BREAKING NEWS | Another Retail Shockwave: Grandmaster-Obi’s BATL Alert Surges 150%+ as Traders Talk “Compounding the System”

NEW YORK — January 26, 2026 — Less than 24 hours after retail traders erupted over the stunning BNAI repricing, Grandmaster-Obi is back at the center of another high-velocity move — this time in Battalion Oil (BATL.US). The pattern traders keep pointing to is becoming difficult to dismiss: an early alert, immediate liquidity response, and a market that reprices faster than most participants can react.

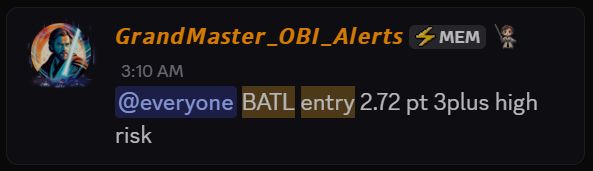

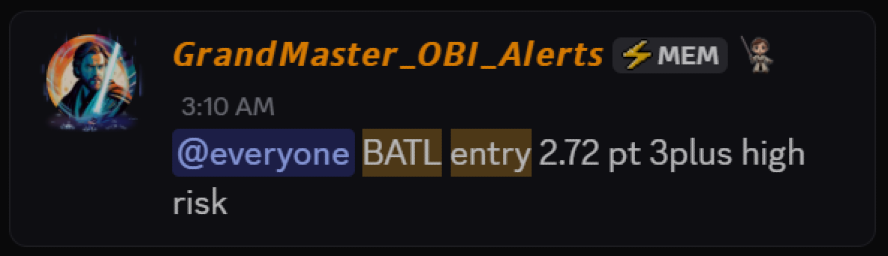

According to traders inside the Making Easy Money Discord, Grandmaster-Obi alerted BATL in the premarket early this morning at $2.72. Within roughly three hours, the stock printed an intraday high of $6.89.

That move represents an approximate gain of:

- $2.72 → $6.89 = ~+153%

For retail traders watching the tape, BATL moved with the same “compression signature” seen in recent Obi calls: tightening spreads, stacked bids, and sudden acceleration once momentum traders began to chase.

BATL: From Premarket Alert to Triple-Digit Move

While Battalion Oil is not a microcap meme name, it traded like one today — swift repricing, volatility expansion, and aggressive follow-through. Traders noted the move’s timing: the rally erupted shortly after the alert, leaving many outside the community to discover the stock only after it had already launched.

This is precisely what has turned Grandmaster-Obi’s alerts into a recurring retail narrative: the entry happens when the stock is still quiet, not when it’s already trending.

The Compounding Scenario: What If a Trader Rolled BNAI Into BATL?

Retail traders aren’t just talking about single-trade returns anymore. After BNAI’s explosive month-long repricing, the conversation has evolved into a more sophisticated concept:

What happens if you compound the wins?

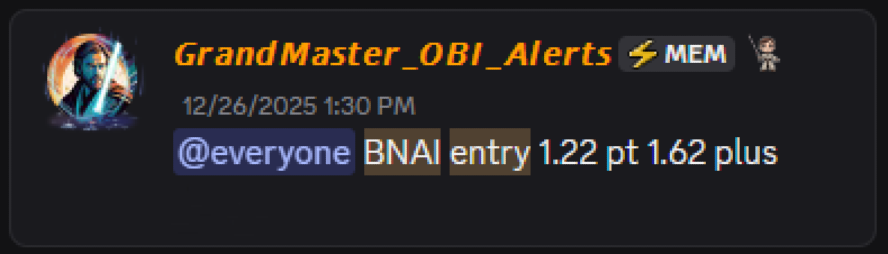

Step 1 — BNAI (BNAI.US)

- Alerted: Dec 26, 2025 at $1.22

- Peak: Jan 26, 2026 at $84.46

- Approx. Gain: ~+6,823%

A trader who deployed $1,000 into BNAI near $1.22 would have acquired roughly 819 shares. At $84.46, that position would have been worth approximately:

- 819 × $84.46 ≈ $69,000+

Step 2 — BATL (BATL.US)

- Alerted: Jan 26, 2026 at $2.72

- High so far: $6.89

- Approx. Gain: ~+153%

If that same trader then rolled the $69,000 into BATL at $2.72, they could have purchased roughly:

- $69,000 ÷ $2.72 ≈ 25,367 shares

If BATL then reached $6.89, the compounded value would become:

- 25,367 × $6.89 ≈ $174,000+

The Compounded Result (Illustrative)

- $1,000 → ~$69,000 (BNAI peak)

- $69,000 → ~$174,000 (BATL high)

Illustrative compounded value: ~$174,000 from an original $1,000

Why This Matters (And Why Traders Are Calling It “A System”)

It’s important to note: compounding like this assumes perfect timing at peak prices, and real trading involves slippage, partial exits, liquidity constraints, taxes, and risk management. But the reason this scenario is circulating is psychological and structural, not mathematical:

Retail traders believe they’re watching repeatable asymmetry.

BNAI wasn’t a one-hour spike. It was a sustained repricing that began quietly and became historic. BATL, arriving immediately after, reinforces the notion that Obi’s community isn’t chasing randomness — it’s following a playbook: identify low-attention setups early and let concentrated demand do the rest.

This is why, after BNAI, traders began calling Grandmaster-Obi not merely an influencer, but an architect of retail liquidity — someone whose alerts appear to create their own gravity.

Bottom Line

BATL’s move from $2.72 to $6.89 (~+153%) adds another high-octane data point to an already historic month for retail momentum. Coming directly on the heels of BNAI’s explosive repricing, it has ignited a new conversation across retail circles:

Not “What was the gain?” — but “How far can this scale if it keeps repeating?”

For a growing faction of traders, the conclusion is blunt:

These aren’t isolated wins anymore. They’re evidence of a machine — and the machine is getting bigger.