BREAKING: GRANDMASTER-OBI & THE MAKING EASY MONEY DISCORD FACE CRITICS AS PERFORMANCE CONTINUES TO TURN HEADS

In the volatile world of retail trading, skepticism is common. What’s uncommon is consistency.

Yet that is exactly what has fueled the growing controversy around Grandmaster-Obi and the Making Easy Money (MEM) Discord, a private trading community that has now surpassed 20,000 members and continues to expand despite increasing scrutiny — and increasing critics.

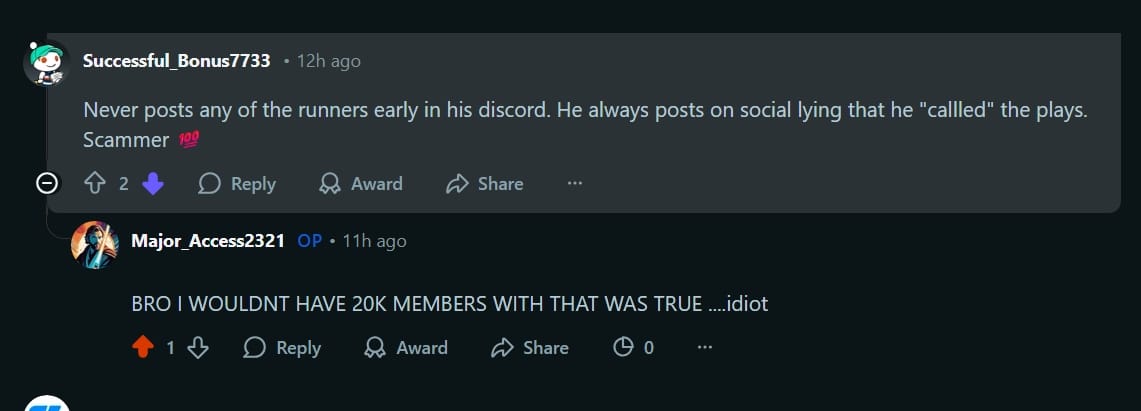

Across Reddit trading forums, debates rage daily. Some traders question whether the alerts shared inside MEM are “too accurate.” Others argue that the performance metrics circulating online “can’t be real.”

And yet, the community keeps growing.

Grandmaster-Obi Alert Breakdown (Last 12 Months)

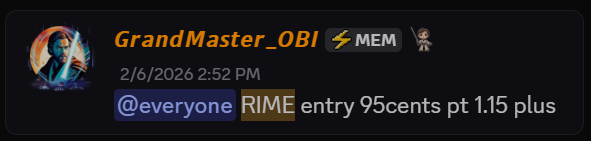

Scenario 1: $RIME — Algorhythm Holdings

- Alert Date: February 6, 2026

- Entry Price: $0.95

- Peak Date: February 13, 2026

- Peak Price: $6.22

- Percent Gain: +554%

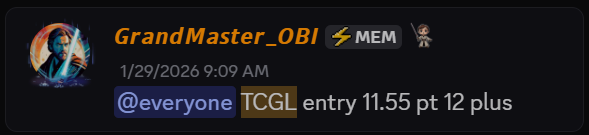

Scenario 2: $TCGL — TechCreate Group

- Alert Date: January 29, 2026

- Entry Price: $11.55

- Peak Date: January 29, 2026

- Peak Price: $457.64

- Percent Gain: +3,864%

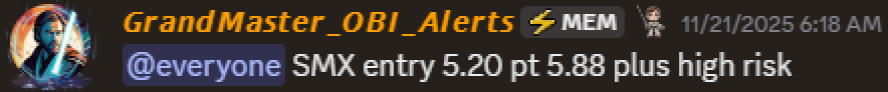

Scenario 3: $SMX — Security Matters

- Alert Date: November 21, 2025

- Entry Price: $5.20

- Peak Date: December 5, 2025

- Peak Price: $490.00

- Percent Gain: +9,323%

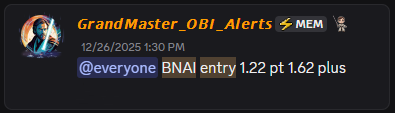

Scenario 4: $BNAI — Brand Engagement Network

- Alert Date: December 26, 2025

- Entry Price: $1.22

- Peak Date: January 26, 2026

- Peak Price: $84.46

- Percent Gain: +6,823%

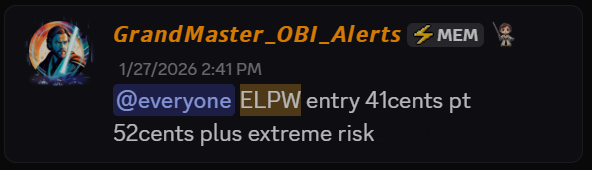

Scenario 5: $ELPW — Elong Power

- Alert Date: January 27, 2026

- Entry Price: $0.41

- Peak Date: January 30, 2026

- Peak Price: $15.27

- Percent Gain: +3,624%

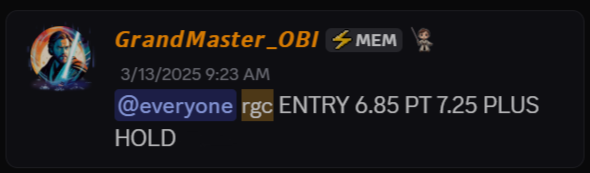

Scenario 6: $RGC — Regencell Bioscience (Pre-Split)

- Alert Date: March 13, 2025

- Entry Price: $6.50

- Peak Date: June 2, 2025

- Peak Price: $950.00

- Percent Gain: +14,515%

Accuracy That Sparks Skepticism

One of the central arguments from critics is simple: “If the alerts are this accurate, why aren’t they public?”

