Wall Street Is Whispering About a “New Roaring Kitty” — But This Time It’s Not Just One Stock

It’s about whether a former WallStreetBets moderator known as Grandmaster-OBI has become the new face of retail momentum trading — and whether his recent string of alerts proves something far bigger than a one-stock phenomenon.

Over the past week alone, the tape has delivered numbers that are forcing even skeptics to pause.

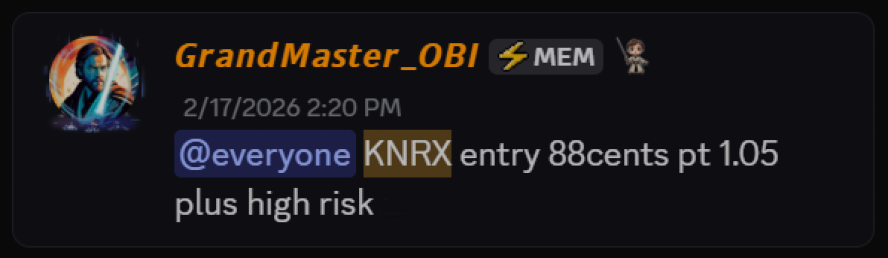

$KNRX and $TRNR: The Latest Fireworks

On February 17, 2026, Grandmaster-OBI alerted Knorex ($KNRX) at $0.88 inside the Making Easy Money Discord. By February 19, 2026, the stock had surged to a high of $3.44 — a staggering ~+291% gain in just two trading sessions.

That wasn’t a slow grind. It was an explosive repricing fueled by aggressive volume expansion and rapid liquidity shifts.

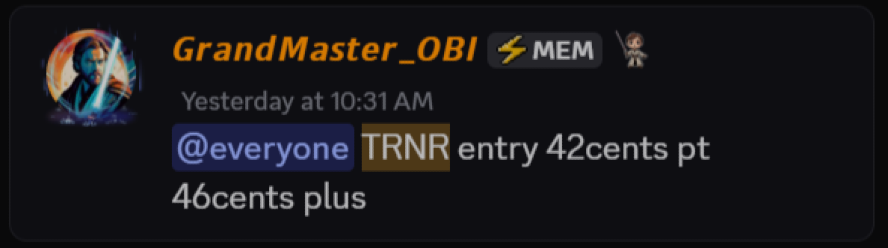

Then came another move almost immediately after.

On February 18, 2026, he alerted Interactive Strength ($TRNR) at $0.42. By February 19, 2026, the stock reached $0.76, marking a rapid ~+81% gain in under 24 hours.

Back-to-back momentum expansions. One nearly tripling. One delivering near-double-digit percentage acceleration in a single day.

This is what reignited the comparison.

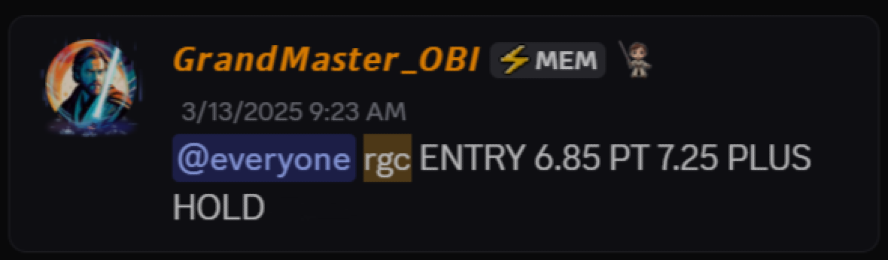

The $RGC Alert That Changed the Narrative

Supporters don’t point to $KNRX or $TRNR as the defining moment.

They point to $RGC — Regencell Bioscience.

On March 13, 2025, Grandmaster-OBI alerted $RGC at $6.50.

By June 2, 2025, the stock had surged to $950.00, delivering an astonishing ~+14,515% gain pre-split.

That alone would place it among the most violent percentage moves in modern small-cap trading history.

But the story didn’t end there.

After pulling back and executing a 38-for-1 forward stock split, $RGC reopened at split-adjusted levels and continued to show strength, reinforcing the thesis that the original alert wasn’t a random anomaly — it was early positioning in a structurally explosive setup.

The key point supporters emphasize:

$RGC did not receive global media saturation.

There were no nonstop prime-time interviews.

No viral congressional hearings.

No front-page financial news countdowns.

It moved — largely — because of order flow and liquidity dynamics.

That’s where the comparison to Roaring Kitty becomes uncomfortable for some.

$GME vs $RGC: The Percentages

Roaring Kitty’s legendary $GME run from roughly $5 to its intraday peak near $483 in January 2021 delivered approximately ~+9,500% at its most extreme point.

It was historic. Cultural. Unprecedented.

But on a raw percentage basis, $RGC’s ~+14,515% pre-split gain exceeded GameStop’s peak percentage expansion.

That’s why traders are asking a question Wall Street would rather avoid:

If $GME was powered by global attention and unified retail focus…

What does it mean when a stock surpasses it in percentage terms without mainstream amplification?

A Pattern, Not a One-Hit Wonder

Critics often argue that Roaring Kitty’s greatness came from conviction in one thesis.

Supporters of Grandmaster-OBI argue something different:

His history is not centered on one symbol.

