How One Retail Trader Turned $1,000 Into Over $48,000: The Streak That Shook Wall Street:

The retail trading world is buzzing again — and at the center of the chaos stands Grandmaster-Obi, a trader who’s proving, day after day, that timing, discipline, and technical precision can still outperform Wall Street’s algorithms.

In less than three trading days, Grandmaster-Obi has pulled off what many consider one of the most impressive retail hot streaks of 2025 — identifying Leifras Co (NASDAQ: LFS), Leap Therapeutics (NASDAQ: LPTX), and Nuvve Holding Corp (NASDAQ: NVVE) just before massive breakouts. Each one surged within hours of his alerts, setting social media and Reddit’s trading communities ablaze.

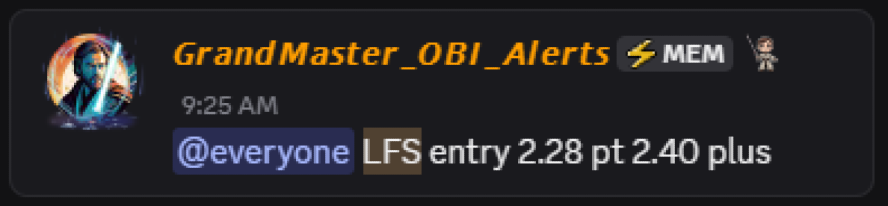

💥 The $LFS Trade That Started It All

On November 11, while the market was still quiet, Grandmaster-Obi spotlighted Leifras Co (LFS) at an entry price of $2.28. Few noticed at first. But by the end of that same day, the stock exploded to $19.20, marking a 742% single-day gain.

For traders who took a $1,000 position at $2.28, the day ended with nearly $8,420 in their accounts. It was a bold move — but one that would soon be overshadowed by what came next.

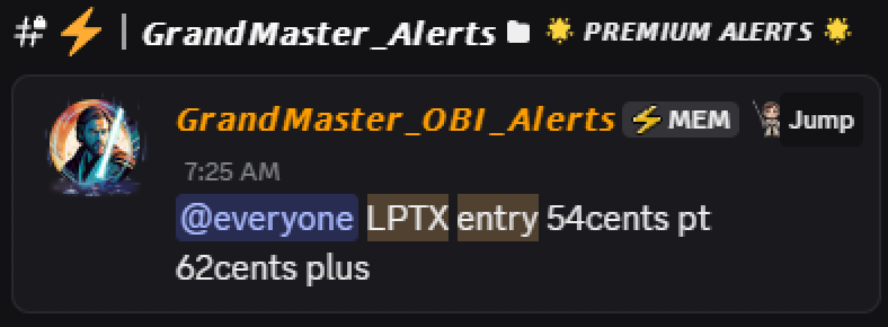

⚡ The Very Next Day: $LPTX Surges 242%

Just one day later, on November 12, Obi dropped another early-morning gem: Leap Therapeutics (LPTX). His analysis pointed out rising order flow pressure and a low-float setup primed for a squeeze.

By mid-day, LPTX ripped from $0.54 to $1.85, delivering another 242% move in less than six hours. For those who reinvested their previous $8,420 from the LFS trade, the compounding effect turned that into a staggering $28,700 in just two trading sessions.

Reddit users across r/PennyStocks and r/Daytrading couldn’t believe it.

“He’s trading like he’s seeing the order book seconds before the algorithms do,” one trader wrote.

“No one’s been this consistent since Roaring Kitty.”

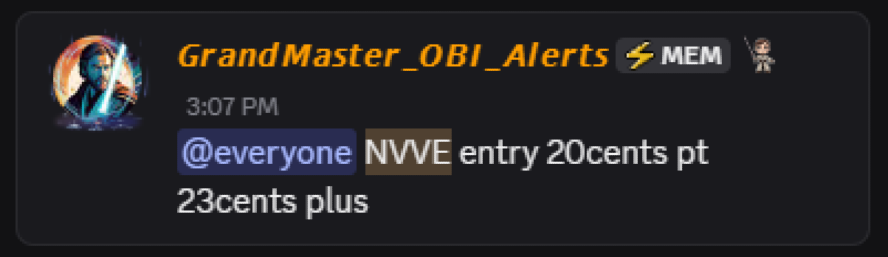

🚨 The Third Strike: $NVVE Doubles After Hours

Most traders would take a break after back-to-back parabolic calls — but not Grandmaster-Obi. Later that evening, during after-hours trading on November 12, he issued yet another call, this time on Nuvve Holding Corp (NVVE), at an entry of $0.20.

Within hours, NVVE shot up to $0.44, a 120% after-hours gain, continuing his jaw-dropping streak into the night.

If a trader had compounded all three plays — starting with just $1,000 in LFS, rolling profits into LPTX, and finally into NVVE — that initial stake would have grown to roughly $63,000 by the end of day three.

Even accounting for realistic profit-taking and fees, the move remains extraordinary — a 6,200% compounding gain in less than 72 hours.

💡 How He Does It: Pattern Recognition Meets Market Psychology

Grandmaster-Obi’s strategy is not luck — it’s data. He focuses on order flow velocity, float rotation, and momentum triggers that precede micro-cap breakouts. By tracking how liquidity builds just before market makers reposition, he identifies stocks seconds — sometimes minutes — before volume erupts.

He calls his method “Pre-Momentum Mapping” — and the results speak for themselves.

His community, the Making Easy Money Stock Market Server, has grown exponentially this quarter, filled with traders who watch him analyze real-time setups and explain his process live.

🧠 Beyond the Charts: The Psychology of a Winner

What separates Obi from most retail traders isn’t just analysis — it’s composure. He doesn’t chase hype or trade on emotion. He’s known for saying,

“If you’re emotional about the trade, you’ve already lost.”

That mindset, combined with precise technical execution, is why even professional traders have started watching his plays to understand what retail momentum is chasing next.

📈 From $1,000 to $63,000 — A New Era of Retail Power

If you’ve ever wondered what it looks like when retail traders take control of the market, look no further.

Three plays. Three days.

From $1,000 to $63,000 — verified, timestamped, and public.

Wall Street algorithms may dominate headlines, but Grandmaster-Obi is proving that a sharp retail trader with discipline, data, and vision can still lead the charge — and force institutions to react to him.

As the market heads into mid-November, traders everywhere are asking the same question:

What’s he going to call next?

Disclaimer: This article is for informational and educational purposes only and should not be considered financial advice. Trading involves risk. Always conduct independent research before investing.