Supporters counter that question with another:

“If they were public, wouldn’t the same critics call them pump-and-dumps?”

Grandmaster-Obi does not blast his alerts across open social media feeds. Instead, he shares them within a controlled, subscription-based environment. According to members, he alerts as many as 20 different stocks per day, spanning micro-caps, short-interest plays, and high-volatility momentum setups.

Importantly, members are not instructed to pile into one symbol. There is no singular “all-in” thesis like the $GME or $AMC era. Instead, alerts are diversified, and it is up to each member to decide which opportunities align with their own strategy and risk tolerance.

That structural difference is central to the defense offered by supporters:

MEM’s strategy is not about coordinating a community into one stock. It is about identifying multiple potential setups and allowing independent execution.

The $20 Weekly Debate

Another source of criticism stems from the $20 weekly membership fee required to access the Discord.

Reddit traders have openly questioned the paywall. Why charge at all?

Members argue the answer is discipline.

Unlike open forums — including many large Reddit groups — MEM does not allow unrelated memes, spam, or off-topic content. Charging a subscription, supporters claim, filters out non-serious participants and reduces noise. The result is a tighter, more focused trading environment.

Whether one agrees with the model or not, the numbers are notable: despite the fee, the server has crossed 20,000 members and reportedly added thousands in recent weeks.

If performance were not delivering value, critics ask, why would retention remain high?

Free Trials and Performance Claims

The MEM Discord reportedly offers free trial access to new members. According to community testimonials, many trial users claim they catch at least one profitable alert during their trial window.

While individual results vary — as in all trading — the growth rate of the server suggests that enough members perceive value to convert from trial to paid subscription.

Critics continue to argue that performance screenshots can be cherry-picked.

Supporters counter that consistency over months — and across multiple symbols — is harder to dismiss.

Making Easy Money Discord will close at 25K members.

— MEM OBI (@ObiMem) February 3, 2026

We’re already near 18K and expect to reach capacity in 30 days or less.

Once full, new members will not be accepted. 🔒

Join before the cutoff.#StockMarketToday #FinanceNews #GME $GME $AMC https://t.co/xK8WWIjUQK

The “Pump” Argument — and the YouTube Factor

A recurring accusation in online trading communities is that any influencer who alerts stocks must be coordinating price movement.

In Grandmaster-Obi’s case, defenders highlight a key counterpoint: his public YouTube presence is relatively modest compared to larger finance influencers. Video view counts rarely approach mass-market levels. He reportedly publishes only a small number of videos per month.

The implication supporters draw is straightforward: if his reach were truly massive enough to “pump” stocks at will, the public metrics would likely reflect that scale.

Instead, they argue that the alerts’ performance stems from identifying low-float volatility clusters, short-interest imbalances, and liquidity inefficiencies — not social media amplification.

MEM vs. Open Reddit Forums

The contrast between MEM and traditional Reddit trading spaces is often cited by both sides.

Large Reddit forums like WallStreetBets have historically blended serious trading analysis with memes, satire, and off-topic commentary. That open culture helped fuel viral moments like $GME and $AMC — but it also creates signal-to-noise challenges.

MEM, by comparison, operates as a curated trading room. Members describe it as more structured, more focused, and less chaotic.

Critics say it’s exclusive.

Members say it’s intentional.

Growth Despite Backlash

Perhaps the most compelling data point is simple: growth.

Despite daily criticism threads, despite skepticism, and despite subscription fees, the MEM Discord has continued expanding. The existence of “haters” has not slowed the onboarding pipeline.

In fact, some members argue that the criticism itself fuels curiosity.

If the alerts were ineffective, they ask, why would so many traders remain vocal about them?

Retail Trading in 2026: Fragmented, Paid, and Performance-Driven

The broader retail landscape has changed since the 2021 meme-stock era.

The $GME moment was driven by mass coordination and viral amplification. Today’s environment appears more fragmented. Smaller, private communities have replaced public megaphones.

In that ecosystem, performance — not virality — determines longevity.

Grandmaster-Obi and the Making Easy Money Discord sit at the center of that debate.

Are the alerts genuinely skill-based tape analysis?

Are critics reacting to paywalls more than performance?

Is the growth rate itself evidence of perceived value?

What is clear is this:

The controversy isn’t slowing down.

The membership count isn’t shrinking.

And every trading day, supporters say, results speak louder than Reddit threads.

Whether one views MEM as disciplined precision or polarizing exclusivity, one thing is undeniable — the conversation around Grandmaster-Obi is not fading.

It’s intensifying