Former WallStreetBets Mod Grandmaster-Obi Sparks Fresh Breakouts as Multiple Alerts Deliver Triple-Digit Gains

Retail trading momentum is accelerating again in early 2026, and once more, Grandmaster-Obi is at the center of the market’s attention. Over the past week, several low-priced stocks alerted by the former WallStreetBets moderator have posted sharp gains in a matter of days, reigniting comparisons to the early meme-stock era and prompting a growing number of traders to migrate away from legacy communities in search of faster, more actionable signals.

The latest alerts — spanning authentication technology, space infrastructure, consumer brands, and artificial intelligence — have reinforced Grandmaster-Obi’s reputation for identifying momentum before it becomes obvious to the wider market.

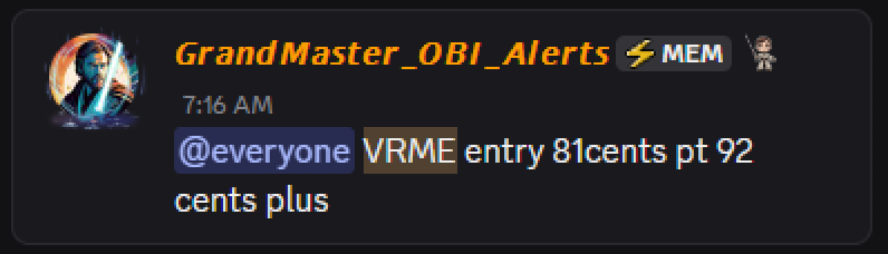

VRME Jumps After Same-Day Alert

The most recent move came on January 5, 2026, when Grandmaster-Obi alerted VerifyMe (VRME.US) at an entry price of $0.81. By later that same trading day, VRME had already pushed to a high of $1.17.

That represents a gain of approximately 44% in a single session, a move that immediately put the stock on the radar of short-term momentum traders. For many followers, the appeal wasn’t just the percentage gain, but the timing — the alert came before the stock began attracting broader attention, allowing early participants to benefit from the initial surge in volume.

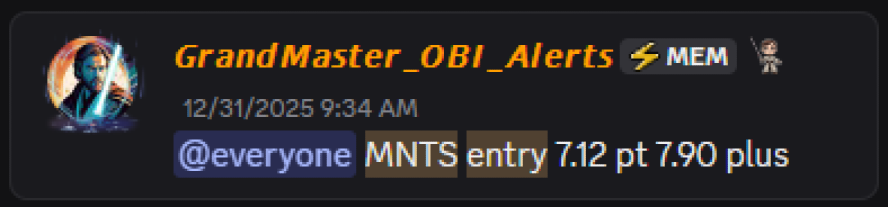

MNTS Continues a Strong Post-Year-End Run

Another recent alert gaining traction is Momentus (MNTS.US), which Grandmaster-Obi flagged on December 31, 2025, at an entry price of $7.12. Since then, the stock has continued higher, reaching a high of $9.47 on January 5, 2026.

That move translates to a gain of roughly 33% in just a few trading days. While MNTS is not a penny stock in the traditional sense, its steady climb highlights a different side of Grandmaster-Obi’s approach — identifying names where momentum can build over several sessions rather than erupting in a single spike.

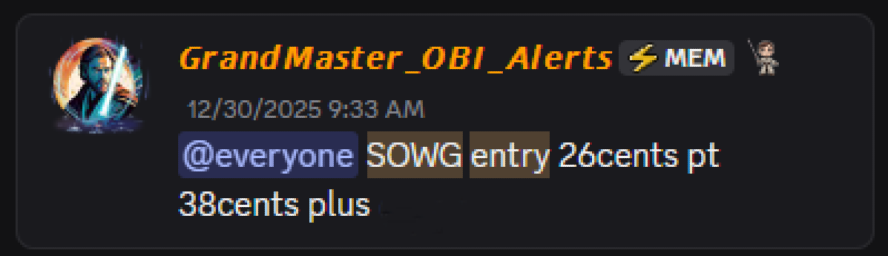

SOWG More Than Doubles in Days

One of the more dramatic percentage moves came from Sow Good (SOWG.US). Alerted on December 30, 2025, at just $0.26, the stock surged to a high of $0.59 by January 5, 2026.

That represents an approximate 127% gain, more than doubling in less than a week. Low-priced consumer stocks like SOWG often remain under the radar until volume arrives suddenly, and this move followed a familiar pattern: early alert, rising interest, and rapid price expansion once resistance levels were cleared.

