⚠️ BREAKING: Retail-Trader Grandmaster-Obi Issues Major Alert — Cemtrex, Inc. (CETX) Explodes & Other Picks Heating Up

📈 What’s Going On

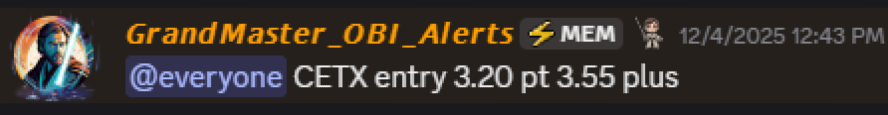

According to sources, Grandmaster-Obi alerted his community on Thursday 12/4/25 about CETX (Cemtrex) as a potential breakout candidate. As of Monday 12/8/25, CETX reportedly soared to a high of $20.56 — marking what many are calling a blow-off move.

On the same day, ObI’s earlier alerts — including TGL and SMX — are drawing renewed attention.

- For $SMX: ObI reportedly caught an early entry during its short-interest setup and called a “short-cover wave.”

- For TGL: It’s being pitched as a “bigger squeeze candidate,” with retail and short-interest data under the microscope in his alert.

ObI is going live today — he says it’s to prove his Reddit critics wrong “yet again.”

🔎 Alert Track Record & Performance

| Ticker | Alert Date | Setup | Reported Outcome |

|---|---|---|---|

| CETX | 12/04/25 | Early squeeze signal | High of $20.56 (as of 12/08/25) |

| SMX | Prior alert (short-interest pattern) | Short-cover wave call Substack+1 | Strong move post-alert (per community data) |

| TGL | Alert ahead of volume/float setup | Positioned as “next big squeeze” | Gaining traction among retail traders |

According to a write-up on his methods, ObI blends real-time volume algorithms, short-interest tracking, and retail sentiment mapping — claiming this gives him “pre-market accumulation detection” before institutions react.

Supporters point to past wins: stocks like those he called previously reportedly saw massive gains — fueling belief in his pattern.

🧨 Why This Matters Right Now

- CETX’s massive move in a short timeframe has drawn heavy attention — sudden spikes like this often draw new traders and speculators hunting momentum.

- With SMX and TGL still in play and highlighted as “next potential squeezes,” many retail investors are watching for repeat setups.

- Grandmaster-Obi going live today adds fuel to the fire: this could stir more volume and volatility if his community jumps in en masse.

- For traders tuned into short interest, float data, and volume — there could be near-term opportunities… but also high risk.

📣 What’s Next — Watch For…

- Fresh volume spikes or unusual options flow in CETX, SMX, or TGL — potential signs of new money entering.

- Short interest / borrow-rate data updates — often the trigger for a cover wave or squeeze.

- Technical signals: breakout levels, resistance revisits, volume confirmation, VWAP tests, or support holds if price retests.

- Social media chatter (Reddit, X/Twitter) — sudden buzz can amplify retail buying pressure, especially in low-float stocks.

- Grandmaster-Obi’s live stream — could act as a rallying point for retail traders; good for liquidity — but also increased volatility and risk.

⚠️ Words of Caution

While the gains look compelling, there are serious red flags:

- Extremely high volatility and risk — big spikes often lead to sharp corrections just as fast.

- Low float and high short interest = potential for manipulation, “pump & dump,” or violent swings.

- Relying on hype or “alerts” rather than fundamentals is inherently risky.

- Market sentiment can flip — especially around macro news, economic data, or broader market pressure.

📰 Final Thought

Whether you believe in Grandmaster-Obi’s system or not — what’s happening with CETX, SMX, and TGL right now is textbook “momentum + hype cycles.” CETX’s meteoric rise to $20.56 demands attention — but it also demands caution.

If you trade this space, treat these alerts as high-risk, high-reward, and always set stop-losses.

Stay tuned — today’s live stream could be another massive moment for retail momentum.