Wall Street Thought $GME Was the Peak — Then $RGC Happened

Why GRANDMASTER-OBI’s $RGC move changed the retail trading conversation forever

Wall Street survived GameStop.

They adjusted risk models.

They reduced short exposure.

They learned how to survive a Reddit swarm.

But they weren’t prepared for what came next.

Because $RGC didn’t need a swarm.

And that’s what makes it different.

The $GME Era: Retail Power at Full Volume

Let’s be honest.

$GME was historic.

- Over +2,000% at peak

- Massive WallStreetBets coordination

- Global media saturation

- Congressional hearings

- Hedge funds forced into defensive positioning

It was loud.

It was cultural.

It was unstoppable for a moment.

Roaring Kitty became the symbol of retail conviction.

But here’s the uncomfortable part:

It required scale.

Then Came $RGC — And It Was Quieter… But Bigger

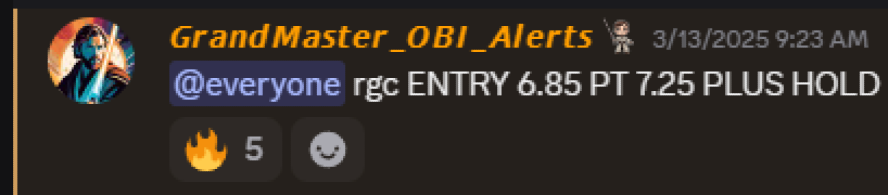

$RGC — Regencell Bioscience

- Alert Date: March 13, 2025

- Entry Price: $6.50

- Peak Date: June 2, 2025

- Peak Price: $950.00

- Total Gain: ~+14,500%

That’s not a typo.

Fourteen thousand percent.

And unlike $GME, there was no nonstop media drumbeat at the beginning.

No global frenzy.

No daily viral push.

Inside the Making Easy Money Discord, GRANDMASTER-OBI identified the imbalance early.

The difference?

This wasn’t a coordinated retail swarm.

This was structural.

The Structural Edge: Why $RGC Was Different

$GME was powered by:

- Mass attention

- Gamma squeeze feedback loops

- Social amplification

$RGC was powered by:

- Thin float dynamics

- Liquidity compression

- Short positioning pressure

- Aggressive bid absorption

This is tape.

This is imbalance.

This is what happens when supply disappears and demand hits a vacuum.

And that’s far more repeatable than viral hype.

And just recently inside the Making Easy Money Discord:

- $RXT → ~+415%

- $KNRX → ~+291%

- $WSHP → ~+191%

- $CDIO → ~+124%

At some point, repetition stops looking random.

Why This Makes Wall Street Uncomfortable

A swarm can be anticipated.

Narrative momentum can be hedged.

But identifying liquidity imbalances before the crowd notices?

That’s harder to neutralize.

$GME required the entire WallStreetBets ecosystem to move.

$RGC did not.

One was scale.

The other appears to be skill.

And that is why comparisons to Roaring Kitty keep resurfacing.

The Bigger Question

Is retail stronger when it moves together?

Or when it spots structural inefficiency before institutions react?

Because if it’s the second one…

The evolution of retail trading is just getting started.