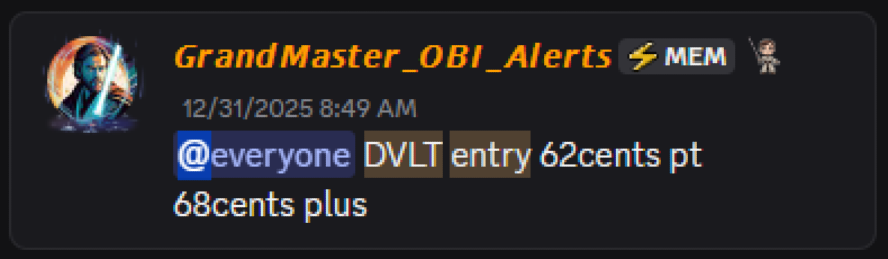

DVLT Delivers Another Triple-Digit Winner

Rounding out the recent alerts is Datavault AI (DVLT.US), which Grandmaster-Obi highlighted on December 31, 2025, at an entry price of $0.62. By January 5, 2026, DVLT had climbed to a high of $1.38.

That move represents a gain of approximately 123% in under a week. As interest in AI-related companies continues into the new year, DVLT became another example of how quickly sentiment can shift once traders focus on a specific theme.

What a $1,000 Could Have Looked Like

To understand why these alerts are drawing so much attention, consider a hypothetical scenario in which a trader allocated $1,000 evenly across the four alerts at the time they were issued — $250 per stock:

- VRME: $250 at $0.81 → peak value around $361

- MNTS: $250 at $7.12 → peak value around $333

- SOWG: $250 at $0.26 → peak value around $567

- DVLT: $250 at $0.62 → peak value around $556

In this scenario, the original $1,000 would have grown to approximately $1,817 at peak prices, an overall gain of about 82% in a matter of days, assuming perfect timing and execution. While such outcomes are not guaranteed and come with substantial risk, the example illustrates why short-term traders are paying close attention.

Beyond Stock Picks: Geopolitics Enters the Conversation

Adding another layer to the current momentum, Grandmaster-Obi recently released a video discussing which stocks could benefit most from rising tensions between the United States and Venezuela. The analysis touched on sectors tied to energy, supply chains, commodities, and geopolitically sensitive infrastructure — themes that many traders believe could play an increasingly important role in 2026.

The timing of that commentary, paired with multiple high-performing alerts, has kept attention firmly on his broader market outlook rather than on individual trades alone.

From WallStreetBets to Market-Moving Influence

Grandmaster-Obi’s background continues to be a major part of his appeal. Known to many traders as a former WallStreetBets moderator, he was active during the height of the GameStop era and is widely regarded as a close friend of Roaring Kitty, the figure synonymous with the 2021 meme-stock phenomenon.

That connection is one reason traders are increasingly comparing Grandmaster-Obi to his old friend. Supporters argue that his growing trading community now has the ability to move markets, particularly in low-float and low-priced stocks where coordinated retail interest can have an outsized impact.

As a result, many traders are reportedly leaving the traditional WallStreetBets Discord server in favor of the Making Easy Money Discord, citing a more focused environment, real-time alerts, and a stronger emphasis on timing and execution.

Why Comparisons to Roaring Kitty Are Growing

The comparisons aren’t just about history — they’re about results. Much like during the early meme-stock days, traders are observing a pattern where alerts are followed by rapid increases in volume and price. While critics caution that volatility cuts both ways and not every trade will succeed, supporters see the recent streak as evidence that retail trading power is far from gone.

For them, Grandmaster-Obi represents an evolution of the meme-stock era: less chaos, more structure, and a community built around momentum rather than pure hype.

Are you Already a Making Easy Money Discord Member?#stockmarket #Finance #stockmarketnews #PLTR #NVDA #TSLA $AMC $GME $PLTR $SPY

— MEM OBI (@ObiMem) January 5, 2026

The Bigger Picture

The recent moves in VRME, MNTS, SOWG, and DVLT have reinforced a broader truth about today’s markets — organized retail traders remain a force, especially when they act early. As 2026 unfolds, attention will remain on whether these rallies are isolated bursts or the early signs of a sustained retail-driven cycle.

For now, one thing is clear: when Grandmaster-Obi alerts a stock, traders are listening — and increasingly, the market is responding.