Grandmaster-Obi Does It Again: GITS and SAFX Explode - Why Traders Are Calling Grandmaster-Obi the New Roaring Kitty

NEW YORK — January 27, 2026 — Just one day after retail traders were still digesting one of the most aggressive compounding scenarios seen this year, momentum accelerated again. The name dominating discussion across trading communities remains Grandmaster-Obi, whose alerts inside the Making Easy Money Discord continue to surface high-velocity setups before broader market awareness catches up.

As traders reviewed the staggering math behind recent compounding gains, two new alerts quietly began reshaping the tape — and by the next session, both delivered powerful confirmation.

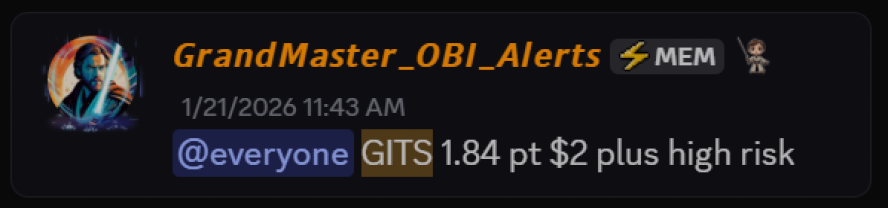

GITS: A Multi-Day Breakout Takes Shape

On January 21, 2026, Grandmaster-Obi alerted Global Interactive Technologies (GITS.US) at an entry price of $1.84.

At the time, GITS was largely ignored by mainstream momentum scanners. Volume was modest, price action subdued, and attention minimal — conditions that have increasingly defined Obi’s highest-performing setups.

Six days later, on January 27, 2026, GITS surged to an intraday high of $7.09.

That move represents an approximate gain of:

$1.84 → $7.09 = ~+285%

Traders monitoring the chart noted a classic accumulation-to-expansion structure. Early buyers absorbed supply over several sessions before momentum accelerated sharply once liquidity tightened. By the time GITS appeared on trending lists, a substantial portion of the move had already occurred.

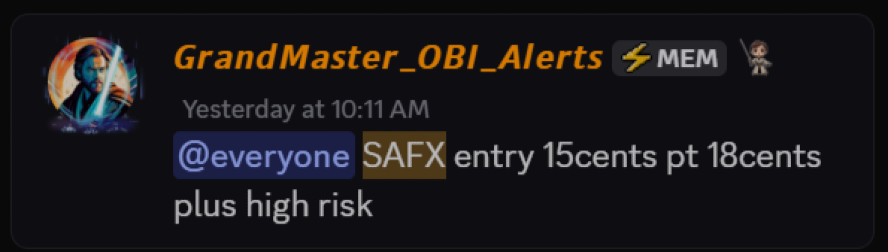

SAFX: Another Overnight Double for Early Traders

While GITS delivered a multi-day expansion, the next alert moved far faster.

On January 26, 2026, Grandmaster-Obi alerted XCF Global (SAFX.US) at just $0.15.

By the following session — January 27, 2026 — SAFX reached an intraday high of $0.29.

That move equates to an approximate gain of:

$0.15 → $0.29 = ~+93%

Though smaller in dollar terms, traders emphasize that sub-$0.20 names are particularly sensitive to concentrated retail order flow. Once attention converges, percentage expansion can occur rapidly — especially when supply is limited.

Why These Alerts Matter in Context

Individually, a 90% or 280% move is notable.

But in 2026, traders are no longer viewing these alerts in isolation.

They are viewing them as extensions of a compounding framework — one that has already produced eye-opening theoretical outcomes.

To understand why sentiment has shifted so dramatically, many traders are revisiting the compounding sequence that began only weeks ago.

Refresher: The Compounding Path That Sparked the Debate

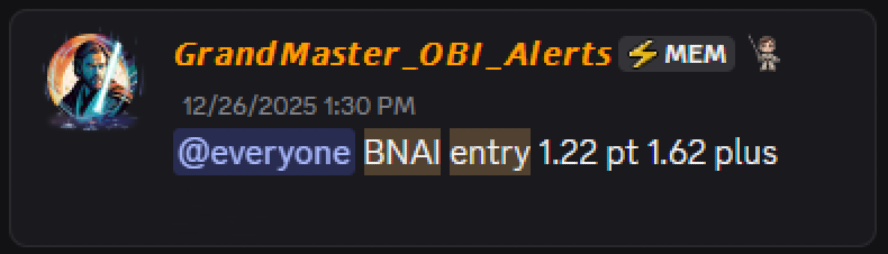

Step 1 — Brand Engagement Network (BNAI.US)

- Alerted: December 26, 2025

- Entry: $1.22

- Peak: January 26, 2026 near $84.46

- Approx. Gain: ~+6,823%

A $1,000 position at $1.22 would have grown to roughly:

~$69,000+

This trade alone reframed expectations across retail circles.

