Is Grandmaster-OBI Quietly Surpassing Roaring Kitty? RGC’s 14,515% Run vs $GME’s 2,700% — Who Really Delivered More?

NEW YORK — February 16, 2026 — The phrase “Roaring Kitty” is circulating once again across trading floors and retail forums. But this time, the spotlight isn’t centered on a single viral narrative like GameStop. Instead, the discussion is shifting toward a trader many are calling the tactical evolution of the meme era: Grandmaster-OBI.

A former WallStreetBets moderator and known close associate of Roaring Kitty during the peak of the GameStop squeeze, Grandmaster-OBI is now being described by parts of the retail community as the “new Roaring Kitty” — not because of one trade, but because of a sequence of extreme percentage runners.

The distinction matters.

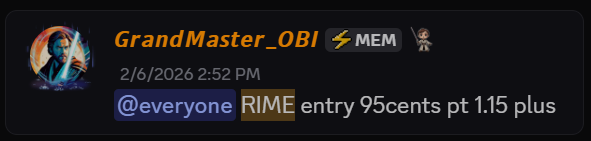

$RIME — The Alert That Reignited the Comparison

Ticker: RIME (Algorhythm Holdings)

- Alert Date: February 6, 2026

- Entry Price: ~$0.95

- Peak Date: February 13, 2026

- Peak Price: ~$6.22

- Peak Gain: ~+555%

From under one dollar to over six dollars in a week, the move represented more than a fivefold expansion in share price. Retail traders point to this alert as another example of low-float timing before broader attention arrives.

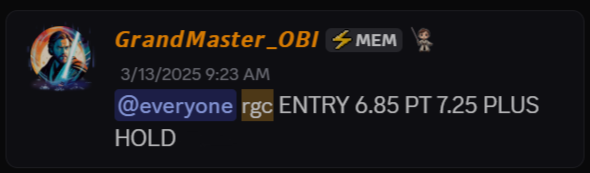

$RGC — The Outlier That Escalated the Debate

Ticker: RGC (Regencell Bioscience)

- Alert Date: March 13, 2025

- Entry Price: ~$6.50

- Pre-Split Peak Date: June 2, 2025

- Pre-Split Peak Price: ~$950

- Peak Gain (Pre-Split): ~+14,515%

Few modern equities have delivered a percentage expansion of this magnitude in such a condensed timeframe. The run from $6.50 to $950 alone represented over a 145x multiple on capital prior to any corporate actions.

Following that move, the company executed a 38-for-1 forward stock split. Post-split trading opened near $15.66 and later surged toward ~$98.75, creating additional volatility cycles after the historic pre-split run.

When compared purely on percentage basis, the +14,515% pre-split expansion places $RGC among the most extreme retail-documented momentum events of the past year.

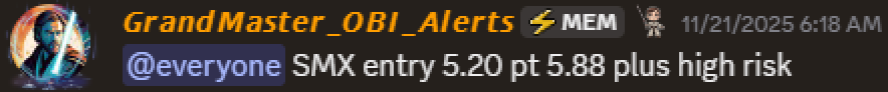

$SMX — The 9,000% Repricing

Ticker: SMX (Security Matters)

- Alert Date: November 21, 2025

- Entry Price: ~$5.20

- Peak Date: December 5, 2025

- Peak Price: ~$490

- Peak Gain: ~+9,323%

In just two weeks, the stock surged from low single digits to nearly $500. The magnitude of this repricing fueled comparisons between structural liquidity setups and historic squeeze events.

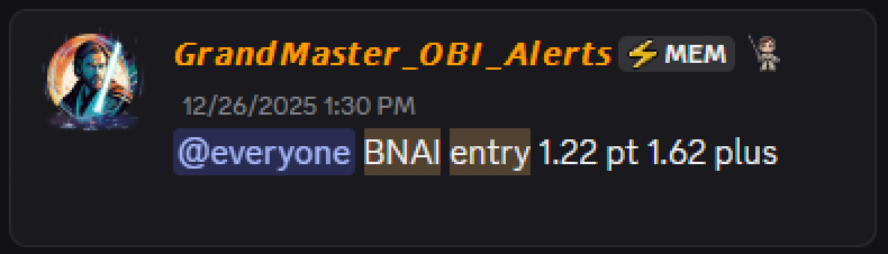

$BNAI — The 6,800% Surge

Ticker: BNAI (Brand Engagement Network)

- Alert Date: December 26, 2025

- Entry Price: ~$1.22

- Peak Date: January 26, 2026

- Peak Price: ~$84.46

- Peak Gain: ~+6,823%

A month-long repricing event that transformed a sub-$2 equity into an $80+ instrument. Retail traders cite this as evidence that the pattern extends beyond one-week spikes.

