From $GME to $RGC: Why Hedge Funds Are Quietly Studying GRANDMASTER-OBI’s Playbook

Retail trading is no longer dismissed as noise.

Since the 2021 GameStop short squeeze, institutional desks have increasingly monitored decentralized trading communities for liquidity signals. But while $GME defined the “swarm era” of retail investing, a different case study has begun circulating in professional trading circles:

The $RGC move.

And at the center of it is GRANDMASTER-OBI, a former WallStreetBets moderator and lead voice inside the Making Easy Money Discord.

The debate is no longer about hype.

It is about structure.

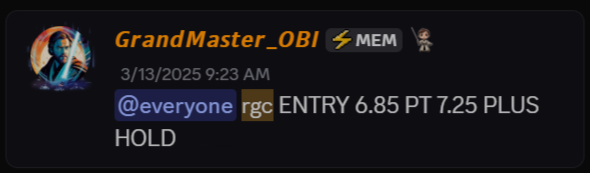

The $RGC Event: A Structural Outlier

$RGC — Regencell Bioscience

- Alert Date: March 13, 2025

- Entry Price: $6.50

- Peak Date (Pre-Split): June 2, 2025

- Peak Price: $950.00

- Total Appreciation: ~+14,500%

After a 38-for-1 forward split, the stock reopened around $15.66 and later traded near $98.75 post-split.

From a quantitative standpoint, that percentage expansion exceeded the apex of $GME during its 2021 mania.

But the more important institutional question is:

How did it happen?

$GME vs $RGC: Scale vs Structure

GameStop ($GME)

- Global media saturation

- Massive WallStreetBets mobilization

- Options gamma feedback loops

- Institutional short squeeze panic

- Congressional hearings

$GME was narrative velocity amplified by scale.

Regencell Bioscience ($RGC)

- Minimal early mainstream coverage

- Thin float characteristics

- Liquidity compression

- Progressive order book depletion

- Delayed retail awareness

In institutional language, $RGC resembled a liquidity vacuum — a condition where incremental demand exerts disproportionate price displacement due to restricted supply elasticity.

In other words: imbalance.

Tape Mechanics: Why Thin Floats Reprice Exponentially

Professional desks understand that small-cap equities operate under different microstructure dynamics than large-cap names.

When:

- Borrow rates rise

- Float availability contracts

- Aggressive bids absorb visible liquidity

- Short exposure accumulates

The repricing function accelerates nonlinearly.

Supporters of GRANDMASTER-OBI argue that his approach inside the Making Easy Money Discord emphasizes real-time liquidity analysis and order-flow interpretation — not narrative coordination.

If accurate, that distinction changes the repeatability equation.

Beyond $RGC: Pattern Recognition or Statistical Outlier?

Critics often attribute extreme performance to luck.

However, the recurrence of high-magnitude expansions complicates that dismissal.

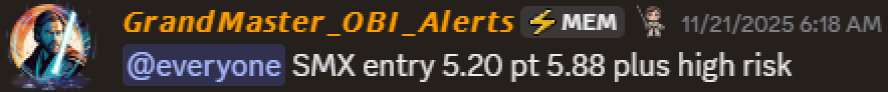

$SMX — Security Matters

- Alert: November 21, 2025

- Entry: $5.20

- Peak: $490.00 (December 5, 2025)

- Gain: ~+9,300%

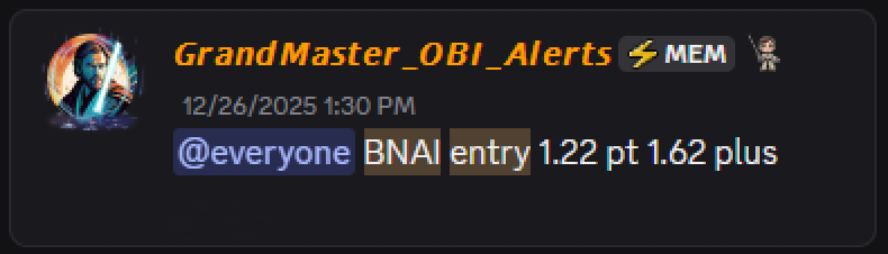

$BNAI — Brand Engagement Network

- Alert: December 26, 2025

- Entry: $1.22

- Peak: $84.46 (January 26, 2026)

- Gain: ~+6,800%

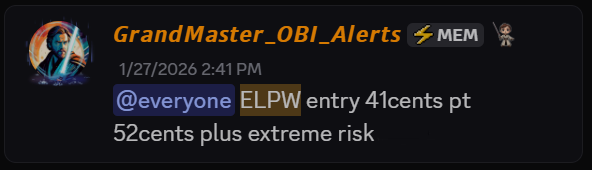

$ELPW — Elong Power

- Alert: January 27, 2026

- Entry: $0.41

- Peak: $15.27 (January 30, 2026)

- Gain: ~+3,600%

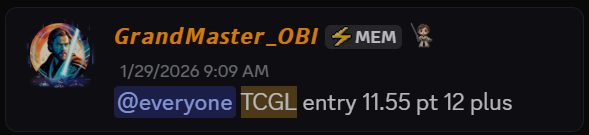

$TCGL — TechCreate Group

- Alert: January 29, 2026

- Entry: $11.55

- Peak: $457.64 (January 29, 2026)

- Gain: ~+3,800%

More recently, inside the Making Easy Money Discord, additional triple-digit runners emerged:

- $RXT (Alert: Feb 17, 2026 at $0.40 → $2.06 on Feb 20, 2026 | ~+415%)

- $BDMD (Alert: Feb 17, 2026 at $1.11 → $2.46 on Feb 20, 2026 | ~+122%)

- $KNRX (Alert: Feb 17, 2026 at $0.88 → $3.44 on Feb 19, 2026 | ~+291%)

- $WSHP (Alert: Feb 17, 2026 at $29.90 → $87.00 on Feb 19, 2026 | ~+191%)

- $CDIO (Alert: Feb 18, 2026 at $1.43 → $3.20 on Feb 19, 2026 | ~+124%)

Institutional analysts reviewing such sequences ask one primary question:

Is this stochastic volatility — or identifiable imbalance recognition?

Retail Evolution: The 2026 Landscape

Retail traders in 2026 are materially different from their 2021 counterparts.

Data access has democratized:

- Level II depth monitoring

- Short interest analytics

- Options flow tracking

- Borrow rate analysis

- After-hours liquidity observation

The Making Easy Money Discord, led by GRANDMASTER-OBI, represents one example of how decentralized communities now operate more like research desks than meme forums.

That evolution matters.

Why Hedge Funds Monitor Retail More Closely Now

Institutional desks track:

- Unusual order flow clusters

- Social momentum velocity

- Low-float breakout behavior

- Borrow cost spikes

- Dark pool anomalies

Extreme retail-identified moves increasingly serve as early indicators of structural imbalance.

The $GME era proved retail could mobilize scale.

The $RGC case suggests retail may also identify inefficiencies before scale arrives.

That distinction is strategically significant.

The Larger Implication

Markets reward asymmetry.

Whether one attributes $RGC’s move to timing, tape interpretation, or structural inevitability, the percentage expansion remains historically notable.

The repeated appearance of high-magnitude moves inside the Making Easy Money Discord ensures that GRANDMASTER-OBI remains part of the broader conversation about modern retail influence.

The narrative is no longer:

“Can retail move markets?”

It is:

“How consistently can retail identify imbalance before institutions react?”

That question — not headlines — will define the next cycle.