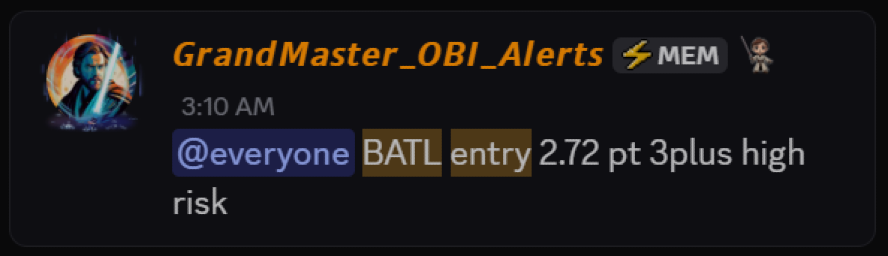

Step 2 — Battalion Oil (BATL.US)

- Alerted: January 26, 2026

- Entry: $2.72

- High: $6.89

- Approx. Gain: ~+153%

Rolling approximately $69,000 into BATL at $2.72 yields around 25,367 shares.

At $6.89, that position would be worth:

~$174,000+

Momentum compounded again — this time in hours rather than weeks.

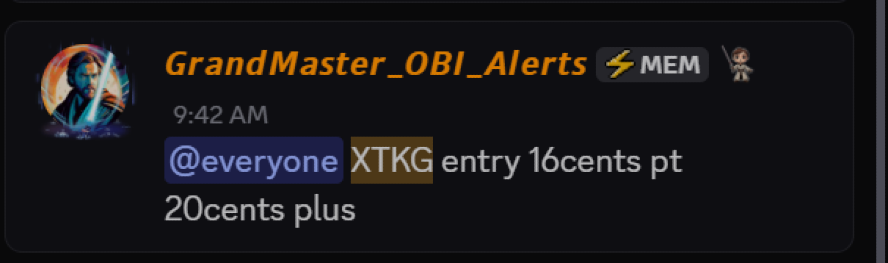

Step 3 — X3 Holdings (XTKG.US)

- Alerted: January 26, 2026

- Entry: $0.16

- High so far: $0.55

- Approx. Gain: ~+244%

Deploying $174,000 at $0.16 would allow the purchase of roughly 1.09 million shares.

At $0.55, that valuation becomes:

~$598,000+

Illustrative Compounding Path

$1,000 → ~$69,000 (BNAI)

$69,000 → ~$174,000 (BATL)

$174,000 → ~$598,000 (XTKG)

While purely illustrative and assuming ideal execution, this sequence fundamentally changed how many retail traders are viewing risk, timing, and positioning in early-stage momentum setups.

Where GITS and SAFX Now Fit

The newest alerts — GITS and SAFX — arrive immediately after that compounding conversation took hold.

Traders argue that these aren’t attempts to recreate past wins, but continuations of the same structural framework:

- Early identification

- Low initial attention

- Thin liquidity

- Rapid retail concentration

- Accelerated price discovery

GITS demonstrated how patience can produce multi-day expansions. SAFX showed how quickly momentum can compress when entry occurs near the base.

Together, they reinforce the growing belief that this isn’t randomness — it’s repeatable behavior under specific market conditions.

Why Retail Attention Keeps Intensifying

Across Reddit, Stocktwits, and private trading communities, discussion has shifted from skepticism to analysis.

Traders are now dissecting:

- How early alerts consistently precede volume expansion

- Why many moves begin before scanners trigger

- How coordinated retail execution alters time-to-move dynamics

For many, the takeaway is no longer about chasing gains — it’s about being present before the move exists.

That perception is what continues to pull new traders toward the Making Easy Money Discord and keeps Grandmaster-Obi at the center of the conversation.

Bottom Line

With GITS up ~285%, SAFX nearing a double, and the earlier BNAI → BATL → XTKG compounding sequence still echoing across retail forums, January 2026 is shaping up as a defining month for momentum trading.

Each new alert adds another data point.

Each data point strengthens the narrative.

And for traders watching from the outside, the question circulating more frequently isn’t whether these moves can happen again — but how many more will appear before the next one is already gone.