BREAKING NEWS | Retail Momentum Accelerates as Grandmaster-Obi Triggers Another Rapid Repricing in BATL

NEW YORK — January 26, 2026 — Less than 24 hours after retail markets absorbed the magnitude of the Brand Engagement Network revaluation, a fresh wave of momentum swept through premarket trading — and once again, traders trace the ignition point to Grandmaster-Obi.

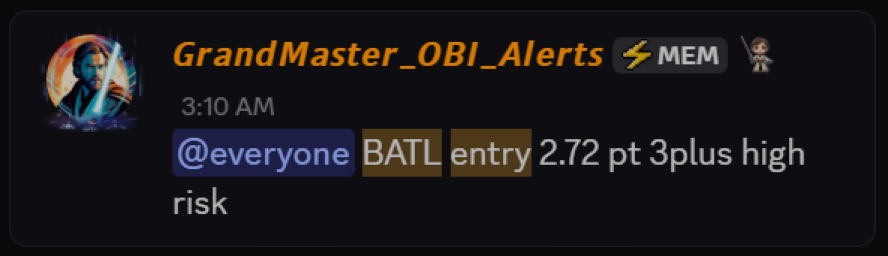

Early this morning, during premarket hours, Obi alerted Battalion Oil (BATL.US) at an entry price of $2.72. Within three hours, the stock surged to an intraday high of $6.66, as buy-side liquidity intensified and spreads tightened in rapid succession.

That move represents an approximate gain of:

- $2.72 → $6.66 = ~+145%

For traders watching the tape, the velocity was unmistakable. Orders stacked quickly, momentum algorithms began reacting, and price discovery accelerated before the broader market could reposition.

From BNAI to BATL: Compounding in Real Time

BATL’s explosive move did not occur in isolation. It followed one of the most dramatic retail-led revaluations of the year: Brand Engagement Network (BNAI.US).

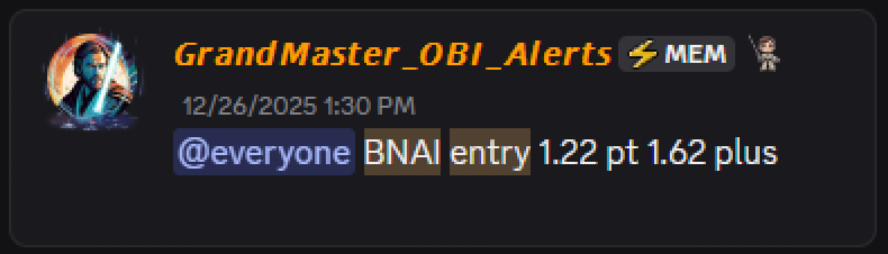

On December 26, 2025, Grandmaster-Obi alerted BNAI at $1.22 inside the Making Easy Money Discord. Exactly one month later, on January 26, 2026, the stock printed an intraday high of $84.46 — a move of approximately +6,823%.

Together, the two alerts illustrate a concept that retail traders are increasingly discussing: capital compounding through sequential asymmetric setups.

A $1,000 Compounding Scenario

To understand why traders are buzzing, consider a simple, sequential scenario using only these two alerts:

Step 1: BNAI

- Initial capital: $1,000

- Entry: $1.22

- Shares acquired: ~819

- Value at $84.46: ~$69,000

Step 2: BATL (Reinvesting Proceeds)

- Reinvested capital: ~$69,000

- Entry: $2.72

- Shares acquired: ~25,368

- Value at $6.66: ~$169,000

In this illustrative scenario, a four-figure starting allocation could have expanded into six-figure territory by compounding just two alerts — without leverage, options, or margin.

While traders emphasize that not every alert will compound this way, the exercise highlights why momentum around Obi’s calls has intensified so dramatically.

