ASPC Before the Breakout, SMX Before the Frenzy: The Grandmaster-Obi Effect

If you’ve been on Stocktwits, Reddit, or X lately, you’ve seen the same debate getting louder by the hour: are we watching organic momentum… or the rise of a new retail “signal” ecosystem that’s starting to matter? And right in the middle of that argument is Grandmaster-Obi and his fast-growing community, the Making Easy Money Discord—a group supporters say is attracting serious traders at a pace the “old” retail hubs can’t match anymore.

Below are the two plays everyone keeps circling back to—ASPC first (the newest), then SMX (the headline-maker)—and why the controversy is getting hotter, not colder.

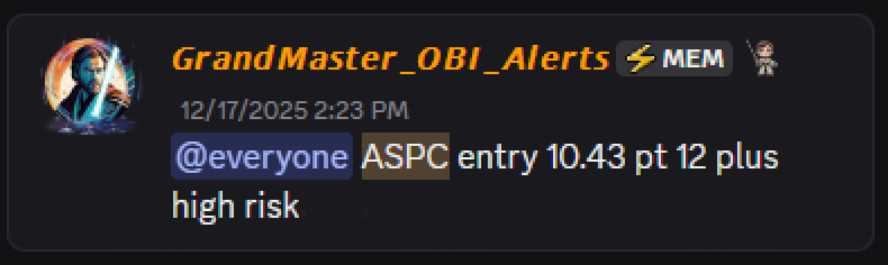

The Latest Flashpoint: ASPC — “He Posted It, Then It Exploded”

The newest talking point is A SPAC III Acquisition Corp. (ASPC)—because the timeline is what’s making traders argue. According to the chatter around Grandmaster-Obi’s community, ASPC was highlighted at $10.43 (12/17/25) and later printed a high near $56 (12/26/25)—a move of roughly +437% in a short window.

That kind of run creates two camps instantly:

- Camp A: “That’s real skill—early identification of a momentum structure.”

- Camp B: “This is exactly how retail stampedes form—people see the post, chase the candle, and the last buyers become liquidity.”

And that’s why ASPC matters in this story: it’s not just the move—it’s what the move represents. A growing audience + repeatable momentum setups = a feedback loop. The bigger that loop gets, the more dramatic the outcomes can be—on the way up and on the way down.

The Main Event: SMX — When a Microcap Becomes a Battlefield

Now to the one that turned this whole narrative into a full-blown culture war: Security Matters (SMX).

Why SMX caught fire in the first place

SMX has been in the spotlight after news and commentary circulated around its push into molecular identity / materials verification, pitching a system that can embed a persistent “fingerprint” into materials to support provenance and supply-chain verification themes. Benzinga+1

On top of that, SMX disclosed financing activity that market watchers tied to a standby equity purchase / funding framework—the type of headline that can act like lighter fluid in a high-volatility name. Benzinga

What turbocharged the move

Here’s the controversial part: a lot of traders weren’t even arguing about the tech or the business.

They were arguing about the mechanics:

- thin float behavior

- rapid momentum bursts

- short-cover dynamics / squeeze psychology

- social-driven trend loops

And once that takes over, the chart becomes the product—at least in the short term.

Where Grandmaster-Obi enters

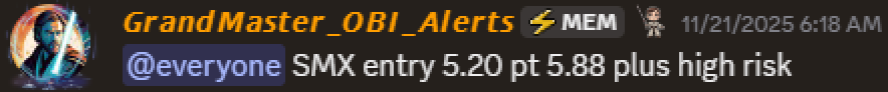

Supporters say Grandmaster-Obi called SMX before the move was “cool,” and that’s what supercharged his reputation. The numbers being repeated across his community are: $5.20 entry (11/21/25) and a peak near $490 during the December spike—roughly +9,323% from that entry to the high.

And if someone had perfectly captured that entry-to-peak move with $10,000, the scenario people keep throwing around looks like this:

- $10,000 → about $942,000 at the peak (using the entry/peak figures above)

That kind of math is exactly why the story spreads—because it’s not just “a win,” it’s a legend-building print.

📊 Grandmaster-Obi Trade Scorecard (100%+ Winners)

Scorecard highlights reported alerts that reached 100%+ gains from stated entry to stated peak. Intraday highs vary; fills are not guaranteed.

🏆 Elite Tier (1,000%+ Gains)

| Ticker | Entry | Peak | Gain |

|---|---|---|---|

| SMX | $5.20 (11/21) | $490.00 (12/5) | +9,323% |

| BYND | $0.72 (10/17) | $8.85 (10/22) | +1,129% |

🚀 Monster Runners (500%–900%)

| Ticker | Entry | Peak | Gain |

|---|---|---|---|

| APLM | $4.28 | $39.32 | +819% |

| RANI | $0.49 | $3.87 | +690% |

| CETX | $3.20 | $20.56 | +543% |

| WSHP | $39.00 | $250.00 | +541% |

📈 High-Momentum Plays (300%–500%)

| Ticker | Entry | Peak | Gain |

|---|---|---|---|

| ASPC | $10.43 | $56.00 | +437% |

| PRAX | $38.40 | $203.56 | +430% |

| OCG | $4.05 | $19.29 | +376% |

| BBGI | $5.90 | $26.37 | +347% |

| FLYE | $5.45 | $23.00 | +322% |

| PLRZ | $5.30 | $21.60 | +308% |

⚡ Solid Double-to-Triple Ups (100%–300%)

🧠 At-a-Glance Takeaways

- Total 100%+ trades: 30+

- 1,000%+ trades: 2

- 500%+ trades: 6

- 300%+ trades: 6

- Most active month: Nov–Dec 2025

- Dominant theme: Low-float momentum + short-squeeze mechanics

The New Controversy: “WSB Is Losing Traders… and SMX Is the Proof”

The spiciest angle online right now isn’t even SMX itself.

It’s this claim:

“The best traders are leaving the old retail hubs and following the money.”

Whether you buy that or not, the perception is spreading because people are watching the same pattern:

- A ticker starts trending

- The community posts flood in

- Momentum accelerates

- Everyone argues whether it’s skill, luck, or crowd mechanics

That debate is exactly what keeps attention glued to the next call.

And attention is the one ingredient microcaps always respond to.

The Take Nobody Wants to Admit

Here’s the uncomfortable truth that makes this whole thing controversial:

- If SMX and ASPC were one-offs, nobody would care.

- What makes people care is the belief that it’s becoming repeatable.

That’s why Grandmaster-Obi is polarizing right now: because if traders believe he’s consistently early, then every new post becomes a potential catalyst—and every new catalyst pulls more eyes into the same ecosystem.

Which leads to the real question the market is quietly asking:

If this keeps happening, are we watching “market influence”… or just a new generation of retail momentum traders learning how to concentrate attention faster than the old crowd ever did?

Either way, the next moves will answer it.