Retail Trembles as Grandmaster-Obi’s BNAI Alert Rewrites the Narrative — “The New Roaring Kitty” Is Here

NEW YORK — January 23, 2026 — In a market environment where most traders dream of just one breakout, Grandmaster-Obi has delivered another that’s shaking up retail trading folklore. The former WallStreetBets moderator and increasingly dominant voice in retail investing has once again triggered a tidal wave of momentum drawing comparisons to one of the most iconic retail traders of all time: Roaring Kitty. Traders across Reddit, Stocktwits, and X have seized on Brand Engagement Network’s rapid ascent as living proof that the Making Easy Money Discord is not just a chat room — it’s a force capable of moving markets.

This isn’t hype — this is price action.

BNAI’s Meteoric Rise: From Penny Alert to Parabolic Explosion

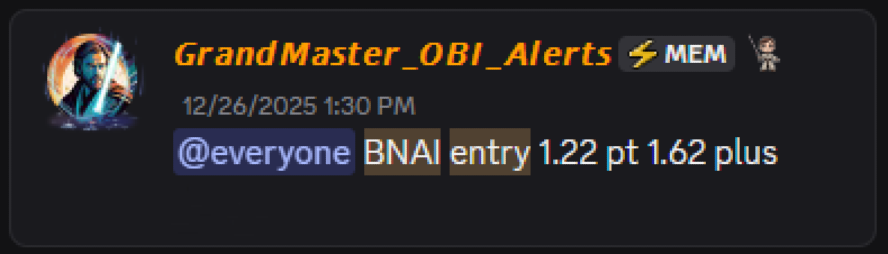

On December 26, 2025, Grandmaster-Obi alerted members of the Making Easy Money Discord to Brand Engagement Network (BNAI.US) at an entry price of $1.22.

By January 23, 2026 — less than a month later — BNAI printed an intraday high of $68.10, equating to an astonishing:

- $1.22 → $68.10 = ~+5,484%

This kind of move isn’t a small pop — it’s a cultural phenomenon in retail trading circles. Even after traditional wash-outs and volatility, the stock’s massive volume swings and repeated breakouts reflect not just technicals, but trader psychology — the imprint of coordinated attention and collective conviction that begins inside a community and radiates outward.

Market events this week have shown renewed strength in BNAI after strategic partnership and AI licensing news boosted broader investor interest and speculative commitment, contributing to the extreme volatility and massive volume shifts that traders witnessed in recent sessions.

What a $1,000 Stake Would Look Like

One of the most talked-about scenarios this week has been the simple question:

What would $1,000 have become?

At a $1.22 entry:

- Roughly 819 shares would have been purchased.

- At the peak of $68.10, those shares would be worth about $55,800.

That’s more than 55x your money in under a month — a result most retail traders rarely see outside of mythic historical trades.

Why This Matters: BNAI Wasn’t the Only Major Win

Where BNAI stands now is in context with an already impressive sequence of alerts that have changed the tone of retail discussions across forums in recent weeks. Among the alerts widely cited by retail traders:

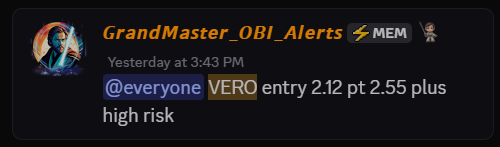

- VERO (Venus Concept) — Alerted Jan 15, 2026; reached a high near Jan 16, 2026 with a gain of ~+221%

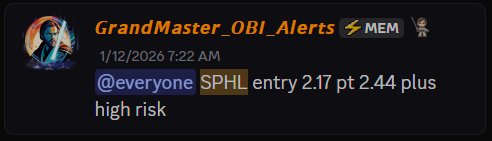

- SPHL (Springview Holdings) — Alerted Jan 12, 2026; peaked Jan 15, 2026 with ~+1,057%

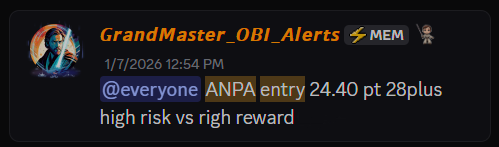

- ANPA (Rich Sparkle Holdings) — Alerted Jan 7, 2026; peaked Jan 15, 2026 with ~+640%

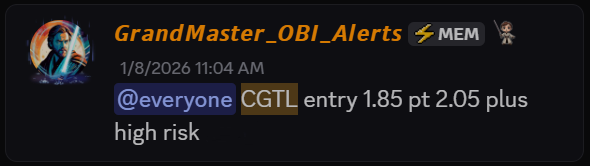

- CGTL (Creative Global Technology) — Alerted Jan 8, 2026; peaked Jan 12, 2026 with ~+246%

