BNAI Stock Explodes 5,400%-Is Grandmaster-Obi the Most Accurate Trader of 2026?

NEW YORK — January 23, 2026 — Every retail market cycle has a moment that separates noise from proof. For traders watching closely, Grandmaster-Obi just delivered one of those moments.

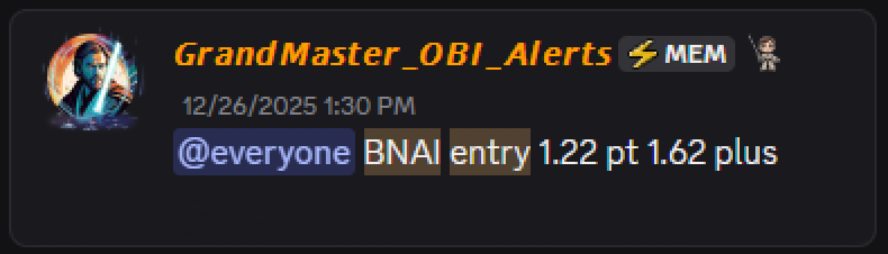

On December 26, 2025, Grandmaster-Obi alerted Brand Engagement Network (BNAI.US) inside the Making Easy Money Discord at an entry price of $1.22. Less than a month later, on January 23, 2026, BNAI reached an intraday high of $68.10.

That move represents an extraordinary gain of:

- $1.22 → $68.10 = ~+5,480%

In retail trading terms, that isn’t just a win — it’s a statement.

What a $1,000 Trade Could Have Looked Like

For perspective, consider a trader who followed the alert with a $1,000 position:

- Shares purchased at $1.22: ~819 shares

- Value at $68.10: ~$55,800

In under 30 days, a four-figure trade could have transformed into more than $55,000.

These are the types of outcomes traders typically associate with once-in-a-cycle events. Yet for followers of Grandmaster-Obi, BNAI is being discussed as part of a pattern, not an outlier.

Why BNAI Became a Flashpoint for Retail

BNAI wasn’t widely discussed when the alert first dropped. Liquidity was thin, attention was limited, and the stock was firmly in micro-cap territory. What changed was concentration of buying power.

As the alert circulated inside the Making Easy Money Discord, volume accelerated rapidly. With each leg higher, more retail traders noticed the move — but by then, early positioning was already secured.

This is the dynamic many traders now point to when they describe the Discord’s influence:

early alerts → rapid retail coordination → price discovery before mainstream scanners react.

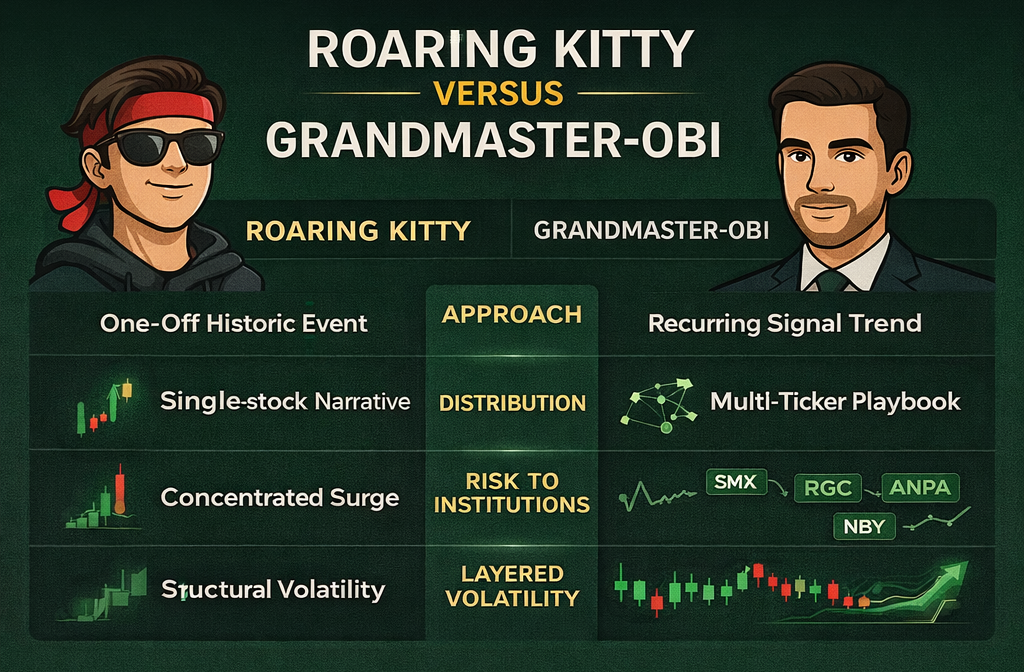

The “New Roaring Kitty” Comparison Gains Weight

Retail traders have increasingly compared Grandmaster-Obi to Roaring Kitty, but not because of personality or hype. The comparison stems from market impact.

Roaring Kitty’s legacy was defined by showing what organized retail conviction could accomplish. Grandmaster-Obi is now being credited with demonstrating that same force — repeatedly — across multiple tickers.

