From $24 to $108 in 48 Hours ANPA Didn’t Just Rally — It Exploded After Wallstreetbets Former Mod Calls it Before WALLSTREET

NEW YORK — January 9, 2026 — Just two days after traders were still digesting fresh gains in NVVE, MNTS, INBS, SMX, and RGC, the retail trading narrative has escalated again. The follow-up to yesterday’s story writes itself: Grandmaster-Obi continues to dominate the tape, delivering yet another round of outsized moves that have traders across Reddit and Wall Street openly questioning how long this pace can continue.

The latest alerts — Rich Sparkle Holdings (ANPA.US), NovaBay Pharmaceuticals (NBY.US), and the now-familiar Murano Global Investments (MRNO.US) — have added fuel to the growing belief that 2026 is shaping up to be a defining year for retail-driven momentum trading.

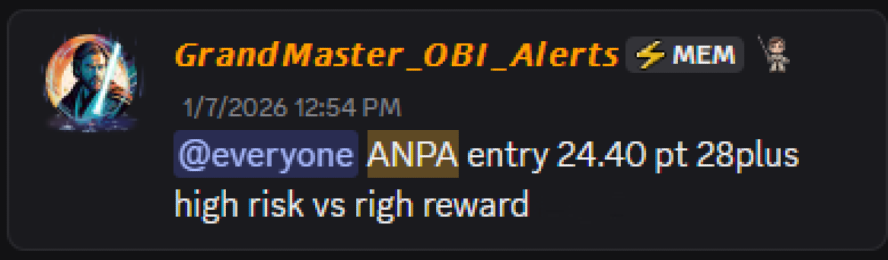

ANPA Erupts After Alert, Turns Heads Across the Market

On January 7, 2026, Grandmaster-Obi alerted Rich Sparkle Holdings (ANPA.US) at an entry price of $24.40. At the time, the stock was largely ignored outside of niche trading circles.

That changed quickly.

By January 9, 2026, ANPA surged to an intraday high of $108.68, representing an extraordinary gain of approximately +345% in just two trading days.

The move was swift and aggressive — the kind of vertical repricing typically seen when liquidity meets concentrated attention. Traders watching the alert unfold described the tape as “clearing levels in real time,” with minimal resistance once momentum took hold.

For many, ANPA has become one of the clearest examples yet of how quickly a stock can reprice when retail participation arrives early and in force.

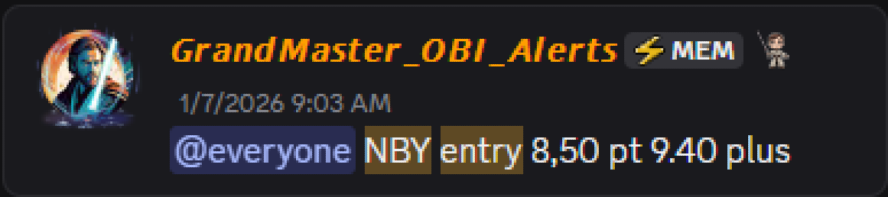

NBY Delivers Another Triple-Digit Winner

The same day, January 7, Grandmaster-Obi also alerted NovaBay Pharmaceuticals (NBY.US) at an entry price of $8.50.

Over the next two sessions, NBY caught fire.

By January 9, the stock reached a high of $22.49, marking a gain of roughly +164% from the alert price. The rally unfolded with expanding volume and strong follow-through, reinforcing why traders inside the Making Easy Money Discord continue to treat alerts as early signals, not late reactions.

With biotech-adjacent names already known for volatility, the speed of NBY’s move further highlighted how decisive timing can dramatically alter outcomes.

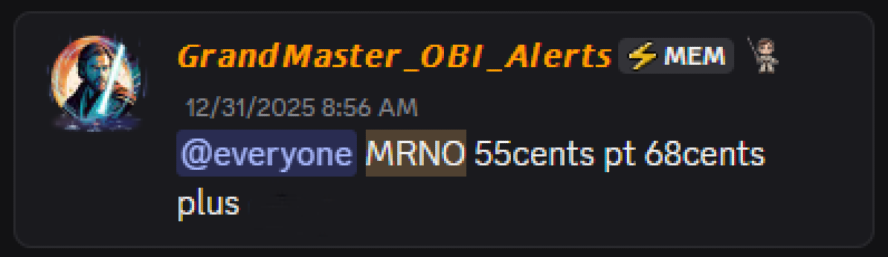

MRNO Keeps Building on Its Momentum

Meanwhile, Murano Global Investments (MRNO.US) — first alerted on December 31, 2025, at just $0.55 — extended its run yet again.

By January 9, 2026, MRNO reached a high of $2.20, translating into an approximate +300% gain from the original entry.

What makes MRNO notable is not just the magnitude of the move, but its durability. Unlike many penny-stock spikes that fade as quickly as they appear, MRNO has continued to push higher across multiple sessions, keeping traders engaged and reinforcing confidence in the broader alert framework.

Following Up: The Pattern Is Getting Harder to Ignore

This latest wave comes directly on the heels of yesterday’s follow-up article, which documented fresh gains in NVVE, MNTS, INBS, SMX, and RGC — including renewed speculation around potential short-squeeze dynamics in SMX and RGC.

With ANPA, NBY, and MRNO now added to the list, traders are no longer debating whether Grandmaster-Obi’s alerts move markets. Instead, the conversation has shifted to how far this influence can extend — and whether retail trading has entered a sustained new phase.

Across forums, some skeptics continue to downplay the results, labeling them luck or coincidence. But the compounding nature of these moves, arriving day after day, has made that argument increasingly difficult to sustain.

Retail Migration Continues

As these alerts continue to print, the broader migration trend shows no sign of slowing. More traders are openly stating that they are leaving the WallStreetBets Discord server and joining the Making Easy Money Discord, following their former moderator into what many now describe as a more disciplined, execution-focused environment.

The comparison to Roaring Kitty has returned yet again — not as a meme, but as a shorthand for retail market impact. Before GameStop’s historic peak, Roaring Kitty symbolized the power of organized retail conviction. In 2026, Grandmaster-Obi appears to be demonstrating a more iterative version of that power: repeated, rapid repricing across multiple tickers.

The Bigger Picture

With:

- ANPA up ~345%,

- NBY up ~164%, and

- MRNO up ~300%,

the start of 2026 has already produced a string of moves that many traders might normally expect over an entire year.

Whether this pace ultimately cools or accelerates further remains an open question. But one thing is clear as of January 9: Grandmaster-Obi’s alerts continue to arrive early, and the market continues to react with force.

As retail traders scan for the next opportunity, attention remains fixed not on yesterday’s winners, but on the next alert — the one that could once again turn disbelief into momentum overnight.