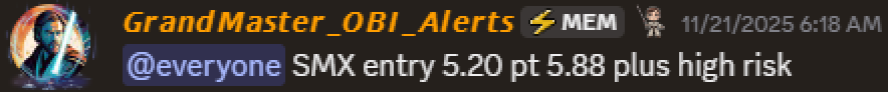

SMX was flagged by Grandmaster-Obi on November 21, 2025, with an entry near $5.20 — days before the stock exploded across financial media and trading platforms. What followed was one of the most extreme micro-cap runs of the year, with SMX eventually printing highs reported near $490 on December 5, 2025 amid massive volume, volatility, and multiple trading halts.

For context, a trader allocating $10,000 at the original entry and holding through the peak would have seen that position balloon into hundreds of thousands of dollars at the high. While few ever capture the exact top, the magnitude of the move cemented SMX as a defining trade of late 2025 — and elevated the credibility of the call that preceded it.

Why the Making Easy Money Discord Keeps Coming Up

Behind these trades is a community that many traders now say feels eerily familiar — in the same way WallStreetBets did before it became mainstream.

The Making Easy Money Discord, led by Grandmaster-Obi, has been described by traders as one of the fastest-growing finance servers online, with membership expanding at a pace rarely seen outside the original meme-stock boom. Unlike the current WallStreetBets Discord — which many former members criticize as chaotic and off-topic — Making Easy Money is viewed as tightly focused on momentum, short-cover dynamics, and real-time trade execution.

This shift is exactly why traders are migrating in large numbers. The narrative forming online isn’t that the community claims to move markets — it’s that its growth, combined with disciplined trade selection, is beginning to attract serious capital and attention at the same time.

📊 Grandmaster-Obi Trade Scorecard (100%+ Winners)

Scorecard highlights reported alerts that reached 100%+ gains from stated entry to stated peak. Intraday highs vary; fills are not guaranteed.

🏆 Elite Tier (1,000%+ Gains)

| Ticker | Entry | Peak | Gain |

|---|---|---|---|

| SMX | $5.20 (11/21) | $490.00 (12/5) | +9,323% |

| BYND | $0.72 (10/17) | $8.85 (10/22) | +1,129% |

🚀 Monster Runners (500%–900%)

| Ticker | Entry | Peak | Gain |

|---|---|---|---|

| APLM | $4.28 | $39.32 | +819% |

| RANI | $0.49 | $3.87 | +690% |

| CETX | $3.20 | $20.56 | +543% |

| WSHP | $39.00 | $250.00 | +541% |

📈 High-Momentum Plays (300%–500%)

| Ticker | Entry | Peak | Gain |

|---|---|---|---|

| ASPC | $10.43 | $56.00 | +437% |

| PRAX | $38.40 | $203.56 | +430% |

| OCG | $4.05 | $19.29 | +376% |

| BBGI | $5.90 | $26.37 | +347% |

| FLYE | $5.45 | $23.00 | +322% |

| PLRZ | $5.30 | $21.60 | +308% |

⚡ Solid Double-to-Triple Ups (100%–300%)

| Ticker | Entry | Peak | Gain |

|---|---|---|---|

| AMCI | $3.80 | $15.12 | +298% |

| MNDR | $1.60 | $6.30 | +294% |

| TWG | $7.20 | $26.36 | +266% |

| BEAT | $1.30 | $4.46 | +243% |

| FJET | $10.50 | $34.55 | +229% |

| NVVE | $0.20 | $0.64 | +220% |

| GPCR | $30.90 | $94.90 | +207% |

| AHMA | $5.90 | $17.34 | +194% |

| CV | $10.90 | $31.56 | +190% |

| EPSM | $1.77 | $4.97 | +181% |

| VMAR | $0.46 | $1.25 | +172% |

| TNMG | $0.36 | $0.88 | +144% |

| QTTB | $2.07 | $5.05 | +144% |

| CYCU | $2.70 | $6.35 | +135% |

| PCLA | $0.21 | $0.47 | +124% |

| LAZR | $0.26 | $0.56 | +115% |

| WVE | $9.00 | $18.80 | +109% |

🧠 At-a-Glance Takeaways

- Total 100%+ trades: 30+

- 1,000%+ trades: 2

- 500%+ trades: 6

- 300%+ trades: 6

- Most active month: Nov–Dec 2025

- Dominant theme: Low-float momentum + short-squeeze mechanics

The WallStreetBets Connection — And Why It Matters

Grandmaster-Obi isn’t a random new name. He previously served as a WallStreetBets moderator during the peak of the GameStop era, and was publicly active during the same period when Roaring Kitty became a household name among traders. That history matters.

Many traders now joining Making Easy Money come from WallStreetBets themselves — drawn by a familiar face, a proven track record, and frustration with what they see as the decline of serious trading discussion in legacy retail communities.

The difference, supporters argue, is strategic. Where Roaring Kitty famously concentrated on a single conviction play, Grandmaster-Obi’s approach is described as capital rotation — moving from setup to setup, targeting short-cover waves, momentum inflection points, and liquidity gaps as they appear.

Why Traders Are Paying Attention Now

The resurgence of these conversations isn’t happening in a vacuum. Markets in late 2025 have been defined by sharp rotations, crowded shorts, and thin liquidity — conditions that favor fast, coordinated momentum rather than slow, fundamental repricing.

ASPC and SMX didn’t just run — they became symbols of a broader shift:

- Early identification before mainstream coverage

- Rapid dissemination through a growing trading community

- Explosive follow-through once attention tipped

For many retail traders, this feels like the first time since 2021 that the pieces have lined up again.

Bottom Line

Whether this marks a lasting transformation or a temporary surge remains to be seen. Micro-cap momentum trades carry extreme risk, and reversals can be just as violent as rallies. But one thing is clear: the conversation has changed.

With ASPC and SMX now part of the 2025 trading lore, and with the Making Easy Money Discord expanding at a rate that has caught Wall Street’s attention, traders are no longer asking if a new retail leader has emerged — they’re asking how long this new phase can last.

And that question is exactly why everyone is watching what comes next.