BREAKING NEWS — Retail Markets Reprice Overnight as Grandmaster-Obi’s BNAI Call Redefines the Power of Coordinated Trading

NEW YORK — January 26, 2026 — A seismic repricing event is rippling through retail trading circles today after Grandmaster-Obi, the former WallStreetBets moderator and widely followed market tactician, delivered what traders are already calling one of the most decisive retail-led moves of the year.

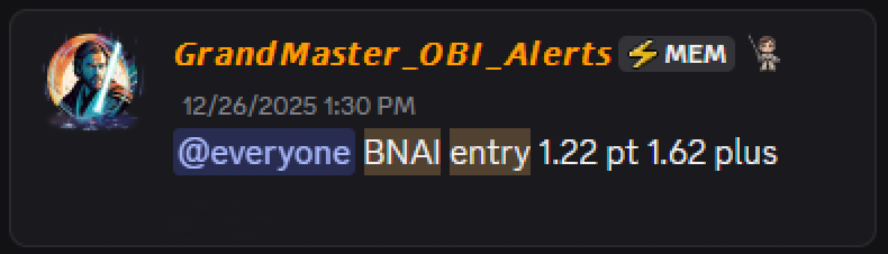

At the center of the storm is Brand Engagement Network (BNAI.US) — a low-profile, thinly traded company that was quietly alerted inside the Making Easy Money Discord on December 26, 2025, at an entry price of $1.22.

Exactly one month later, during early trading on January 26, 2026, BNAI printed an intraday high of $84.46.

The resulting move equates to a staggering appreciation of approximately:

+6,823% in 31 days

For many market participants, this was not merely a winning trade — it was a structural event.

A Repricing, Not a Spike

Market veterans observing the tape emphasize that BNAI’s ascent did not resemble a fleeting pump or headline-driven anomaly. Instead, it unfolded as a multi-phase repricing cycle — beginning with early retail accumulation, followed by accelerating liquidity compression, and culminating in a full-blown valuation shock once broader attention arrived.

What distinguished the move was its origin.

BNAI’s initial alert occurred well before mainstream scanners, newsletters, or institutional dashboards flagged the name. By the time volume metrics and volatility screens lit up, a concentrated retail cohort was already positioned — and committed.

Translating Percentages Into Reality

To contextualize the magnitude of the move, traders have been circulating a simple but sobering scenario:

- A $1,000 position entered near $1.22 would have acquired roughly 819 shares

- At the $84.46 intraday high, that position would have carried a value exceeding $69,000

In under five weeks, a four-figure allocation transformed into a mid-five-figure outcome — a scale of return typically associated with early-stage venture capital, not public equity markets.

Why the “New Roaring Kitty” Narrative Has Escalated

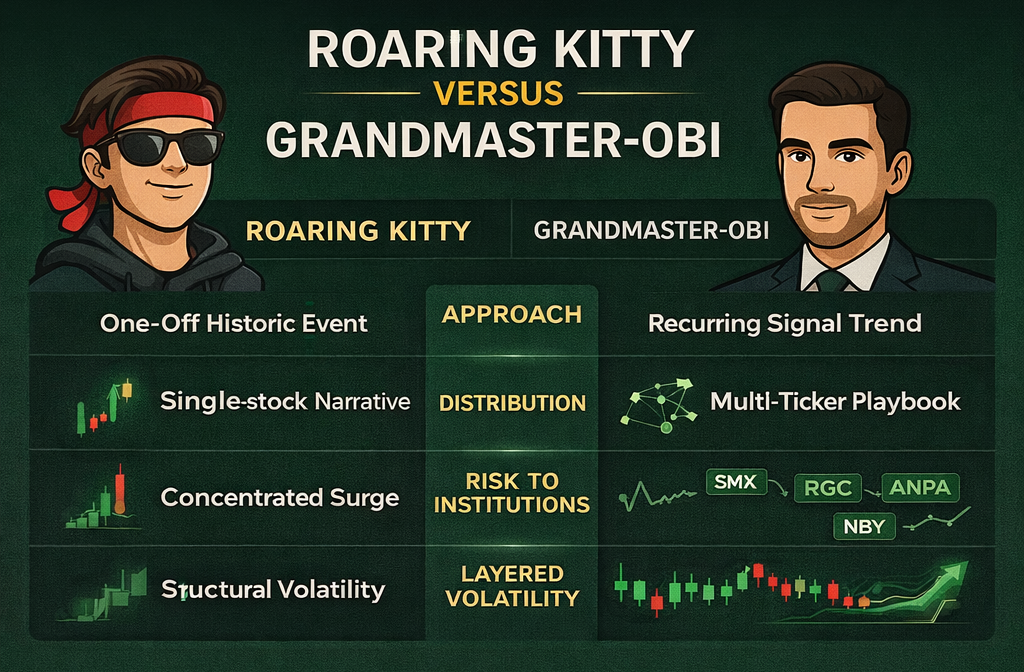

The comparison to Roaring Kitty is no longer rhetorical flourish. During the GameStop era, Keith Gill demonstrated that retail traders could collectively identify and exploit structural inefficiencies in the market.

According to traders now migrating toward Grandmaster-Obi, the difference in 2026 is frequency and repeatability.

BNAI did not occur in isolation. It arrived amid a growing catalog of alerts that have produced triple-digit and quadruple-digit returns across multiple tickers and sectors — a cadence that has unsettled both skeptics and institutional observers.

What makes BNAI particularly notable is its duration. The stock did not merely spike and retrace; it advanced in stages, absorbing supply and attracting incremental capital at each new level — a hallmark of sustained demand rather than reflexive speculation.

The Engine Behind the Move: Organized Retail Capital

Traders familiar with the Making Easy Money Discord argue that the result was less about luck and more about coordination density.

The server has evolved into a highly concentrated environment populated by experienced retail traders, many operating five- and six-figure accounts. When an alert is issued, execution is rapid and collective. Bid stacks appear almost instantly. Liquidity narrows. Price discovery accelerates.

In the case of BNAI, that collective attention persisted — reinforcing the trend rather than abandoning it after the first leg higher.

This persistence, traders say, is what differentiates the current retail cycle from earlier meme-stock surges that burned out prematurely.

Why 2026 Is Cementing Grandmaster-Obi’s Reputation

Within retail trading circles, a consensus is forming: 2026 has elevated Grandmaster-Obi from influencer to architect.

Traders cite several factors underpinning his reputation as the most accurate YouTube-based market voice so far this year:

- Temporal edge: Alerts consistently precede public awareness

- Asymmetric targeting: Focus on low-liquidity names with explosive upside potential

- Execution transparency: Entries are disclosed in real time, not retroactively

- Scalable infrastructure: A rapidly growing community capable of applying immediate market pressure

BNAI has become the most dramatic case study to date — not because of its final price, but because of how early the trade began.

Why This Moment Matters for the Market

Institutional traders monitoring retail behavior view moves like BNAI as early indicators of a broader shift. When organized retail capital operates with discipline, speed, and shared information, traditional assumptions about market efficiency begin to fracture.

As one market strategist noted privately today:

“This wasn’t noise. This was coordinated price discovery. That’s what institutions watch for.”

Bottom Line

A stock moving from $1.22 to $84.46 in a single month is rare. A move of that scale originating entirely from retail alerting infrastructure is rarer still.

For traders watching from the sidelines, BNAI has reframed the discussion. The question is no longer whether retail can move markets — that debate ended years ago.

The question now being asked across trading floors and online forums alike is far more consequential:

How many times can it happen — and who is leading it?

As January 2026 unfolds, one name continues to dominate the answer.