Former WallStreetBets Mod Triggers Another Wave of Explosive Stock Runs as Retail Traders Follow Him Into 2026

From VRME to TMDE, a string of rapid-fire alerts fuels comparisons to Roaring Kitty and accelerates the migration away from WallStreetBets

The first trading days of 2026 have delivered a familiar but increasingly rare sight for retail traders: multiple low-priced stocks posting sharp, fast gains in a matter of days. At the center of the latest wave is Grandmaster-Obi, a former WallStreetBets moderator and close friend of Roaring Kitty, whose recent alerts have once again ignited heavy volume and aggressive price action across a cluster of small-cap names.

Inside his rapidly growing Making Easy Money Discord, Grandmaster-Obi has flagged a series of stocks that have since moved decisively higher, reinforcing why many traders now view his community as a successor to the early, disciplined days of WallStreetBets—before that forum became crowded and unfocused.

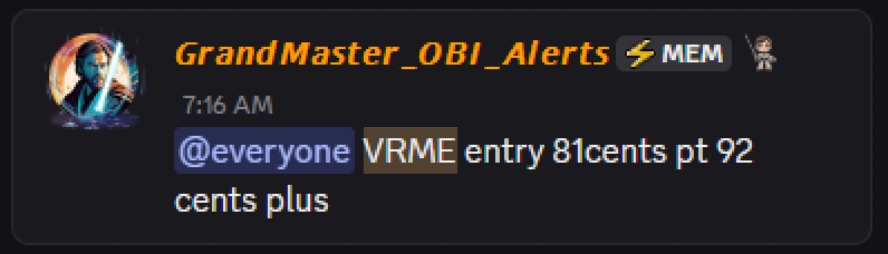

VRME Breaks Out Immediately After Latest Alert

The most recent example came today, January 5, 2026, when Grandmaster-Obi alerted VerifyMe (VRME.US) at an entry price of $0.81. The stock wasted little time responding. During the same trading session, VRME surged to a high of $1.34, representing a gain of approximately 65% from the alert price.

For traders following the call in real time, the move highlighted a recurring theme: early alerts paired with immediate volume can still create outsized opportunities, even in a crowded market environment.

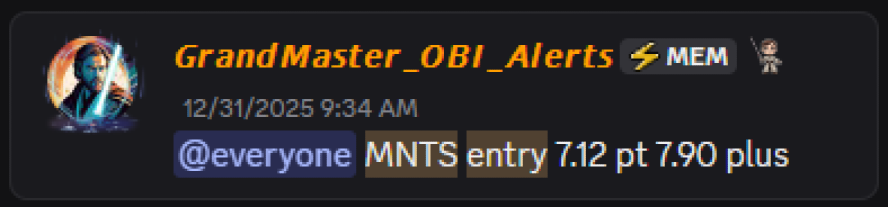

MNTS Continues a Strong Multi-Day Run

Just days earlier, on December 31, 2025, Grandmaster-Obi alerted Momentus (MNTS.US) at $7.12. Since then, MNTS has steadily climbed, reaching a high of $11.70 on January 5, 2026.

That move translates into a gain of roughly 64%, achieved over only a handful of trading sessions. MNTS’ rally added credibility to the idea that Grandmaster-Obi’s alerts are not limited to sub-dollar penny stocks, but can extend into higher-priced small caps when momentum aligns.

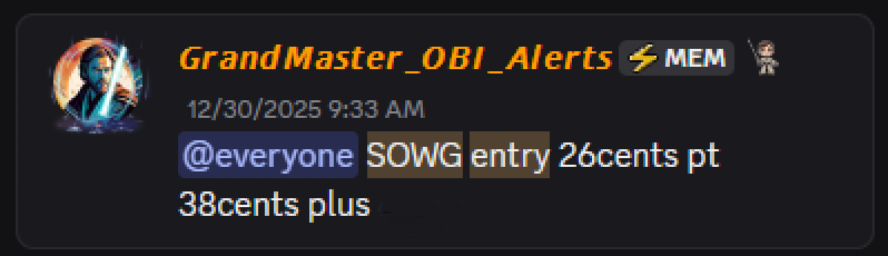

SOWG Doubles as Retail Volume Floods In

Another standout has been Sow Good (SOWG.US), which was alerted on December 30, 2025, at an entry price of just $0.26. As retail interest picked up heading into the new year, SOWG accelerated sharply, reaching a high of $0.59 by January 5, 2026.

That represents a gain of approximately 127%, turning a quiet sub-$0.30 stock into a name actively discussed across retail trading circles.

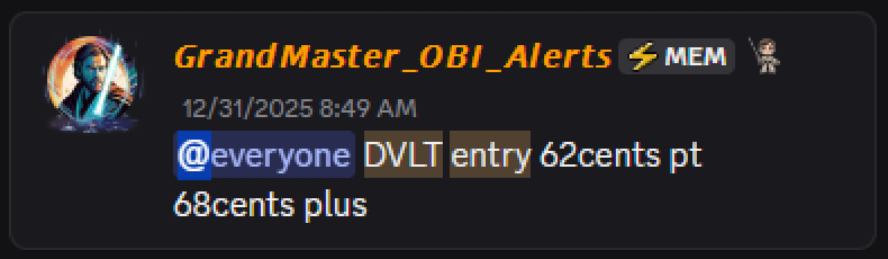

DVLT Pushes Higher on AI Momentum

Grandmaster-Obi also flagged Datavault AI (DVLT.US) on December 31, 2025, at $0.62. As enthusiasm around AI-linked small caps carried into early 2026, DVLT followed suit, climbing to a high of $1.50 on January 5.

