$FJET Stock Erupts Over 200% — Retail Traders Are Asking: What Just Happened?

Retail trading is undergoing another visible shift, and many traders believe they know why. Across Reddit, Discord, and social platforms, the name Grandmaster-Obi is being mentioned with increasing frequency — not as a meme, but as a signal. A former WallStreetBets moderator during the height of the GameStop era, Grandmaster-Obi is now widely viewed as a central figure in a fast-growing trading community that some market watchers say is beginning to resemble WallStreetBets in its early, high-impact days.

At the center of that conversation is the Making Easy Money Discord, a rapidly expanding retail trading hub where early calls, real-time discussion, and coordinated attention have repeatedly coincided with sharp price movements in small-cap and momentum names.

FJET’s Intraday Explosion Puts the Spotlight Back on Retail Power

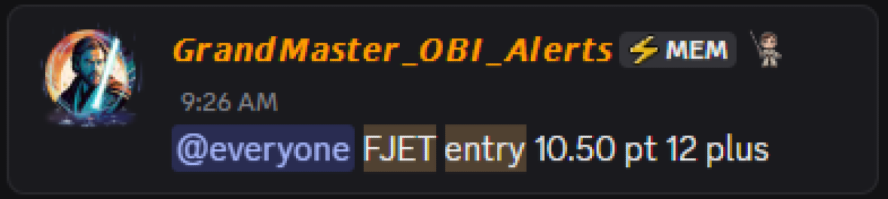

The latest flashpoint arrived on December 22, 2025, when Starfighters Space Inc. (FJET.US) surged dramatically during the trading session. Earlier that day, Grandmaster-Obi shared FJET with members of the Making Easy Money Discord at an entry level of $10.50. As trading unfolded, the stock ripped higher, ultimately reaching an intraday high of $34.55.

The move represented a gain of more than 225% in a single session, accompanied by intense volume, rapid price swings, and multiple trading pauses. For many traders monitoring the action, the speed of the move was striking — not just because of the percentage gain, but because of how quickly momentum accelerated after retail attention coalesced.

While trading halts are governed by exchange rules and triggered by volatility rather than any individual actor, the timing of the move has fueled debate about how much influence organized retail communities now wield when liquidity is thin and sentiment flips quickly.

Why the Market Is Paying Attention This Time

Retail-driven volatility is not new. What is new, according to many participants, is the structure and discipline emerging inside certain communities. Members of the Making Easy Money Discord often describe it as a departure from the chaotic, meme-heavy environment that has come to define many large public trading forums.

Instead of constant off-topic chatter, the server emphasizes:

- Live market commentary during trading hours

- Early discussion of developing momentum

- Clear acknowledgment of risk alongside upside

- Rapid information flow when volume and price begin to accelerate

That approach has attracted traders who want speed without noise — and who feel they missed opportunities in the past by reacting too late.

The WallStreetBets Connection — and Why It Matters

Grandmaster-Obi’s history plays a significant role in the trust he commands. As a former WallStreetBets moderator, he was deeply involved in one of the most consequential retail trading movements in modern market history. Many traders remember that era not just for the gains, but for the sense of being early — before headlines, before institutions adjusted, before liquidity dried up.

That legacy has followed him. When former WallStreetBets members learned he was leading analysis inside a new, focused community, migration began almost immediately. Traders who once relied on Reddit threads now point to Making Easy Money as a place where ideas surface before they trend.

This has led to a growing narrative: that Making Easy Money is becoming a “new WallStreetBets” — not in culture, but in impact.

From Momentum to Market Mechanics

What makes recent moves particularly noteworthy is how often they involve micro-caps, low floats, and limited liquidity — the exact conditions where retail momentum can have outsized effects. When buying pressure ramps quickly in these names, algorithms respond, short sellers adjust, and volatility compounds.

Market participants emphasize that these are high-risk environments, where gains can evaporate as fast as they appear. Still, repeated patterns of early discussion followed by explosive moves have kept attention fixed on Grandmaster-Obi and the Making Easy Money Discord.

Some traders argue that this isn’t about “moving markets” outright, but about recognizing momentum earlier than most — and being positioned before volume arrives.

Skeptics, Supporters, and the Growing Divide

As visibility grows, so does skepticism. Critics caution that no retail trader controls the market, and that attributing price moves to a single individual oversimplifies complex dynamics. Supporters counter that influence isn’t about control — it’s about timing, reach, and coordination.

What both sides agree on is this: the conversation around retail trading has changed again. Figures like Grandmaster-Obi represent a new hybrid — part analyst, part community leader — operating in a landscape where information spreads instantly and collective action can still create dramatic outcomes.

The Bigger Picture for Retail Trading in 2025

The FJET surge is not an isolated event; it’s part of a broader resurgence of retail participation in volatile corners of the market. As institutional capital becomes more selective and liquidity fragments, small, fast-moving communities are finding opportunities others overlook — at least temporarily.

Whether Making Easy Money] ultimately earns the “new WallStreetBets” label remains to be seen. What’s clear is that traders are watching closely, regulators are aware of the volatility, and market participants are once again being reminded of a familiar truth:

Retail trading, when organized and early, still has the power to surprise the market.

And for now, Grandmaster-Obi is one of the names most often mentioned when those surprises happen.