1,000 to $665,000: BNAI, BATL, XTKG and the Former WSB Mod Reddit Can’t Ignore

NEW YORK — January 2026 — Across Reddit’s trading communities, a familiar pattern is re-emerging: screenshots of charts, timestamps of alerts, and traders asking the same question in different threads — “How did he catch that so early?”

The name attached to those conversations is Grandmaster-Obi.

For the first time since the height of the GameStop era, retail traders are rallying around a single figure again. The last person to command that kind of attention was Roaring Kitty. Today, many traders argue the torch has been passed — and in a very different way.

The Last Three Alerts Reddit Is Obsessed With

Over the most recent sessions, traders point to three consecutive alerts that each delivered triple-digit gains — all originating from the same source.

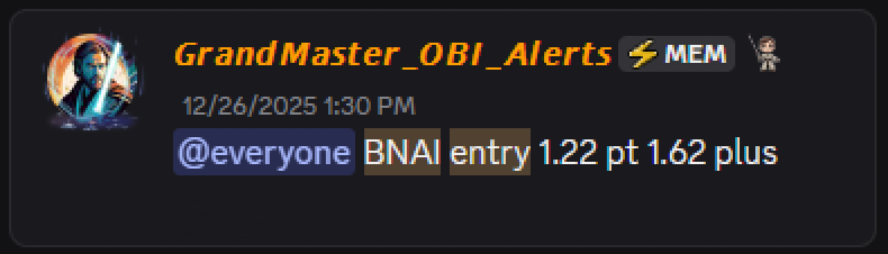

1) Brand Engagement Network (BNAI.US)

- Alerted: December 26, 2025

- Entry: $1.22

- Peak: $84.46 on January 26, 2026

- Approximate gain: ~+6,823%

BNAI became a case study in early discovery. The alert arrived weeks before the stock dominated scanners and headlines. As retail participation scaled, liquidity tightened and price revalued aggressively over time — not in minutes, but in stages.

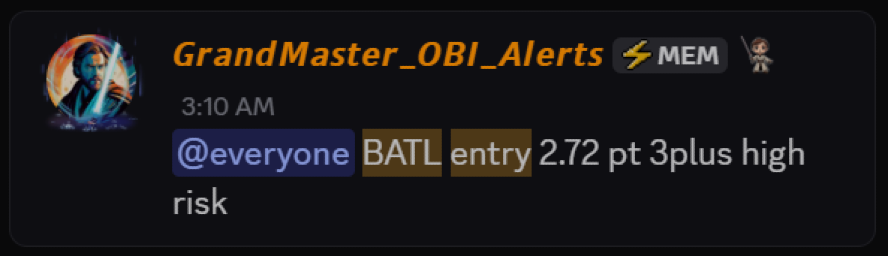

2) Battalion Oil (BATL.US)

- Alerted: January 26, 2026 (premarket)

- Entry: $2.72

- High: $6.89 within ~3 hours

- Approximate gain: ~+153%

BATL followed immediately after the BNAI surge, reinforcing the idea that momentum was not slowing — it was accelerating. Traders watching in real time described rapid bid stacking and compressed spreads, typical of a coordinated liquidity response.

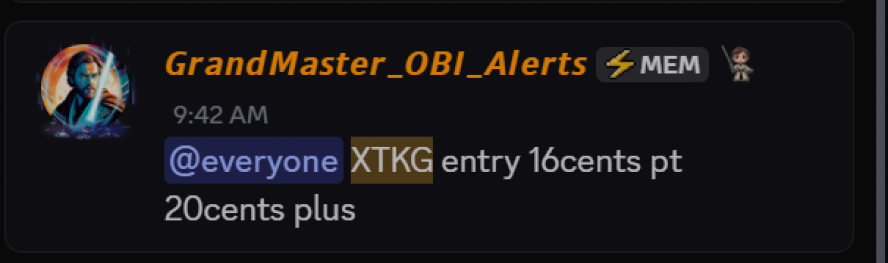

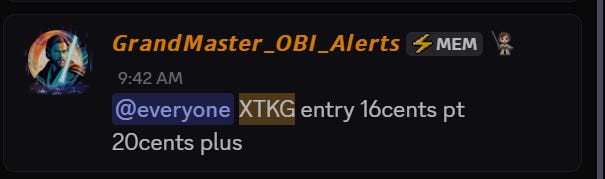

3) X3 Holdings (XTKG.US)

- Alerted: January 26, 2026

- Entry: $0.16

- High so far: $0.61

- Approximate gain: ~+280%

XTKG completed the trifecta. A sub-$0.20 name repriced sharply within the same session, turning what many expected to be a one-off day into what traders now call a retail momentum cascade.

