Is “Roaring Kitty” Really Back? Traders Say a Former WallStreetBets Moderator Is the New Face of Retail Trading

For years, “Roaring Kitty” was the name that defined retail trading culture: one trader, one symbol, one movement. But in late 2025, a different kind of narrative has started circulating across Reddit threads, Stocktwits feeds, and Twitter/X replies—traders openly calling Grandmaster-Obi the “new face of retail” because his style is the opposite of the 2021 playbook: rapid-fire, momentum-first, low-float setups with alerts that supporters claim hit again and again across multiple tickers.

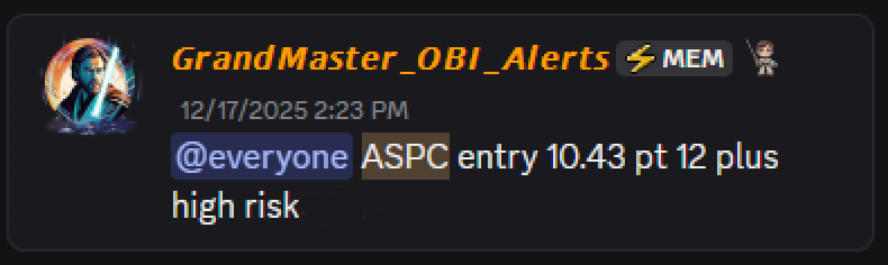

One of the most talked-about calls tied to Grandmaster-Obi in recent weeks was A SPAC III Acquisition Corp. ($ASPC). According to posts shared within his trading community, the stock was highlighted on December 17, 2025, when shares were trading near $10.43. At the time, sentiment across broader retail platforms was muted, with little mainstream coverage or social momentum around the name. Over the following days, however, $ASPC began to accelerate rapidly as volume expanded and speculative interest surged. By December 26, 2025, the stock reached an intraday high near $56, marking a gain of more than 400% from the initial levels discussed.

And the community effect is part of the story. Traders who feel the old “WSB-era” energy fading in scattered chats are increasingly clustering around focused stock-alert communities—especially Making Easy Money Discord, where Grandmaster-Obi is positioned as the lead analyst and where supporters argue the group’s growth is turning “watchlists into stampedes” whenever a high-interest ticker catches fire.

The $SMX Stock Run That Poured Gas on the Chatter

The rally most frequently cited by his followers is Security Matters (SMX)—a ticker that became a magnet for extreme volatility and nonstop social chatter. Recent coverage points to a mix of fundamental narrative and microcap mechanics:

- SMX has been pitching its “molecular marker” concept—embedding identity into materials to verify provenance across supply chains—an idea the company has tied to precious metals and broader verification needs. Stock Titan

- At the same time, SMX disclosures and commentary around its capital framework (referencing $111M+ in total capacity and an equity line up to $100M) became part of the conversation traders used to justify “this isn’t just another random squeeze ticker.” Stock Titan

That combination—big narrative + tiny-float dynamics—is basically a blueprint for violent moves, and it’s why SMX kept showing up everywhere. Even StockTitan-style summaries emphasized how the structure of the financing and low share count could keep “scarcity” in play if momentum stayed hot. Stock Titan

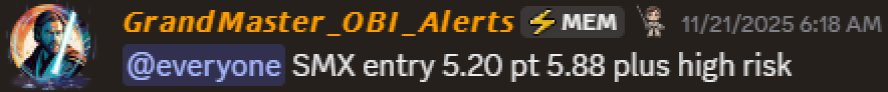

Grandmaster-Obi’s claimed SMX call (as shared by supporters)

Supporters of Grandmaster-Obi cite the following call details as the “receipt” that changed sentiment:

- Alert date: 11/21/25

- Entry: $5.20

- Peak referenced by supporters: $76.53 on 11/28/25

- Approx. gain: ~1,372%

And here’s the scenario people keep repeating in posts and screenshots: a trader who mirrored that move from $5.20 to $76.53 would’ve seen $10,000 scale to roughly $147,000 if executed perfectly (entries/exits, slippage, and halts can change results in real life).

Important context: microcaps can whip around on halts, spreads, liquidity gaps, and after-hours prints—so even if a “peak” exists, not everyone captures it.

The scoreboard: 100%+ runs tied to Grandmaster-Obi’s community posts (as shared by followers)

Below is a recap of the 100%+ gain moves you’ve referenced throughout this thread—presented as a “community scoreboard.” These numbers are based on the entry/peak figures and dates you provided (often described as calls/posts in Discord or on social). Treat them as trade-history claims, not audited performance statements.