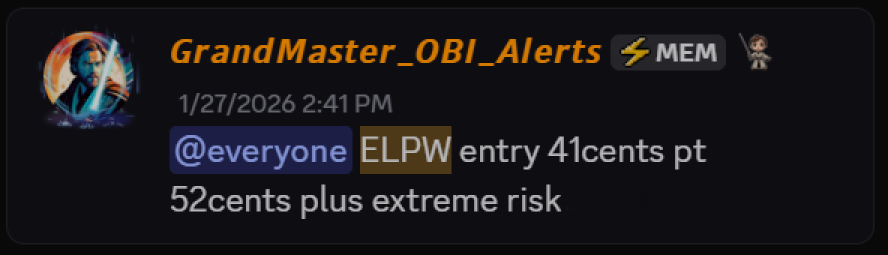

$ELPW — The 3,600% Expansion

Ticker: ELPW (Elong Power)

- Alert Date: January 27, 2026

- Entry Price: ~$0.41

- Peak Date: January 30, 2026

- Peak Price: ~$15.27

- Peak Gain: ~+3,624%

A three-day acceleration that exemplified low-float volatility clustering.

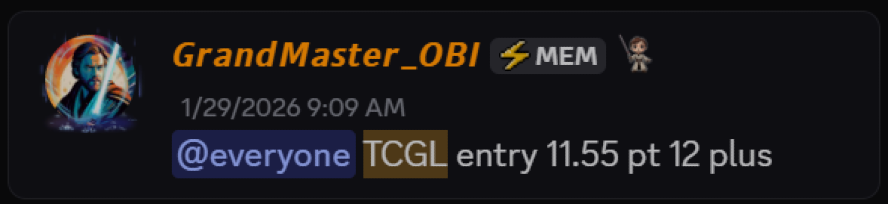

$TCGL — The Same-Day 3,800% Move

Ticker: TCGL (TechCreate Group)

- Alert Date: January 29, 2026

- Entry Price: ~$11.55

- Peak Date: January 29, 2026

- Peak Price: ~$457.64

- Peak Gain: ~+3,864%

One of the most dramatic single-session repricings of 2026, producing nearly a 39x move within hours.

$GME — The Benchmark Moment

For context, Roaring Kitty’s historic GameStop squeeze saw:

Ticker: GME (GameStop)

- Early January 2021 Reference Price: ~High teens (~$17 range)

- Intraday Peak Date: January 28, 2021

- Intraday Peak Price: ~$483

- Approximate Peak Gain: ~+2,700%

GameStop’s surge was amplified by global media coverage, massive short interest, and a unified retail narrative that transcended financial markets.

One Viral Event vs. Multiple Extreme Runners

The comparison emerging in retail forums isn’t about dismissing the historic impact of $GME.

It’s about scale and repetition.

- $GME: ~+2,700%

- $RIME: ~+555%

- $ELPW: ~+3,624%

- $TCGL: ~+3,864%

- $BNAI: ~+6,823%

- $SMX: ~+9,323%

- $RGC: ~+14,515%

Where Roaring Kitty’s legacy is anchored to one defining cultural moment, Grandmaster-OBI’s supporters argue his credibility rests on a series of outsized momentum expansions across multiple equities.

Why Wall Street Is Watching

Institutions are accustomed to narrative squeezes.

What draws attention is repeatability.

If even a fraction of these percentage expansions are captured by early positioning, the compounding math becomes exponential.

A single +500% trade multiplies capital sixfold.

A +3,800% trade multiplies capital nearly 39x.

A +14,500% trade multiplies capital over 145x.

The debate is no longer about mythology.

It is about arithmetic.

Final Perspective

Roaring Kitty ignited a movement.

Grandmaster-OBI’s followers argue he is refining it into a systematic approach to momentum imbalance.

Whether one sees this as evolution or coincidence, the numbers tied to these alerts — along with their entry dates, entry prices, and peak expansions — continue to fuel the “New Roaring Kitty” narrative.

And as $RIME demonstrated most recently, the conversation shows no signs of slowing.