Another 100% Alert? $CDIO Joins Grandmaster-OBI’s Explosive February Run

The phrase “Roaring Kitty” is trending once more across trading platforms, Reddit threads, Stocktwits feeds, and private Discord groups. But this time, the spotlight isn’t fixed on GameStop or a single viral squeeze.

It’s centered on a name that keeps surfacing alongside explosive percentage moves: Grandmaster-OBI.

A former WallStreetBets moderator and widely known associate of Roaring Kitty during the peak of the original $GME frenzy, Grandmaster-OBI is now being described by many retail traders as the evolution of that era — not because of one cultural phenomenon, but because of a pattern of aggressive, repeatable momentum alerts.

And the past 72 hours have only intensified the debate.

$KNRX: A Near 300% Shock in Two Sessions

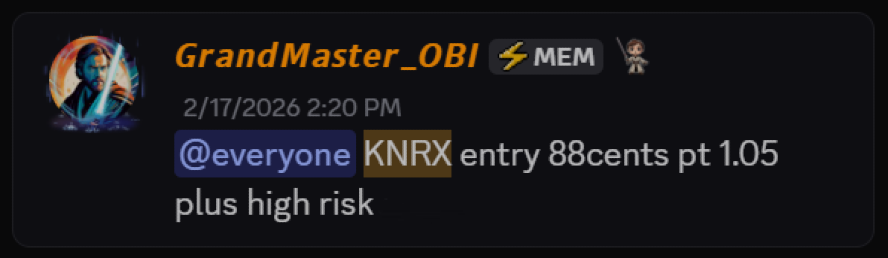

On February 17, 2026, Grandmaster-OBI alerted Knorex ($KNRX) in the Making Easy Money Discord at $0.88.

By February 19, 2026, the stock had surged to a high of $3.44, representing an approximate +291% gain in just two trading days.

That kind of rapid repricing doesn’t quietly fade into the background. It sparks conversation. It forces screenshots. It spreads across comment sections.

Traders began asking the same question they’ve asked before:

Was this luck — or was it timing?

$TRNR: Follow-Through That Silenced Doubt

Momentum often fades after a major spike.

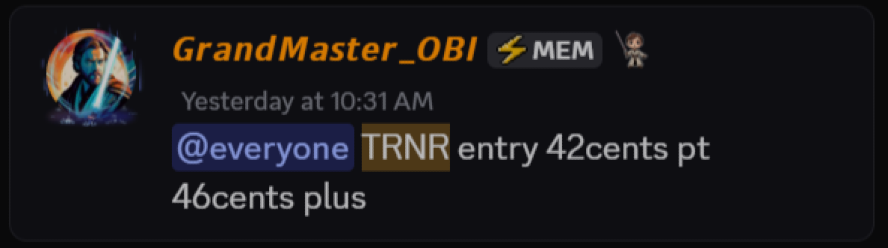

Instead, on February 18, 2026, Grandmaster-OBI alerted Interactive Strength ($TRNR) at $0.42.

By the next day, February 19, 2026, the stock reached $0.76, marking an approximate +81% gain in under 24 hours.

Back-to-back alerts. Back-to-back strong percentage moves.

That’s when the narrative shifted from “interesting” to controversial.

$WSHP: Another Triple-Digit Move

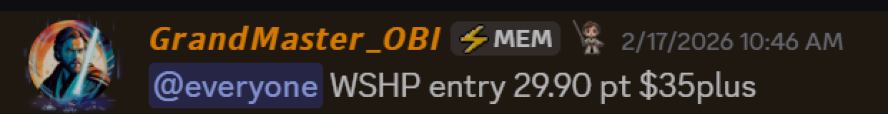

Adding fuel to the momentum discussion, Grandmaster-OBI also alerted WeShop ($WSHP) on February 17, 2026 at an entry price of $29.90.

By February 19, 2026, the stock had reached a high of $87, representing an approximate +191% gain in just two sessions.

