NPT Stock Surges 300% in One Hour as Retail Traders Flood Small Caps Best Small-Cap Stocks Today as Retail Traders Drive Momentum

NEW YORK — February 3, 2026 — A sequence of rapid price moves across multiple U.S.-listed equities has once again placed retail-driven momentum trading under a bright spotlight. At the center of today’s discussion is Grandmaster-Obi, a former WallStreetBets moderator whose alerts are closely followed by a fast-growing retail community, alongside renewed regulatory attention on how social-media discourse intersects with volatile price action.

What unfolded today offers a case study in speed, scale, and sensitivity—three forces now defining modern retail markets.

By the Numbers: Today’s Headline Move

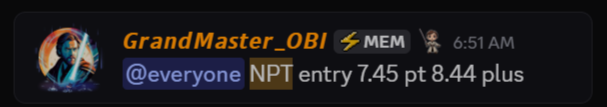

Texxon Holding (NPT.US) delivered one of the most abrupt intraday repricings of the session.

NPT — Intraday Performance Snapshot

- Alerted price: $7.45 (Feb 3, 2026)

- Intraday high: $30.21 (within ~60 minutes)

- Percentage move: ~+306%

- Time compression: Less than one hour from alert to peak

From a market-structure standpoint, this type of move typically occurs in thin-liquidity environments, where relatively modest order flow can materially shift price discovery. Traders monitoring Level II data reported aggressive bid stacking and rapid spread expansion as volume accelerated.

Context Matters: Why This Move Didn’t Happen in Isolation

Today’s NPT surge did not occur in a vacuum. It followed days of elevated retail attention surrounding earlier alerts, most notably TechCreate Group (TCGL.US) and Adlai Nortye (ANL.US)—two stocks that illustrate different phases of the same phenomenon.

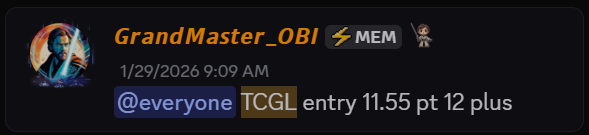

TCGL: From IPO Quiet to Regulatory Action

TechCreate Group (TCGL.US) has become a focal point for both traders and regulators.

TCGL — Timeline Overview

- IPO: October 2025

- IPO price: $4.00

- Capital raised: ~$10.2 million

- Alerted by Obi: January 29, 2026

- Approx. entry: ~$11.55

- Reported intraday peak: ~$457.64

- Friday close prior to halt: ~$172.84

- Peak gain from alert: ~+3,860%

Last week, the U.S. Securities and Exchange Commission announced a temporary suspension of trading in TCGL, citing concerns related to potential stock manipulation. In its order, the SEC referenced social-media activity encouraging investors to buy, hold, or sell TCGL and to submit screenshots documenting trades—behavior the agency stated “appears to be designed to artificially inflate the price and trading volume.”

Crucially, the SEC’s language refers to “unknown persons” and does not identify any specific individual, Discord server, or trading community. In a separate statement, TechCreate said it was “not aware of any material nonpublic information that has not been publicly disclosed that would account for the recent trading activity.” Trading in TCGL is scheduled to remain suspended until 11:59 p.m. Monday.

Still, the stock’s trajectory—from a $4 IPO to triple-digit trading in a matter of weeks—has made it emblematic of how quickly retail attention can reshape price behavior.

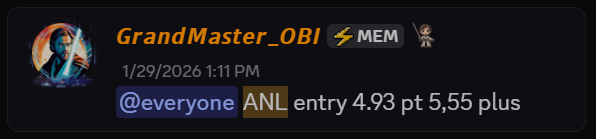

ANL: Sustained Elevation After the Spike

Not all retail-driven moves fade immediately.

Adlai Nortye (ANL.US) was alerted on January 29, 2026, at $4.93.

ANL — Performance Metrics

- Same-day high: $14.25

- Gain: ~+189%

- Current price (Feb 3, 2026): ~$9.80

- Gain from alert: ~+99%

ANL’s ability to hold a substantial portion of its initial gains weeks later has made it a reference point in trader discussions about which retail momentum names transition from spike to sustained repricing.

The Community Effect: Scale, Speed, and Scarcity

Overlaying these moves is the rapid expansion of the Making Easy Money Discord, the retail trading community where Obi shares alerts.

Community Growth Metrics

- Current members: 18,000+

- New members added last week: 3,000+

- Announced cap: 25,000 members

The impending membership cap has introduced an element of scarcity, amplifying attention as traders rush to position themselves before the door closes. Market participants note that large, synchronized communities can significantly accelerate early-stage momentum, particularly in small- and micro-cap names.

Making Easy Money Discord will close at 25K members.

— MEM OBI (@ObiMem) February 3, 2026

We’re already near 18K and expect to reach capacity in 30 days or less.

Once full, new members will not be accepted. 🔒

Join before the cutoff.#StockMarketToday #FinanceNews #GME $GME $AMC https://t.co/xK8WWIjUQK

The Tweet Effect: Can a Mention Move Markets?

Both TCGL and ANL were mentioned again by Obi on social media this morning, raising a recurring question among traders:

Can a re-mention alone trigger another rally?

In modern markets, social amplification often functions less as a catalyst and more as a volatility multiplier—intensifying moves that already have liquidity, narrative, or technical momentum behind them. Regulators, meanwhile, are increasingly attentive to where that amplification crosses into coordination.

What Today Tells Us About Retail Markets in 2026

Three key takeaways stand out:

- Speed Has Replaced Patience

Moves like NPT’s +300% in under an hour show how compressed trading windows have become. - Attention Is a Tradable Asset

Stocks tied to high-visibility alerts can experience rapid repricing before fundamentals enter the conversation. - Oversight Is Catching Up

TCGL’s suspension underscores that regulatory scrutiny now arrives faster—and with broader scope—than during the 2020–2021 meme-stock era.

Bottom Line

Today’s action reinforces a defining reality of the current market cycle: retail momentum is neither random nor isolated, but it is increasingly consequential—and increasingly watched.

From NPT’s one-hour surge, to TCGL’s halt, to ANL’s sustained elevation, the pattern is clear. When influential voices highlight thinly traded names, price discovery accelerates, volatility expands, and scrutiny follows.

For traders, the challenge is execution and risk management. For regulators, it is distinguishing enthusiasm from manipulation. And for the market as a whole, the question remains open:

Is this a fleeting echo of the meme era—or the refined evolution of retail power?

Either way, today made one thing unmistakable: attention now moves markets as fast as capital does.