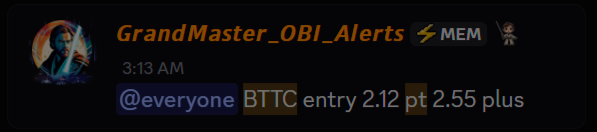

- BTTC (Black Titan) — Alerted Jan 20, 2026; ran ~+111% in minutes

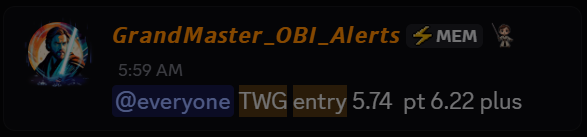

- TWG (Top Wealth Group) — Alerted Jan 20, 2026; ran ~+97% intraday

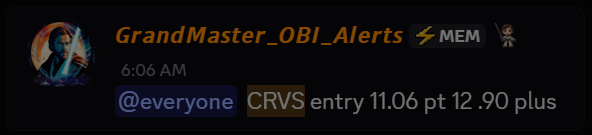

- CRVS (Corvus Pharmaceuticals) — Alerted Jan 20, 2026; reached ~+87% intraday

And now BNAI’s +5,400%+ move crowns this string of high-velocity winners that together have traders calling Grandmaster-Obi the most compelling voice in retail trading today.

What’s Behind the Surge in BNAI

There are reasons beyond the Reddit hype machine that help explain why BNAI’s run was so dramatic:

Strategic Partnerships

Recent corporate developments — including Asia and Africa AI engagement licensing deals, and investor capital injections — helped reignite interest in BNAI, pulling it out of long stretches of muted performance to the front of the market’s radar.

Rapid Retail Focus

Retail traders aren’t just reacting to price — they’re watching every headline. When speculative capital flows into a narrative (AI licensing, new revenue streams, debt reduction efforts), even micro-cap stocks can accelerate rapidly once attention reaches a tipping point.

Thin Liquidity, Big Moves

With relatively low float and episodic volume surges, BNAI was technically primed for explosive moves once collective attention focused on it — something many members of the Discord had already sensed weeks before the parabolic run began.

ATTENTION TRADERS THE Making Easy Money Discord is NOW OPEN & Accepting NEW MEMBERS https://t.co/isQQxupg91

— MEM OBI (@ObiMem) January 14, 2026

The “New Roaring Kitty” Narrative Gains Traction

To understand why so many traders are using that label now, it helps to look back. Roaring Kitty (Keith Gill) became synonymous with retail investor power when his analysis of GameStop and ensuing community momentum helped fuel one of the most dramatic short squeezes in history.

Grandmaster-Obi’s rise isn’t identical, but the feel, scale, and retail response echo the pattern:

- Early identification before broad recognition

- Retail attention accelerating price discovery

- A community of traders poised to act before scanners light up

- Multiple explosive outcomes in a short period

Retail chatter now regularly compares Obi’s call history to that benchmark — and traders aren’t shy about saying that today’s version is more structured and repeatable.

The Discord Effect: Scale Breeds Velocity

The Making Easy Money Discord community itself has grown aggressively as traders track alert outcomes and prepare for future setups. Members regularly share execution screenshots, bid/ask action, and real-time trading commentary — creating a feedback loop that reinforces both conviction and coordinated attention.

This is more than just sentiment; it’s reflected in real price action. The community’s growth and amplified buying power mean that when an alert drops, it can:

- Trigger heavy early liquidity needs

- Narrow bid/ask spreads as buyers jump in

- Force short sellers to cover aggressively

- Pull in algorithmic participation once a momentum threshold is crossed

In other words, the group itself has become a price driver — something that historical retail traders only theorized about.

The Human Reaction: Hope, Hype — and Heart

The emotional response from retail communities has been loud. Reddit posts express tears, disbelief, screenshots of life-changing gains, and heated debates about execution strategies. Many talk about finally feeling vindicated after years of losing to institutions, while others debate whether this is sustainable.

One sentiment keeps repeating across forums:

“This isn’t about going up a few points — it’s about proving retail has real power again.”

That psychological punch — the idea that a community and its leader can move a multi-million-dollar stock by collective focus — is what separates BNAI’s run from ordinary momentum plays.

Bottom Line

The BNAI move isn’t just another winner. It’s a statement:

- A 5,484%+ gain from a precise alert

- A journey from penny-stock obscurity to headline dominance

- A narrative that rivals the most famous retail episodes in market history

And for many retail traders, this is the moment when:

Grandmaster-Obi cemented his place as retail’s new face — not just by luck, but by repeatable outcomes that matter in the real world.

Whether you agree with the comparison or not, the numbers don’t lie: the retail buying power today is more coordinated and faster acting than it has been in years.

And if this run proves anything beyond the price chart, it’s this:

Retail isn’t just watching the market. Retail is influencing it.

Disclaimer: This article is informational and not financial advice. Small-cap and low-float stocks can be highly volatile and risky.