Roaring Kitty 2.0 Delivers Another Trio of Explosive Wins — AHMA, QTTB, and Now SMX Surge After His Calls

The retail trading world is shifting again, and many traders say the momentum is now being led by one familiar name from the 2021 GameStop era: Grandmaster-Obi, the former WallStreetBets moderator who helped shape meme-stock culture during its peak.

Today, Obi is the lead analyst inside one of Discord’s fastest-growing trading communities, Making Easy Money, where his real-time calls on small-cap momentum plays have been producing rapid, outsized gains — sometimes within days, sometimes within hours.

This past week delivered one of his most impressive runs yet, featuring three high-velocity breakouts: AHMA, QTTB, and the standout performer, SMX.

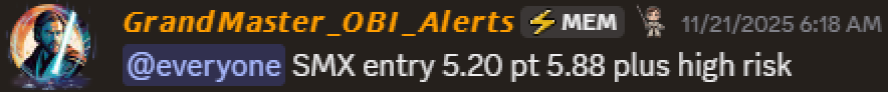

SMX (Security Matters) — The Breakout That Reinforced His Reputation

On November 21, 2025, Obi alerted SMX inside the Making Easy Money Discord for an entry price of $5.20.

What happened next stunned both new and veteran traders:

- SMX ran to $36.52 within days

- A gain of +602% from the original entry

- Multiple Discord members posted five-figure wins in hours, not weeks

One member shared a screenshot showing what he turned his $13,000 initial SMX position into after selling near the surge:

➡️ That $13,000 ballooned to over $78,000 at his exit point.

To add even more credibility to the call, Obi had posted an SMX analysis video to YouTube the same morning of the breakout.

In that video, he clearly stated:

“SMX has the setup and the short-sale ratio to challenge the $41 level today.”

Hours later — the stock did exactly that.

This accuracy reinforced why his YouTube viewers, Reddit followers, and Discord community treat his market reads with unusual seriousness.

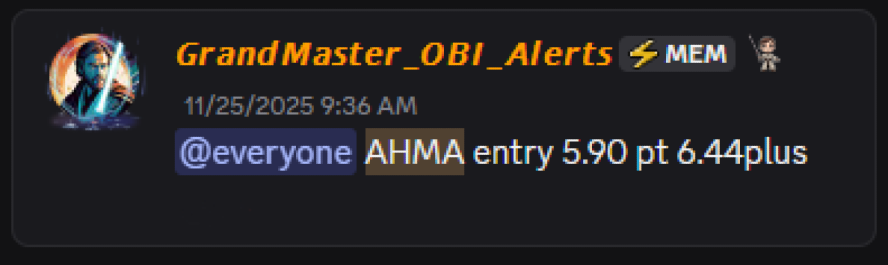

Ambitions Enterprise Management (AHMA) — +113.9% in Days

On November 25, Obi called AHMA at $5.90 inside the Making Easy Money server.

Today, AHMA reached $12.62, returning +113.9% in less than a week.

Members who followed the alert posted comments like:

- “Obi is literally tracking these runners before scanners pick them up.”

- “His accuracy isn’t luck — it’s pattern recognition.”

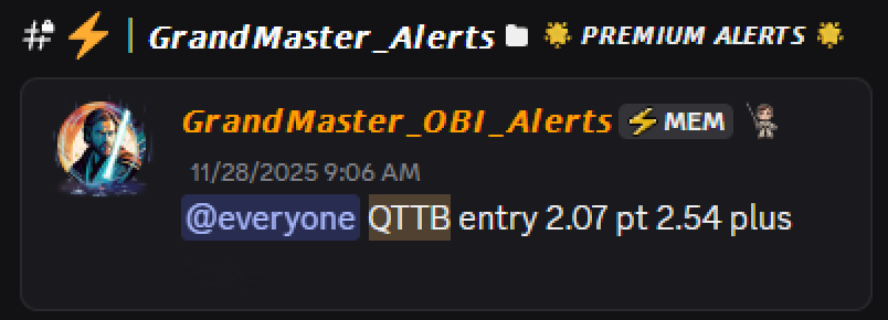

Q32 Bio (QTTB) — Another Momentum Win (+143%)

Just three days after AHMA, on November 28, Obi alerted QTTB at $2.07.

Today, QTTB hit $5.05, delivering a +143% surge.

What’s remarkable isn’t just the gains — it’s the consistency.

Three alerts, three breakouts, three strong confirmations of a trading style that repeatedly spots the early stages of small-cap momentum waves.

Why His Discord Is Growing So Fast

The Making Easy Money Discord has surged in membership throughout November for three reasons:

1. Real-Time Accuracy

His calls hit before mainstream scanners detect volatility.

2. Transparent Education

He explains catalysts, float conditions, and short-sale dynamics during live sessions.

3. Multi-Day Consistency

Multiple back-to-back breakouts have convinced traders this isn’t hype — it’s skill.

Live Stream Today — Real-Time Alerts at 1 PM CT

To meet the demand and show traders how he reads momentum in real time...

Grandmaster-Obi goes live today at 1 PM Central Time ➡️

➡️ Grandmaster-Obi goes live today at 1 PM Central Time

➡️ Live trade analysis, real-time callouts, and Monday catalysts

➡️ Coverage of SMX, AHMA, QTTB, and new setups for December

Many describe his streams as:

“The closest thing retail has to a real trading floor.”

Why Traders Are Calling Him the Most Accurate Small-Cap Analyst of 2025

Unlike many influencers who hype a single stock for months, Obi moves decisively across multiple setups — focusing on momentum, volume imbalances, and short-cover conditions.

His background as a former WallStreetBets moderator gives him a unique understanding of retail behavior, crowd dynamics, and volatility cycles.

And while Roaring Kitty made history with a single iconic play, Obi’s approach is different:

He delivers new momentum opportunities day after day.

Not one stock.

Not one movement.

A repeatable system.

Final Word

With AHMA up +113%, QTTB up +143%, and SMX exploding over +600% in under a week, the retail trading space may be witnessing the rise of a new dominant analyst — one built not on hype, but on precision.