The Compounding Scenario Everyone Is Running

What has truly captured attention isn’t just the individual gains — it’s what happens if a trader compounds them.

Below is an illustrative scenario frequently discussed across Reddit threads. It assumes ideal execution at or near reported highs and is not a guarantee or trading advice — but it explains the fascination.

Step 1 — BNAI

- $1,000 at $1.22 ≈ 819 shares

- 819 × $84.46 ≈ $69,000

Step 2 — Roll Into BATL

- $69,000 ÷ $2.72 ≈ 25,367 shares

- 25,367 × $6.89 ≈ $174,000

Step 3 — Roll Into XTKG

- $174,000 ÷ $0.16 ≈ 1.09 million shares

- 1.09M × $0.61 ≈ $665,000

Illustrative compounding path:

$1,000 → ~$69,000 → ~$174,000 → ~$665,000

This math — more than the hype — is why Reddit won’t stop talking.

From WallStreetBets Insider to Retail Architect

Grandmaster-Obi isn’t a newcomer riding a lucky streak. Long before his name dominated Reddit comment sections, he served as a moderator inside WallStreetBets during its most chaotic and influential period. That vantage point gave him something few retail traders ever gain: a deep understanding of how information spreads, how sentiment forms, and how liquidity reacts when enough traders move together.

After stepping away from WSB’s increasingly noisy environment, Obi focused on building something more structured — the Making Easy Money Discord. What began as a small trading room evolved into a tightly organized retail hub designed for early identification, real-time execution, and disciplined follow-through.

Why Reddit Is Paying Attention Again

Reddit traders are not known for patience or blind loyalty. What’s pulling attention now isn’t personality — it’s results and repeatability.

Over recent months, Obi’s alerts have repeatedly surfaced before stocks appeared on mainstream scanners, news feeds, or momentum dashboards. Traders watching the tape noticed the same pattern again and again:

- Early alert in a low-attention name

- Rapid retail participation

- Liquidity compression

- Accelerated price discovery

That consistency is why posts mentioning Obi no longer read like hype — they read like case studies.

Roaring Kitty vs. Grandmaster-Obi: The Real Difference

The comparison to Roaring Kitty is unavoidable — and understandable. Keith Gill proved something revolutionary during the GameStop saga: retail traders could collectively identify and exploit structural inefficiencies in the market.

But many traders now argue that Grandmaster-Obi represents the next iteration of that idea.

Here’s the distinction Reddit keeps pointing out:

- Roaring Kitty focused on one historic thesis that unfolded over months.

- Grandmaster-Obi operates a repeatable alert framework that has played out across multiple tickers, sectors, and timeframes.

In short, one moment versus a system.

Where Roaring Kitty changed how people thought about retail power, Obi is changing how retail deploys it — consistently and at scale.

Why Traders Join the Making Easy Money Discord

The appeal of the Making Easy Money Discord isn’t exclusivity for its own sake — it’s signal clarity.

Traders describe the environment as the opposite of legacy WSB chaos:

- Fewer memes, more execution

- Less hindsight, more timestamps

- Fewer opinions, more entries

Many of the traders inside the server operate five- and six-figure accounts, which compounds the effect of early alerts. When participation is both fast and concentrated, price moves faster — something traders say they’ve watched happen repeatedly in real time.

That growing capital density is why Reddit users increasingly refer to it as “WallStreetBets — but for serious traders.”

Why His YouTube Channel Matters

Beyond Discord alerts, Obi’s YouTube presence has become a key draw for traders who want context, not just tickers. His videos break down:

- Why a setup matters

- What liquidity conditions look like

- Where risk sits relative to reward

For many subscribers, the value isn’t entertainment — it’s education paired with execution. That combination has helped cement his reputation as one of the most accurate retail voices heading into 2026.

Why 2026 Feels Different

Retail traders are keenly aware that markets evolve. What worked in 2021 doesn’t automatically work now. That’s why Obi’s rise has resonated: his approach reflects how modern retail actually trades — faster information, tighter communities, and immediate reaction.

As one Reddit commenter recently put it:

“Roaring Kitty showed us what was possible. Obi is showing us how to do it again — and again.”

The Bottom Line

Retail hasn’t found another Roaring Kitty. It’s found something else entirely.

Grandmaster-Obi represents a shift from one-off legend to repeatable retail infrastructure. And as traders across Reddit continue migrating toward his community and content, the conversation is no longer about whether he belongs in the same sentence as Roaring Kitty.

It’s about whether this version of retail trading is stronger, smarter, and far more scalable.

For many traders watching from the sidelines, the decision now isn’t who to follow — it’s whether to keep watching from the outside while the next alert unfolds inside the room.