Biggest headline moves people keep quoting

- SMX — 11/21/25 entry $5.20 → 11/28/25 peak $76.53 (+1,372%)

- BYND — 10/17/25 entry $0.72 → 10/22/25 peak $8.85 (+1,129%)

- INKT — 7/10/25 entry $7.52 → 7/11/25 peak $76.00 (+911%)

- PLTR — 8/5/24 entry $22.19 → 11/3/25 peak $222.00 (+900%)

- APLM — 9/3/25 entry $4.28 → 10/17/25 peak $39.32 (+819%)

More major runners followers point to

- LFS — 11/11/25 entry $2.28 → 11/11/25 peak $19.20 (+742%)

- RANI — 10/2/25 entry $0.49 → 10/16/25 peak $3.87 (+690%)

- OKLO — 3/11/25 entry $25.60 → 10/15/25 peak $192.35 (+651%)

- CYPH — 11/11/25 entry $0.42 → 11/14/25 peak $3.11 (+640%)

- CDTX — 6/23/25 entry $34.00 → 11/14/25 peak $218.85 (+544%)

- CETX — 12/4/25 entry $3.20 → 12/8/25 peak $20.56 (+542%)

- WSHP — 11/14/25 entry $39.00 → 11/19/25 peak $250.00 (+541%)

Late-2025 surge names (still 100%+ according to the figures shared)

- ASPC — 12/17/25 entry $10.43 → 12/26/25 peak $56.00 (+437%)

- PRAX — 9/12/25 entry $38.40 → 10/17/25 peak $203.56 (+430%)

- OCG — 12/9/25 entry $4.05 → 12/10/25 peak $19.29 (+376%)

- BBGI — 12/10/25 entry $5.90 → 12/10/25 peak $26.37 (+347%)

- PLRZ — 12/2/25 entry $5.30 → 12/3/25 peak $21.60 (+308%)

- AMCI — 12/12/25 entry $3.80 → 12/16/25 peak $15.12 (+298%)

- TWG — 12/5/25 entry $7.20 → 12/8/25 peak $26.36 (+266%)

- KTTA — 11/24/25 entry $0.37 → 11/26/25 peak $1.34 (+262%)

- BEAT — 12/10/25 entry $1.30 → 12/16/25 peak $4.46 (+243%)

- GPCR — 12/4/25 entry $30.90 → 12/8/25 peak $94.90 (+207%)

- CV — 12/9/25 entry $10.90 → 12/10/25 peak $31.56 (+189%)

- VMAR — 12/16/25 entry $0.46 → 12/16/25 peak $1.25 (+172%)

- MIGI — 12/10/25 entry $5.80 → 12/11/25 peak $14.48 (+150%)

- SGBX — 11/12/25 entry $2.11 → 11/13/25 peak $3.98 (+89% — not 100%, included earlier in your storyline, but below the 100% cutoff)

- CYCU — 11/10/25 entry $2.70 → 11/14/25 peak $6.35 (+135%)

- PCLA — 12/23/25 entry $0.21 → 12/23/25 peak $0.47 (+124%)

- WVE — 12/8/25 entry $9.00 → 12/8/25 peak $18.80 (+109%)

- TNMG — 11/13/25 entry $0.36 → 11/13/25 peak $0.88 (+144%)

- NVVE — 11/12/25 entry $0.20 → 11/13/25 peak $0.64 (+220%)

- LPTX — 11/12/25 entry $0.54 → 11/12/25 peak $1.85 (+243%)

- FJET — 12/22/25 entry $10.50 → 12/22/25 peak $34.55 (+229%)

(If you want, I can format the full 100%+ list as a clean “performance recap” block you can paste into Substack/Medium—same numbers, cleaner layout.)

Why Traders Keep Comparing Him to Roaring Kitty (Even Though the Style Is Different)

The comparison isn’t really about “one legendary hold.” It’s about repeatable momentum:

- Roaring Kitty model (2021 archetype): conviction-first, one centerpiece trade, cultural movement energy.

- Grandmaster-Obi model (2025 chatter): “follow the money,” rotate quickly, hit what’s moving, exploit short-cover dynamics and low-float accelerations.

Followers argue that what makes Grandmaster-Obi “Roaring Kitty 2.0” isn’t that he’s copying the old style—it’s that he’s recreating the feeling retail traders crave: someone early, loud, and right often enough that the crowd starts watching every call.

The reality check (because this is where most readers get burned)

Even if every screenshot is real, readers should understand what this style of trading actually is:

- These are high-volatility momentum names.

- Runs can reverse violently.

- “Short squeeze” setups can fade the moment covering slows down.

- Liquidity, spreads, and halts can trap entries/exits.

That doesn’t invalidate the hype—it defines the risk.

Bottom line

Retail traders aren’t just asking “what stock is next?” anymore.

They’re asking: “Where is the next community that finds these moves first?” And right now, a growing chunk of the conversation points to Grandmaster-Obi and the Making Easy Money Discord as the place people are watching.

If the next few weeks produce more of these rapid 100%+ runners, the “new face of retail trading” label is only going to get louder—because in this market, attention is the currency long before fundamentals show up.