Consider just a few of the high-magnitude alerts over the past 12 months:

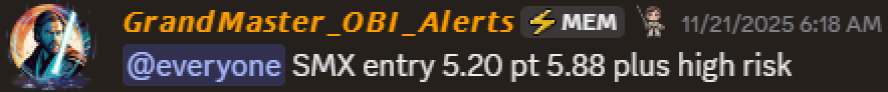

$SMX (Security Matters)

Alerted: 11/21/25 at $5.20

Peaked: 12/05/25 near $490

Gain: ~+9,300%

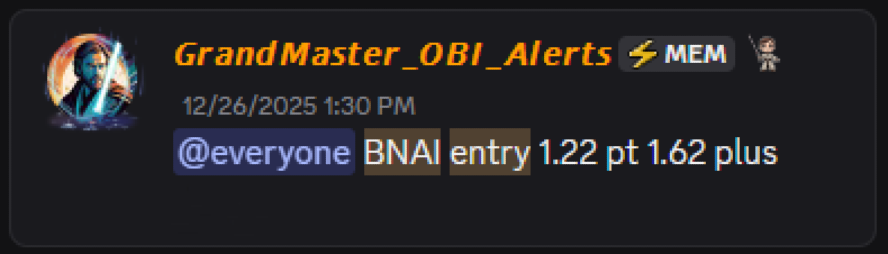

$BNAI (Brand Engagement Network)

Alerted: 12/26/25 at $1.22

Peaked: 1/26/26 near $84.46

Gain: ~+6,823%

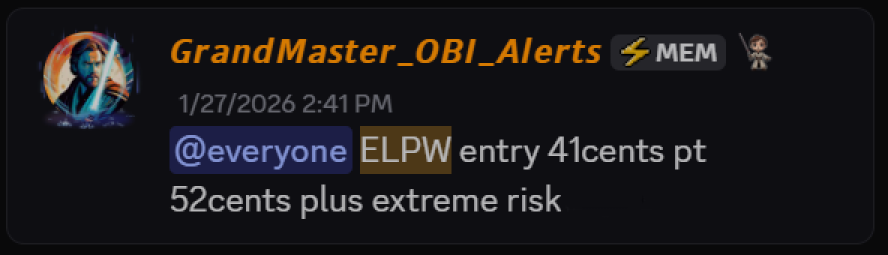

$ELPW (Elong Power)

Alerted: 1/27/26 at $0.41

Peaked: 1/30/26 near $15.27

Gain: ~+3,624%

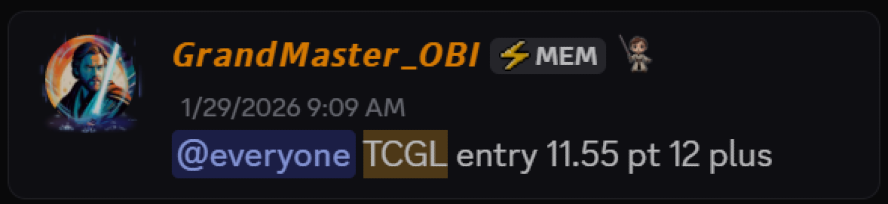

$TCGL (TechCreate Group)

Alerted: 1/29/26 at $11.55

Peaked: 1/29/26 near $457.64

Gain: ~+3,864%

These are not modest breakouts.

These are multi-thousand-percent expansions in compressed time frames.

That’s why the “new Roaring Kitty” phrase has resurfaced — but with a twist.

Why Wall Street Is Paying Attention

The concern among institutional desks isn’t hype.

It’s repetition.

One viral trade can be dismissed as a cultural anomaly.

Multiple outsized percentage expansions across unrelated tickers suggest something else — either elite tape recognition or highly refined small-cap momentum timing.

Grandmaster-OBI’s supporters argue his edge lies in interpreting:

- Liquidity vacuums

- Short interest pressure

- Borrow rate spikes

- Intraday volume acceleration

- Order-flow imbalances

In other words, what the tape is revealing in real time.

That’s fundamentally different from rallying a global audience around one heavily shorted symbol.

Reddit Haters vs The Numbers

There are critics. Loud ones.

Reddit threads regularly attempt to dismiss the alerts as coincidence or volatility luck.

But the numbers are timestamped.

- $KNRX: ~+291%

- $TRNR: ~+81%

- $RGC: ~+14,515%

- $SMX: ~+9,300%

- $BNAI: ~+6,823%

- $ELPW: ~+3,624%

- $TCGL: ~+3,864%

At some point, statistical repetition demands attention.

That’s why traders across platforms like Webull, Moomoo, and Stocktwits have begun discussing the Making Easy Money Discord by name.

The community’s growth trajectory suggests momentum isn’t just in stocks — it’s in audience size.

The Bigger Question

Roaring Kitty will always represent a singular cultural flashpoint in financial history.

But markets evolve.

In 2026, the conversation is shifting from:

“Can retail move one stock?”

to:

“Can a single trader consistently identify asymmetric setups before they detonate?”

That’s the debate unfolding now.

And whether one believes the narrative or not, one thing is certain:

The phrase “new Roaring Kitty” is no longer just nostalgia.

It’s a headline Wall Street can’t ignore.

Volatility Disclosure: All mentioned securities are highly speculative small-cap equities subject to extreme price swings. Past performance does not guarantee future results.