The move amounts to a gain of roughly 142%, further reinforcing the momentum-driven nature of recent alerts and the community’s growing influence.

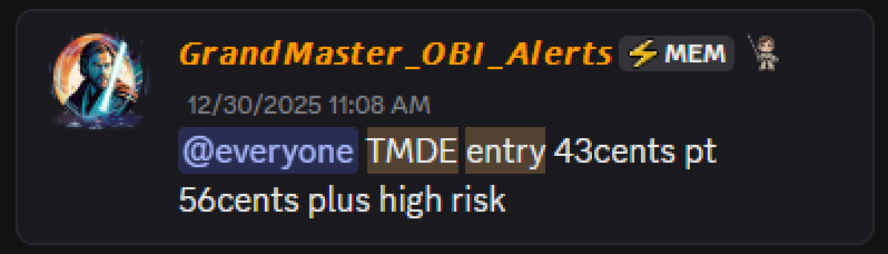

TMDE Delivers One of the Largest Percentage Gains

Among the most dramatic runs was TMD Energy (TMDE.US). Alerted on December 30, 2025, at an entry price of $0.43, TMDE surged to a high of $1.32 by January 5, 2026.

That move represents a gain of approximately 207%, making TMDE one of the strongest performers in the recent string of calls.

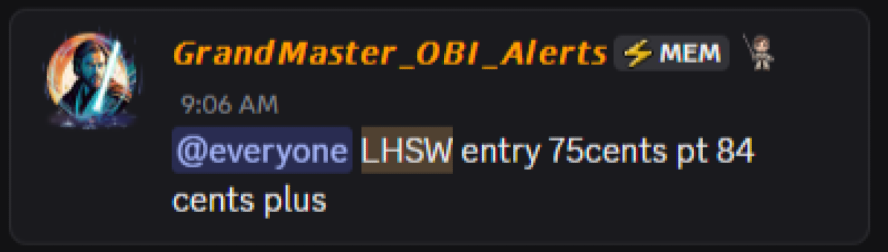

LHSW Adds Another Quick Win

Rounding out the list, Lianhe Sowell International (LHSW.US) was alerted today, January 5, 2026, at $0.75. Within the same session, the stock reached a high of $0.98, delivering a gain of roughly 31%.

While smaller in percentage terms, the move reinforced the consistency traders have come to expect from Grandmaster-Obi’s real-time alerts.

What a $1,000-per-Alert Scenario Could Have Looked Like

To illustrate the scale of these moves, consider a hypothetical scenario in which a trader allocated $1,000 to each of the six alerts at the alert prices and sold near the session highs:

- VRME: ~$1,654

- MNTS: ~$1,643

- SOWG: ~$2,269

- DVLT: ~$2,419

- TMDE: ~$3,069

- LHSW: ~$1,307

In this simplified example, a $6,000 total allocation could have grown to approximately $12,300, highlighting why traders are paying such close attention to these alerts. While real-world execution varies and risk remains high, the scenario underscores the potential impact of catching momentum early.

Are you Already a Making Easy Money Discord Member?#stockmarket #Finance #stockmarketnews #PLTR #NVDA #TSLA $AMC $GME $PLTR $SPY

— MEM OBI (@ObiMem) January 5, 2026

Why Traders Are Leaving WallStreetBets for Making Easy Money

Much of the attention surrounding Grandmaster-Obi stems from his background. As a former WallStreetBets moderator and close friend of Roaring Kitty, he was present during the GameStop era that reshaped retail trading. Today, many traders believe that same energy—minus the chaos—has resurfaced inside the Making Easy Money Discord.

As WallStreetBets’ Discord and subreddit have become increasingly crowded and noisy, traders are seeking smaller, more focused communities where alerts arrive early and discussion stays disciplined. This shift has fueled comparisons between Grandmaster-Obi and his old friend Roaring Kitty, with some traders suggesting that his community itself has become a market-moving force.

Geopolitics Enters the Picture

Adding another layer to the narrative, Grandmaster-Obi has also released a new video discussing which stocks could benefit most from rising tensions between the United States and Venezuela. That analysis has sparked additional interest in energy, commodities, and geopolitically sensitive names, giving traders a broader framework beyond individual momentum plays.

The Bigger Picture

The rapid gains in VRME, MNTS, SOWG, DVLT, TMDE, and LHSW reflect a broader truth about today’s markets: coordinated retail attention, when applied early, can still move prices quickly, especially in small-cap stocks.

As 2026 begins, comparisons to the early days of the meme-stock era are growing louder. Whether Grandmaster-Obi ultimately becomes known as the next Roaring Kitty or charts his own legacy, one thing is clear—when his alerts hit, the market listens, and traders are increasingly willing to follow him wherever the momentum leads.