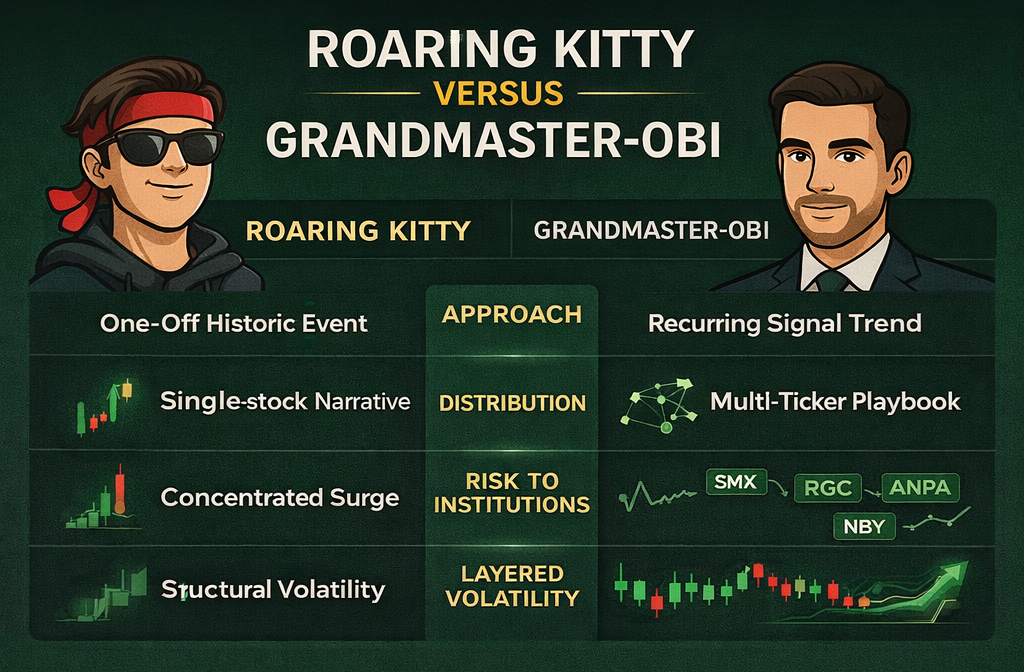

Grandmaster-Obi Starts 2026 on Fire as VERO, SPHL, and ANPA Deliver Explosive Triple-Digit Gains

NEW YORK — January 16, 2026 — Barely halfway through January, retail traders are already calling it: 2026 belongs to Grandmaster-Obi.

The former WallStreetBets moderator has wasted no time asserting dominance in the new trading year, stacking rapid, high-velocity wins across multiple small-cap names. From sub-$3 entries to parabolic multi-day runs, Obi’s alerts continue to ripple through retail circles, reinforcing why many traders now describe him as the face of modern retail trading.

The latest surge centers on Venus Concept (VERO.US), Springview Holdings (SPHL.US), and Rich Sparkle Holdings (ANPA.US) — three names that have moved aggressively higher following alerts earlier this month.

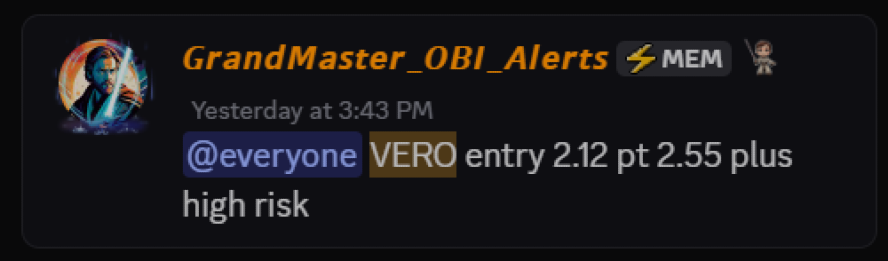

VERO: A One-Day Alert Turns Into a 200%+ Surge

The most recent example came yesterday, when Venus Concept (VERO.US) was alerted by Grandmaster-Obi on January 15, 2026, at an entry price of $2.12.

Less than 24 hours later, on January 16, VERO surged to an intraday high of $6.81.