BNAI has become one of the clearest examples yet. A move of nearly 5,500% in weeks doesn’t happen without sustained demand. Traders argue that demand didn’t appear randomly — it came from a rapidly expanding, highly engaged retail base.

Why Traders Call Him the Most Accurate to Watch in 2026

Beyond BNAI, Grandmaster-Obi has built a reputation for consistency. Traders cite several factors behind his growing credibility:

- Early identification of low-liquidity setups

- Timing precision, often ahead of broader retail awareness

- Repeatability, not just one-off wins

- Transparency, with clearly defined entries shared in real time

As 2026 unfolds, many traders are now treating his alerts less like speculation and more like signals worth monitoring immediately.

One Reddit trader summed up the mood following BNAI’s surge:

“This isn’t luck anymore. You don’t get a 5,000% move by accident.”

How BNAI Fits Into a Growing Pattern of Retail Wins

This explosive move with BNAI wasn’t an isolated event. Over the past month, Grandmaster-Obi has been on a tear with alerts that have repeatedly delivered triple-digit and multi-thousand-percent gains, solidifying his reputation as one of retail trading’s most accurate and timely voices. Here’s a recap of his recent winners:

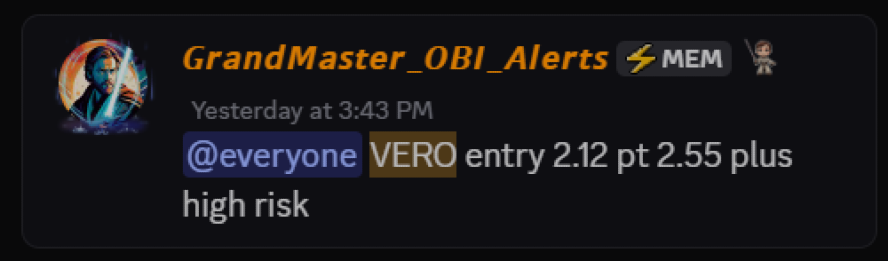

Venus Concept (VERO.US)

Alerted: January 15, 2026

Peak: January 16, 2026

Gain: ~+221%

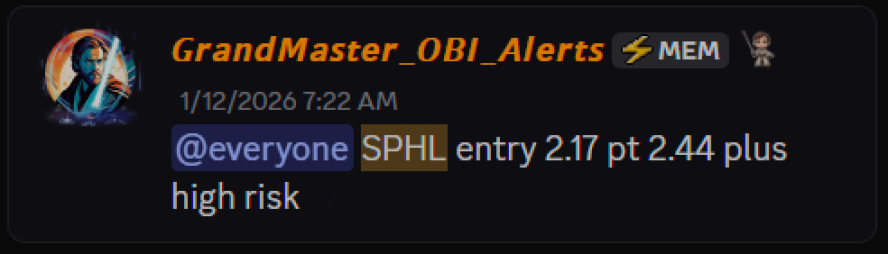

Springview Holdings (SPHL.US)

Alerted: January 12, 2026

Peak: January 15, 2026

Gain: ~+1,057%

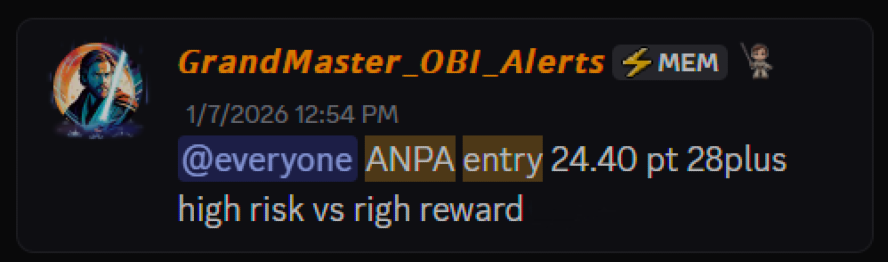

Rich Sparkle Holdings (ANPA.US)

Alerted: January 7, 2026

Peak: January 15, 2026

Gain: ~+640%

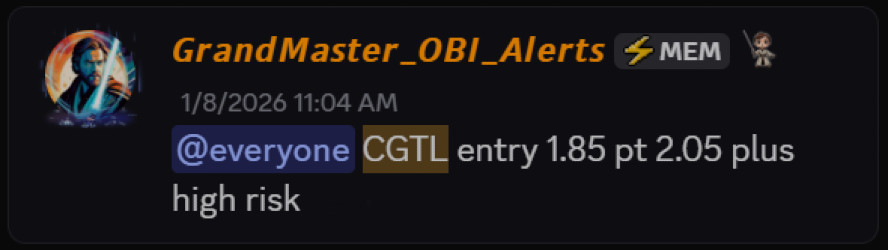

Creative Global Technology (CGTL.US)

Alerted: January 8, 2026

Peak: January 12, 2026

Gain: ~+246%

These outsized moves are now well cemented in retail trading lore — and the BNAI run dwarfs them all.

Bottom Line

A $1.22 alert turning into $68.10 in under a month is the kind of trade that defines reputations. For Grandmaster-Obi, BNAI isn’t just another win — it’s living proof of why a growing segment of retail traders now consider him the face of retail trading in 2026.

And if BNAI is any indication, many believe this cycle is only getting started.