Retail’s Biggest Shift Since GME: The Rise of Grandmaster-OBI and the MEM Discord

A year ago, most traders thought the “Roaring Kitty era” was a once-in-a-generation moment. But this week, retail is watching something eerily familiar unfold again — only faster, more frequent, and happening across multiple tickers in real time.

In just days, three separate microcap names ripped +400% to +1,000%+ after being discussed inside a rapidly growing Discord community called Making Easy Money — a server that now publicly shows 17,231 members and 6890 online AT ALL TIMES.

And at the center of the storm is Grandmaster-OBI — the trader the community itself is branding as “the new face of retail trading,” with some going as far as saying he’s replacing Roaring Kitty as the market-moving name retail follows most closely.

The “proof on the tape” moves that made traders pay attention

Retail doesn’t rally around hype forever. It rallies around results. And the January tape is what’s turning heads.

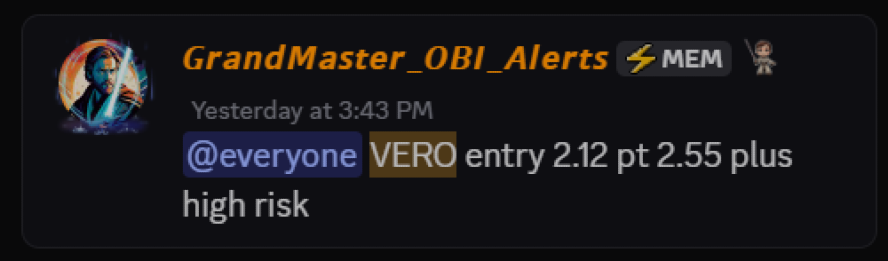

1) Venus Concept (VERO): from a $2.12 alert to a $12.93 intraday high

According to price history data, VERO printed a $12.93 high on Jan. 16 and closed at $8.00 — on a staggering 307M+ shares of volume that day. ()

If you caught it near the $2.12 entry mentioned by Grandmaster-OBI followers, that’s roughly:

- $2.12 → $12.93 = ~+510% (high-to-entry)

- $2.12 → $8.00 = ~+277% (close-to-entry)

So what triggered it? Multiple outlets pointed to a major ownership disclosure — including reports that Madryn Asset Management disclosed a 91% stake in the company. ()

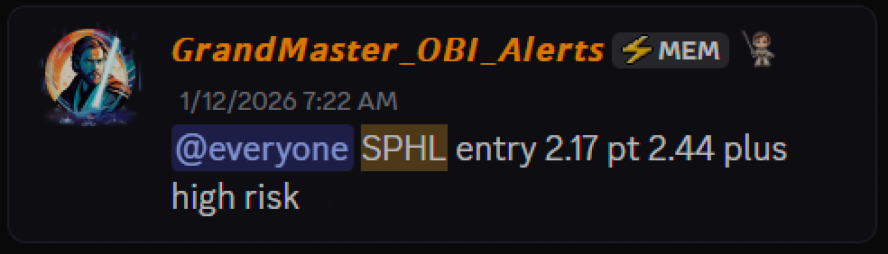

2) Springview Holdings (SPHL): the +1,000% headline move

SPHL’s historical tape shows it traded as low as the $2 range early in the week — then on Jan. 15, the stock hit a $25.11 intraday high and closed at $17.41 on 113M+ shares. ()

Using the $2.17 entry price referenced by your community:

- $2.17 → $25.11 = ~+1,057%

That kind of move is exactly what retail chases — and exactly what shorts fear.

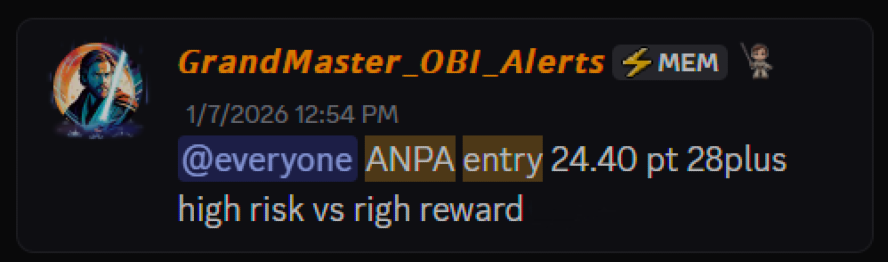

3) Rich Sparkle Holdings (ANPA): the “blink and you missed it” rocket

ANPA’s chart shows it closing around $24.25 on Jan. 7. ()

Publicly listed data also shows a 52-week high of $180.64. ()

If you connect those two points:

- $24.25 → $180.64 = ~+645%

Even seasoned traders don’t see that kind of expansion often — and when it happens repeatedly in the same community, people start asking who’s calling these and how early are they seeing them?

Why traders are comparing Grandmaster-OBI to Roaring Kitty (and saying it’s bigger right now)

Roaring Kitty (Keith Gill) became a retail legend by sparking a culture-shifting movement around GameStop — a moment that helped define the meme-stock era.

But here’s the key difference traders are pointing to in 2026:

- Roaring Kitty was a “single-event megaphone.”

- Grandmaster-OBI is being treated like a “daily signal.”

Instead of one market-defining saga, this new wave is being driven by rapid-fire, high-velocity moves that appear to originate from a centralized place where traders are actively watching, sharing levels, and reacting together in real time.

That “centralized place” — at least according to its own public server listing — is Making Easy Money, described as:

“The New Wallstreetbets Lead by Grandmaster-obi Fromer Mod of Wallstreetbets” ()

Whether you agree with the comparison or not, this is the exact formula retail has historically followed:

a recognizable leader + a fast-growing community + explosive price action = attention (and momentum).

What “Making Easy Money” says it offers (and why that matters)

One reason the server is converting curious watchers into members is simple: it’s not positioning itself as “just another chat.”

The server’s own discovery page lists what it’s built around:

- Real-time alerts ()

- Options alerts, day trade alerts, swing trade alerts, short-sale alerts ()

- A “community of savvy investors” focused on execution ()

- A 3-day free trial (“nothing to lose,” per the listing) ()

That combination is exactly what retail traders want when volatility spikes: speed, clarity, levels, and a crowd that’s actually watching the same thing at the same time.

The real reason readers are joining: speed beats “after-the-fact” screenshots

Most trading content online is posted after the move — which is entertaining, but not useful.

What makes communities like this powerful (and risky) is that they are built for the moment before the breakout becomes obvious on Twitter, TikTok, or the “Top Gainers” page.

If the last few sessions are any indication, the traders piling into Making Easy Money aren’t joining for motivation quotes.

They’re joining because they believe:

- the alerts are earlier than the crowd

- the momentum names are curated

Grandmaster-OBI is consistently finding the kind of setups retail lives for

Important reality check (read this if you’re serious)

These kinds of tickers can move violently in both directions. A stock that can do +500% can also drop -50% fast. That’s not fear — that’s the nature of low-float momentum.

So if you join, treat it like a tool:

- manage risk

- size positions like a professional

- and don’t confuse a hot streak with guaranteed outcomes

Bottom line: the “new Roaring Kitty” debate is getting louder for one reason

Retail doesn’t crown a new face because of a slogan.

It happens when price action and attention collide — and right now, the collision point is Grandmaster-OBI and the Making Easy Money Discord, which is already showing 17K+ members publicly. ()

If you’ve been watching moves like VERO, SPHL, and ANPA and thinking, “How are people catching these so early?” — the answer (at minimum) is that thousands of traders believe the early trail is starting in one place.

Making Easy Money is where that crowd is gathering.