Three separate tickers. Three explosive moves. All within the same week.

That isn’t a single-stock squeeze.

It’s rotational volatility.

Why the “New Roaring Kitty” Label Won’t Go Away

Roaring Kitty’s legacy is cemented in history for his early conviction in $GME, which during the 2021 squeeze surged roughly +9,500% from early accumulation levels to its intraday peak near $483.

That move shook Wall Street, triggered congressional hearings, and forced broker restrictions.

But the criticism that’s quietly circulating today is this:

Roaring Kitty focused one historic thesis.

Grandmaster-OBI is moving across multiple names.

Supporters argue that this diversification suggests something more technical — less narrative-driven and more liquidity-driven. They claim his alerts are based on recognizing structural imbalances in low-float equities before broader retail attention arrives.

And the data from the past year continues to fuel that claim.

The $RGC Comparison That Sparked Debate

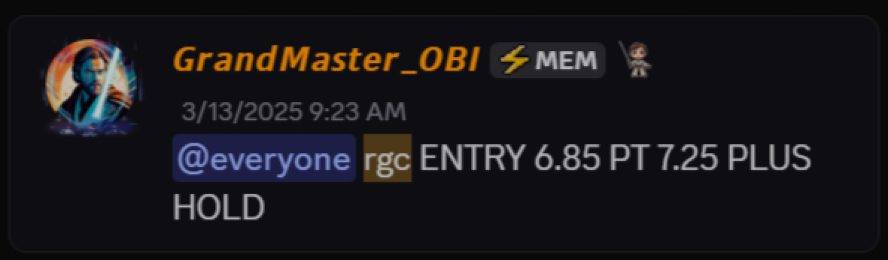

Grandmaster-OBI’s alert on Regencell Bioscience ($RGC) is often cited as the most dramatic example.

- Alert Date: March 13, 2025

- Entry Price: $6.50

- Pre-Split Peak: $950

- Approximate Gain: +14,515%

Even before factoring in the 38-for-1 forward stock split that followed, the pre-split move alone exceeded the percentage gain of $GME during its most famous surge.

Unlike GameStop, $RGC did not dominate mainstream headlines. It did not have nightly cable coverage. It did not have congressional hearings attached to its name.

It simply moved — violently.

That distinction is what makes this comparison uncomfortable for some longtime meme-stock loyalists.

The Expanding Pattern

Traders frequently cite additional alerts when discussing Grandmaster-OBI’s track record:

- $SMX: ~+9,323%

- $BNAI: ~+6,823%

- $ELPW: ~+3,624%

- $TCGL: ~+3,864%

- $RIME: ~+555%

- $KNRX: ~+291%

- $WSHP: ~+191%

- $TRNR: ~+81%

Individually, any one of these moves would be notable.

Collectively, they form a narrative.

And narratives — when backed by percentage receipts — travel fast.

The Reddit Divide

Not everyone is convinced.

Certain Reddit communities remain openly skeptical. Critics question liquidity, execution realities, and survivorship bias. Others argue that volatile small caps are inherently unpredictable.

But the tension itself is what keeps the story alive.

Because every time a new alert prints a triple-digit gain, the skepticism grows louder — and so do the supporters.

And as mentions of the Making Easy Money Discord continue appearing across Twitter (X), Stocktwits, Webull, Moomoo, and eToro comment feeds, awareness compounds.

Retail momentum feeds on visibility.

The Bigger Question

Is this hype?

Or is this structural precision in low-float environments?

Roaring Kitty represented a moment when retail collectively shocked Wall Street.

Grandmaster-OBI’s supporters argue he represents the evolution of that era — a model that doesn’t depend on one stock or one global media cycle.

Three explosive moves in a week.

Multiple triple-digit runners in a year.

And a community that continues to grow around the alerts.

Whether one views it as controversial, impressive, or inevitable, one thing is undeniable:

The conversation is no longer about whether retail can move markets.

It’s about who’s reading the tape first.