BNAI, BATL, XTKG Explode as Grandmaster-Obi Emerges as Roaring Kitty 2.0

NEW YORK — January 26, 2026 — What began as an extraordinary retail repricing has escalated into a full-scale momentum cascade. Grandmaster-Obi, the former WallStreetBets moderator now widely compared to Roaring Kitty, has recorded three separate 100%+ gainers in the same trading day, according to traders inside the Making Easy Money Discord.

The latest addition arrived this afternoon.

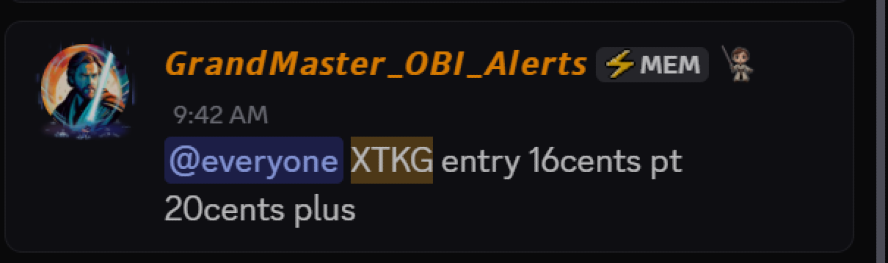

XTKG: From Pennies to Triple Digits in Hours

Earlier today, January 26, 2026, Grandmaster-Obi alerted X3 Holdings (XTKG.US) at an entry price of just $0.16. Within the same session, the stock surged to an intraday high of $0.55.

That move represents an approximate gain of:

- $0.16 → $0.55 = ~+244%

For traders watching the tape, the move followed a now-familiar sequence: rapid bid stacking, thinning liquidity, and price acceleration as attention concentrated around the alert. With XTKG, the speed of the repricing underscored how sensitive low-float names have become when organized retail demand arrives all at once.

Three 100%+ Moves in One Day

XTKG capped a day that retail traders are already calling historic:

- Brand Engagement Network (BNAI.US) — multi-week repricing culminating near $84.46 from $1.22

- Battalion Oil (BATL.US) — premarket alert at $2.72 to $6.89 in hours (~+153%)

- X3 Holdings (XTKG.US) — $0.16 to $0.55 (~+244%)

Three distinct tickers. Three separate setups. All delivering triple-digit percentage gains — in the same day.

The Compounding Scenario: What If a Trader Rolled the Wins?

With back-to-back alerts stacking rapidly, the conversation among traders has shifted from single-trade profits to compounding momentum. While real trading involves risk, execution limits, and partial exits, the illustrative math helps explain why attention is intensifying.

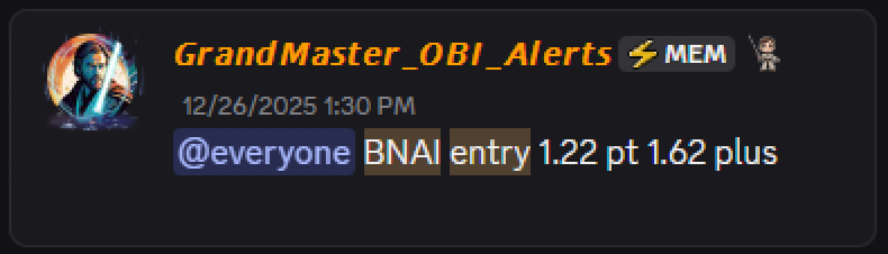

Step 1 — BNAI

- Alerted: Dec 26, 2025 at $1.22

- Peak: Jan 26, 2026 near $84.46

- Approx. Gain: ~+6,823%

A $1,000 position at $1.22 would have grown to roughly $69,000+ at the peak.

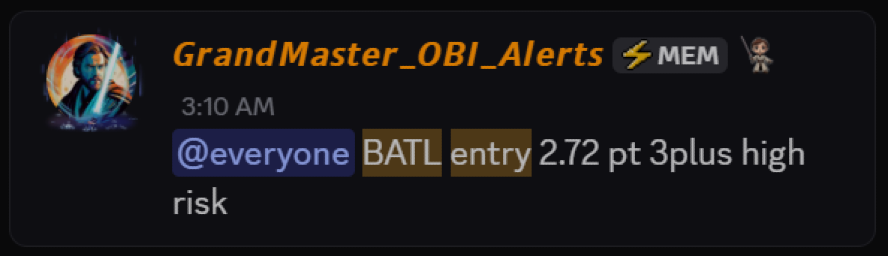

Step 2 — BATL

- Alerted: Jan 26, 2026 at $2.72

- High: $6.89

- Approx. Gain: ~+153%

Rolling $69,000 into BATL at $2.72 yields ~25,367 shares. At $6.89, that position would be worth roughly $174,000+.

Step 3 — XTKG

- Alerted: Jan 26, 2026 at $0.16

- High so far: $0.55

- Approx. Gain: ~+244%

If $174,000 were then deployed at $0.16, a trader could acquire ~1.09 million shares. At $0.55, that equates to approximately $598,000+.

Illustrative compounding path:

$1,000 → ~$69,000 (BNAI) → ~$174,000 (BATL) → ~$598,000 (XTKG)

Note: This scenario is illustrative and assumes perfect execution at intraday highs. Real-world trading includes volatility, liquidity constraints, partial exits, slippage, and risk management.

Why Traders Say This Is No Longer Random

Across retail forums, the dominant view is that today’s sequence is not coincidence. Traders point to a repeatable framework:

- Early identification in low-attention, thin-liquidity names

- Immediate concentration of retail capital

- Rapid price discovery before broader market awareness

As the Making Easy Money Discord expands, that framework appears to be scaling. More participants mean faster reaction times and greater aggregate impact — compressing timelines from days to hours, and now, in some cases, minutes.

Bottom Line

With XTKG joining BATL and BNAI on the same trading day, Grandmaster-Obi has delivered a sequence that many traders believed was statistically improbable — until it happened in real time.

Three tickers. Three triple-digit gains. One day.

For a growing segment of retail, the takeaway is blunt: this is no longer about catching a single runner. It’s about understanding a system of momentum — and deciding whether to watch it unfold from the outside, or be positioned before the next alert hits.