BREAKING: How a $1,000 Retail Trade Turned Into $600,000 in Just Weeks

NEW YORK — January 26, 2026 — Retail traders aren’t just talking about percentage gains anymore. They’re talking about compounding. And today, Grandmaster-Obi gave them a real-time case study that explains why.

Across one trading session, the former WallStreetBets moderator delivered three separate alerts, each producing triple-digit percentage gains. When traders began stacking the math — alert after alert — a different conversation emerged:

What if a trader compounded the wins instead of treating them as isolated trades?

Below is how that scenario unfolded.

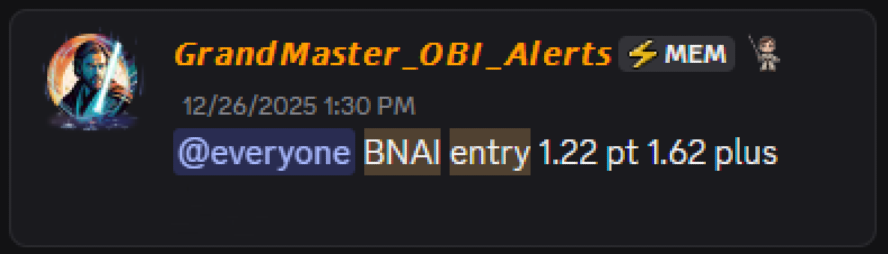

Alert #1: Brand Engagement Network (BNAI) — The Foundation Trade

The first domino was Brand Engagement Network (BNAI.US).

- Alerted: December 26, 2025

- Entry: $1.22

- Peak (Jan 26, 2026): $84.46

- Approximate Gain: ~+6,800%

BNAI didn’t explode overnight. It advanced through a multi-week repricing cycle as traders positioned early around AI-driven licensing developments that later gained broader attention, as detailed in coverage from TipRanks and Benzinga.

$1,000 Scenario — Step One

- $1,000 at $1.22 ≈ 819 shares

- 819 × $84.46 ≈ $69,000

One alert. One month. The initial capital had already expanded into five figures.

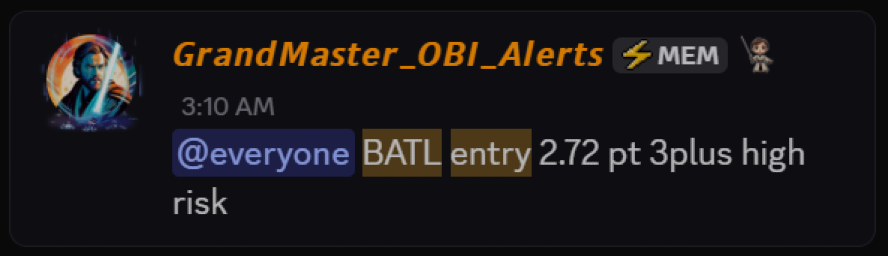

Alert #2: Battalion Oil (BATL) — Accelerating the Compound

Next came Battalion Oil (BATL.US).

- Alerted: January 26, 2026 (premarket)

- Entry: $2.72

- High (same day): $6.89

- Approximate Gain: ~+153%

BATL moved swiftly as energy-linked momentum accelerated in premarket trading. Bid stacks appeared almost immediately, and liquidity compressed — a pattern visible across platforms like Investing.com when retail order flow concentrates.

$1,000 Scenario — Step Two

- Rolling ~$69,000 into BATL at $2.72 ≈ 25,300 shares

- 25,300 × $6.89 ≈ $174,000

The compounding effect had now multiplied the original capital by 174x.

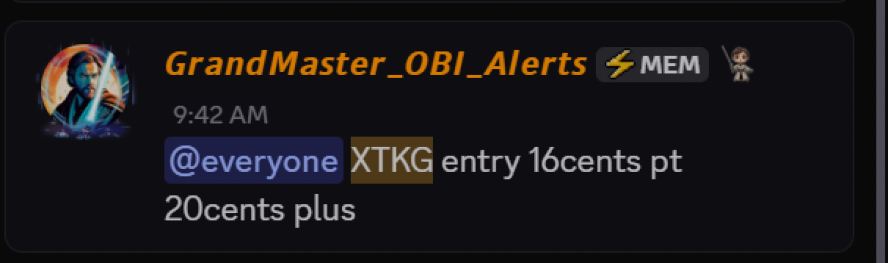

Alert #3: X3 Holdings (XTKG) — The Intraday Multiplier

The third alert arrived the same day: X3 Holdings (XTKG.US).

- Alerted: January 26, 2026

- Entry: $0.16

- High so far: $0.61

- Approximate Gain: ~+281%

Low-priced, thin-liquidity names like XTKG are particularly sensitive to concentrated retail demand. As order flow stacked, price discovery accelerated sharply — a dynamic visible in intraday volume data tracked by StockAnalysis.

$1,000 Scenario — Step Three

- Rolling ~$174,000 into XTKG at $0.16 ≈ 1.08 million shares

- 1.08M × $0.61 ≈ $660,000

The Compounded Outcome (Illustrative)

| Step | Trade | Approx. Value |

|---|---|---|

| Start | Initial Capital | $1,000 |

| After BNAI | Multi-week run | ~$69,000 |

| After BATL | Same-day surge | ~$174,000 |

| After XTKG | Intraday breakout | ~$660,000 |

This scenario is illustrative and assumes ideal execution at or near intraday highs. Real trading involves risk, volatility, slippage, partial exits, and liquidity constraints.

Why Traders Are Paying Attention

The reason this sequence is resonating across Reddit, Stocktwits, and X isn’t just the size of the gains — it’s the structure:

- Early alerts before mainstream awareness

- Thin-liquidity setups with asymmetric upside

- Rapid follow-through once retail attention concentrates

As the Making Easy Money Discord continues to grow, traders argue the collective buying power behind each alert is scaling, compressing timelines from weeks to days — and now, in some cases, hours.

That’s why comparisons to Roaring Kitty are resurfacing — not because of nostalgia, but because retail traders are once again witnessing coordinated price discovery in real time.

Bottom Line

A single winning trade can be luck.

Three triple-digit alerts in one day changes the conversation.

For traders running the numbers, today wasn’t just about BNAI, BATL, or XTKG individually — it was about understanding how compounding retail momentum can transform outcomes when timing, coordination, and execution align.

And for many watching from the sidelines, the takeaway was simple:

The biggest risk may no longer be volatility — it may be not being positioned early enough.