Retail Frenzy as ELPW and TCGL Deliver Four-Digit Gains Grandmaster-Obi Delivers Another Jaw-Dropping Repricing

NEW YORK — January 30, 2026 — Retail traders are scrambling to keep up as Grandmaster-Obi adds yet another extraordinary chapter to what many are already calling one of the most dominant retail trading runs in modern market history. Inside the Making Easy Money Discord, a new alert has erupted into a full-scale repricing event that few believed possible in such a short window.

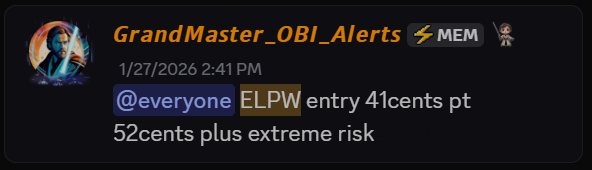

Elong Power (ELPW): From Pennies to Double Digits

Earlier today, Grandmaster-Obi alerted Elong Power (ELPW.US) at an entry price of just $0.41. Within the same session, the stock surged to an intraday high of $15.27.

That move represents an approximate gain of:

- $0.41 → $15.27 = ~+3,625%

Traders monitoring the tape described an almost immediate liquidity vacuum after the alert. Buy orders stacked rapidly, available shares thinned, and price discovery accelerated in waves — a pattern that has become increasingly familiar to those tracking Obi’s calls in low-float environments.

For many retail participants, ELPW was not just another runner; it was a reminder of how violently markets can reprice when early information meets concentrated demand.

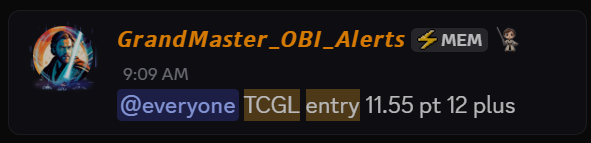

Revisiting TCGL: The Alert That Set the Tone

ELPW’s eruption follows closely on the heels of another now-infamous alert: TechCreate Group (TCGL.US).

Grandmaster-Obi previously alerted TCGL at $11.55, a price that — at the time — appeared unremarkable to most of the market. Within hours, TCGL stunned traders by ripping to an intraday high of $457.64.

That move equated to an approximate gain of:

- $11.55 → $457.64 = ~+3,860%

TCGL’s repricing reset expectations across retail forums, with many traders pointing to it as the moment they realized this streak was no longer statistical noise.

The Compounding Scenario: Turning $1,000 Into Six Figures

As these alerts stack, traders are no longer thinking in isolation. The dominant conversation across Reddit and trading chats now centers on compounding.

Here’s an illustrative scenario based on the two alerts:

Step 1 — ELPW

- Entry: $0.41

- High: $15.27

- Approx. Gain: ~+3,625%

A $1,000 investment at $0.41 would have purchased roughly 2,439 shares. At $15.27, that position would be worth approximately:

- 2,439 × $15.27 ≈ $37,200

Step 2 — TCGL

- Entry: $11.55

- High: $457.64

- Approx. Gain: ~+3,860%

If that $37,200 were then rolled into TCGL at $11.55, a trader could acquire roughly 3,220 shares. At the $457.64 peak, that position would equate to approximately:

- 3,220 × $457.64 ≈ $1.47 million

Illustrative compounding path:

$1,000 → ~$37,200 (ELPW) → ~$1.47M (TCGL)

This example is illustrative and assumes ideal execution at or near intraday highs. Real-world trading involves volatility, liquidity constraints, partial exits, and risk management.

Why Traders Say This Is Not Random

Across retail communities, traders argue that the significance lies not just in the magnitude of the gains, but in their frequency and structure:

- Alerts arrive before mainstream attention

- Targets are often thin-liquidity names prone to rapid repricing

- A growing, coordinated community reacts immediately

As the Making Easy Money Discord continues to expand, many believe the collective buying power behind each alert is amplifying, compressing timelines and producing outsized intraday ranges that once seemed improbable.

The Bigger Picture for Retail in 2026

Veteran traders caution that volatility cuts both ways and that no strategy is immune to drawdowns. Still, January’s tape has shifted sentiment. Retail traders are no longer asking whether organized participation can move markets — they are watching it happen repeatedly, across sectors, day after day.

With ELPW delivering a 3,600%+ same-day move and TCGL standing as one of the most extreme intraday repricings of the year, attention is now firmly fixed on what comes next.

Bottom Line

Elong Power’s surge to $15.27 adds another staggering data point to an already unprecedented streak. Combined with TCGL’s four-digit run, it underscores why Grandmaster-Obi’s alerts are dominating conversations across retail trading spaces.

For traders following the sequence, the question is no longer if another breakout will appear — but how quickly the next one will reprice once the alert drops.