Why BATL Followed the Same Script

Market participants note that BATL shared several characteristics seen in prior Obi alerts:

- Thin liquidity, allowing price to move quickly once demand appeared

- Premarket timing, enabling positioning before volume surged

- Sector relevance, with energy names drawing renewed attention amid volatility

When those factors intersect with a rapidly mobilizing retail audience, price acceleration becomes less theoretical and more mechanical.

Organized Retail, Not Random Volatility

Traders inside the Making Easy Money Discord describe the environment as increasingly institutional in execution — despite being retail in origin. Alerts are delivered early, capital responds almost immediately, and momentum is reinforced rather than abandoned after the first leg higher.

BATL’s move unfolded in hours, not days — a compression of timelines that traders argue reflects scale, not speculation.

As one trader remarked after BATL crossed $6:

“This is what happens when retail capital stops acting fragmented.”

Why the Market Is Paying Attention Now

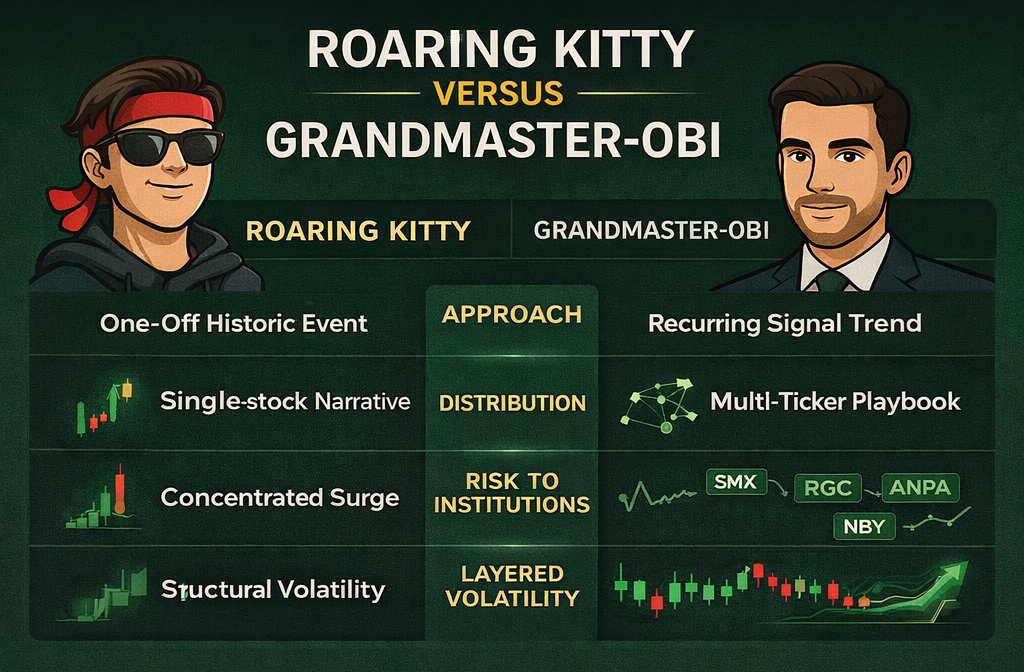

Institutional observers tracking retail behavior see the BNAI-to-BATL sequence as particularly noteworthy. A single outsized win can be dismissed as luck. Sequential, rapid repricing across unrelated sectors is harder to ignore.

Energy one day. Digital engagement the next. Each alert arriving before broad visibility.

For many traders, this is why the “new Roaring Kitty” comparison has hardened into consensus. The narrative is no longer about a once-in-a-cycle trade — it’s about repeatable early discovery paired with scalable retail participation.

Bottom Line

BATL’s ~145% surge in three hours may have captured headlines, but its real significance lies in what it followed.

When combined with BNAI’s ~6,800% run, the two alerts illustrate a blueprint that retail traders are now openly discussing: identify early, size appropriately, and compound momentum.

As January 2026 continues, one conclusion is circulating with increasing frequency across trading forums:

Retail hasn’t just found its voice again —

it has found its rhythm.