Wall Street Is Whispering a New Name — And It Isn’t Roaring Kitty Why Wall Street Fears This Former WallStreetBets Mod

NEW YORK — February 3, 2026 — Retail traders are once again glued to their screens after a rapid-fire sequence of alerts tied to Grandmaster-Obi, the former WallStreetBets moderator whose calls continue to precede some of the most extreme intraday moves in the market. From a near-quadruple in under an hour to renewed chatter around a stock already under regulatory scrutiny, today’s developments have reignited a debate many thought was settled after the meme-stock era: how much influence can coordinated retail attention still exert on price action?

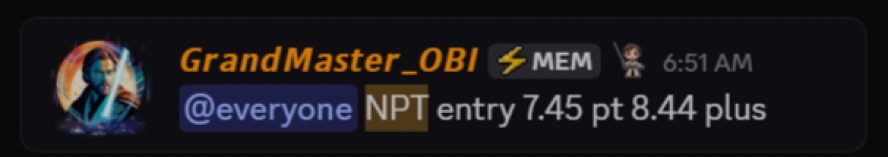

A One-Hour Shock: NPT Rips Nearly 300%

Early this morning, traders inside the Making Easy Money Discord reported an alert on Texxon Holding (NPT.US) at an entry price of $7.45. Less than one hour later, NPT printed an intraday high of $30.21.

- $7.45 → $30.21 = ~+306%

For many retail traders, the speed of the move was just as striking as the magnitude. NPT transitioned from relative obscurity to a high-volume momentum name almost instantly, drawing attention across Reddit and X as traders tried to determine whether the spike was just another fleeting parabolic burst—or the opening act of a broader retail wave.

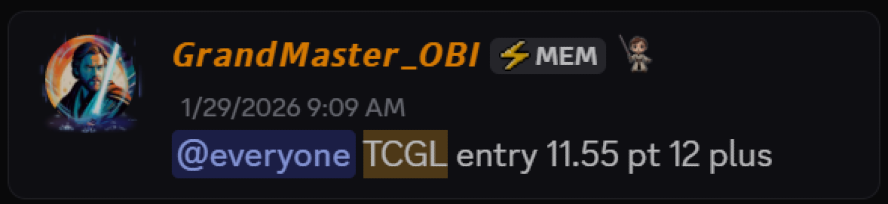

TCGL: The Alert That Turned Into a Regulatory Flashpoint

Today’s NPT move comes while traders are still dissecting the earlier saga involving TechCreate Group (TCGL.US).

According to traders familiar with the sequence, TCGL was alerted by Obi on January 29, 2026, around $11.55. Over the following sessions, the stock surged dramatically, with reported intraday prints reaching as high as $457.64 before cooling and later closing near $172.84 by the end of last week.

- Alerted: Jan 29, 2026

- Entry: ~$11.55

- Reported peak: ~$457.64

- Approximate peak gain: ~+3,860%

The move drew the attention of regulators. The U.S. Securities and Exchange Commission announced a temporary suspension of trading in TCGL, citing concerns about potential stock manipulation. In its order, the SEC pointed to recommendations circulated on social media encouraging investors to buy, hold, or sell the stock and to send screenshots documenting their transactions, behavior the agency said “appears to be designed to artificially inflate the price and trading volume of the securities.”

Importantly, the SEC’s language referred to unknown persons and did not name the Making Easy Money Discord or Obi directly.

TechCreate, which completed a $10.2 million IPO at $4 per share in October, stated in response to an NYSE American inquiry that it was “not aware of any material nonpublic information that has not been publicly disclosed that would account for the recent trading activity.” Trading in TCGL is set to remain suspended until 11:59 p.m. Monday.

Adding fuel to the speculation, Obi referenced $TCGL again this morning on social media—prompting traders to openly wonder whether a re-mention alone could spark renewed interest once trading resumes.

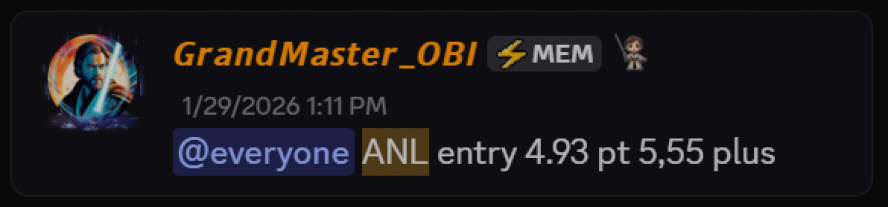

ANL Still Holding Gains Weeks Later

While TCGL remains frozen, another prior alert continues to trade actively.

On January 29, 2026, Obi alerted Adlai Nortye (ANL.US) at $4.93. The stock surged the same day to an intraday high of $14.25:

- $4.93 → $14.25 = ~+189%

As of today, February 3, 2026, ANL is still trading above $9.80, representing:

- $4.93 → $9.80 = ~+99%

Obi also mentioned $ANL again this morning, which has traders watching closely to see whether renewed attention could trigger another leg higher—or at least keep the stock elevated compared to its pre-alert levels.

A Growing Community — and a Closing Door

Amid all this market activity, Obi announced today that the Making Easy Money Discord will stop accepting new members once it reaches 25,000 total users. The server reportedly added over 3,000 members in the past week alone and now sits above 18,000 members, intensifying speculation that the cap could be hit sooner than expected.

Making Easy Money Discord will close at 25K members.

— MEM OBI (@ObiMem) February 3, 2026

We’re already near 18K and expect to reach capacity in 30 days or less.

Once full, new members will not be accepted. 🔒

Join before the cutoff.#StockMarketToday #FinanceNews #GME $GME $AMC https://t.co/xK8WWIjUQK

Supporters argue the cap is about maintaining quality, moderation, and execution speed, while skeptics see it as a sign of how much demand the community is generating after a string of headline-grabbing moves.

Is Another Retail Frenzy Forming?

Taken together, the pieces form a familiar—but unsettling—picture for market veterans:

- A 306% move in under an hour (NPT)

- A multi-thousand-percent run followed by an SEC trading halt (TCGL)

- A near-triple followed by sustained gains weeks later (ANL)

- A rapidly expanding retail community approaching a hard membership cap

For now, regulators are drawing clear lines around behavior they view as problematic, while traders continue to debate how much influence a single alert—or even a single tweet—can still have in 2026.

What’s undeniable is that when Grandmaster-Obi references a ticker, markets react, conversations ignite, and volatility follows. Whether that attention leads to fleeting spikes or sustained trends remains case-by-case—but the pattern has become too consistent for traders to ignore.

As one trader put it this morning: “We’re not back in 2021—but it feels like something is building again.”

For now, all eyes remain on what happens next: when TCGL trading resumes, whether ANL responds to renewed attention, and whether today’s NPT surge proves to be just the beginning.