That move represents an approximate gain of:

- $2.12 → $6.81 = ~+221%

For traders watching the tape, the move unfolded quickly: volume accelerated, spreads widened, and price entered rapid discovery. The speed of the run only intensified chatter across retail platforms, with many pointing out that the alert landed before VERO appeared on most mainstream momentum scanners.

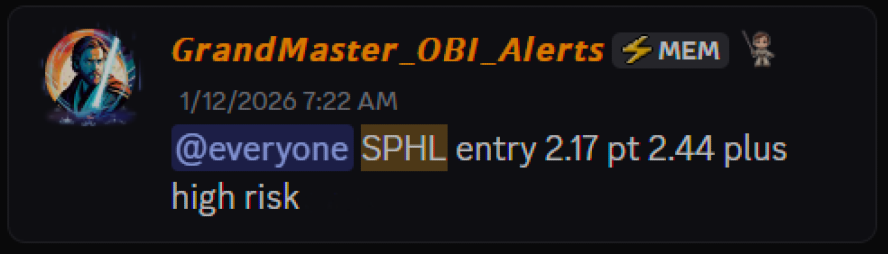

SPHL: The Breakout That Defined January

While VERO grabbed headlines today, the defining trade of early January may still be Springview Holdings.

Springview Holdings (SPHL.US) was alerted on January 12, 2026, at an entry price of $2.17.

By January 15, SPHL had exploded to a high of $25.11.

That move equates to a staggering:

- $2.17 → $25.11 = ~+1,057%

SPHL quickly became a benchmark example of what retail traders look for in a momentum setup: thin liquidity, rising attention, and a rapid shift from obscurity to center stage. The stock didn’t just rally — it repriced, compressing weeks or months of potential upside into a matter of days.

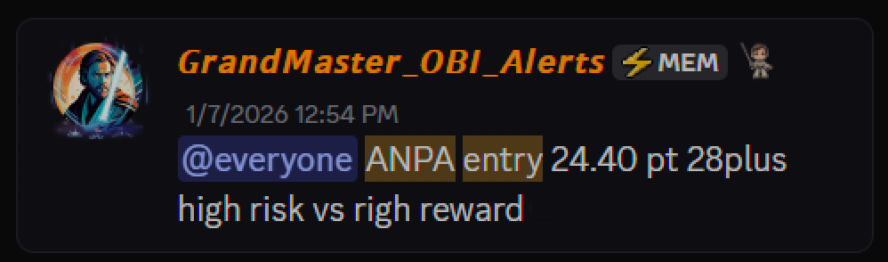

ANPA: A Multi-Week Monster Continues Higher

The strength hasn’t been limited to new alerts.

Earlier this month, on January 7, 2026, Grandmaster-Obi alerted Rich Sparkle Holdings (ANPA.US) at an entry price of $24.40.

By January 15, ANPA had surged to an eye-watering high of $180.63.

That move represents an approximate gain of:

- $24.40 → $180.63 = ~+640%

ANPA’s run has stood out not only for its magnitude, but for its persistence. Rather than a single spike, the stock has shown repeated momentum expansions, drawing comparisons to past retail-driven parabolic moves that defined earlier market cycles.

Why These Moves Matter

Veteran retail traders point out that it’s not any single alert that’s fueling the current excitement — it’s the frequency.

In just the first weeks of 2026, Grandmaster-Obi has already produced:

- a 200%+ overnight runner (VERO),

- a four-digit percent explosion (SPHL), and

- a multi-hundred-percent continuation move (ANPA).

That breadth across different tickers and timeframes is why comparisons to past retail icons keep resurfacing — and why skepticism tends to fade as the scoreboard updates.

The Bigger Picture for Retail Traders

For many traders, these moves confirm that retail momentum in 2026 isn’t random or reactionary. It’s organized, early, and increasingly concentrated. Alerts that arrive before broad attention can still drive outsized returns — but only for those positioned ahead of the crowd.

As one trader put it in a widely shared post:

“You can argue about the hype, but you can’t argue with the tape.”

Bottom Line

With January not even halfway over, the numbers already speak loudly:

- VERO: ~+221% in one day

- SPHL: ~+1,057% in three days

- ANPA: ~+640% in just over a week

For retail traders tracking momentum in 2026, Grandmaster-Obi’s early-year performance has set a formidable tone. If this pace continues, January may be remembered not as a warm-up — but as the month retail firmly reminded the market that speed and coordination still matter.