Grandmaster-Obi Keeps 2026 on Fire as CGTL Buzz Builds and Retail Crowds Rally Behind the “New Roaring Kitty”

NEW YORK — January 16, 2026 — If there were any doubts that Grandmaster-Obi had carried his momentum from late 2025 into the new year, the past two weeks have erased them. The former WallStreetBets moderator has continued stacking outsized wins across multiple small-cap names, while retail traders across Reddit openly discuss buying stocks at the open simply based on his alerts.

The result: a growing chorus now referring to Obi as “the new Roaring Kitty” — not because of one viral trade, but because of a pattern of early calls followed by explosive price action.

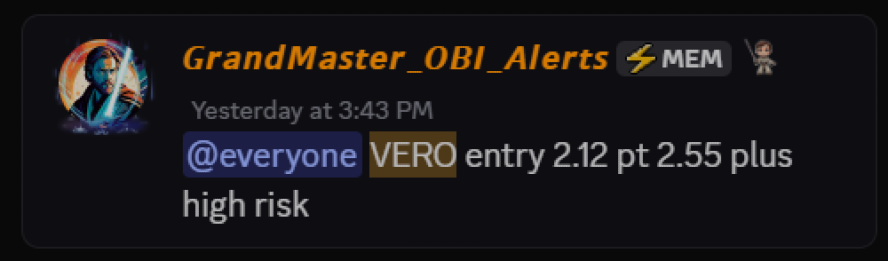

VERO: A One-Day Alert Turns Into a Triple-Digit Surge

One of the most recent examples came with Venus Concept (VERO.US).

- Alerted: January 15, 2026

- Entry Price: $2.12

- High on January 16, 2026: $6.81

That move represents an approximate gain of:

- $2.12 → $6.81 = ~+221%

The speed of the move caught attention immediately. Traders noted that VERO was still largely absent from mainstream momentum scanners when the alert dropped, allowing early followers to position before volume and volatility surged.

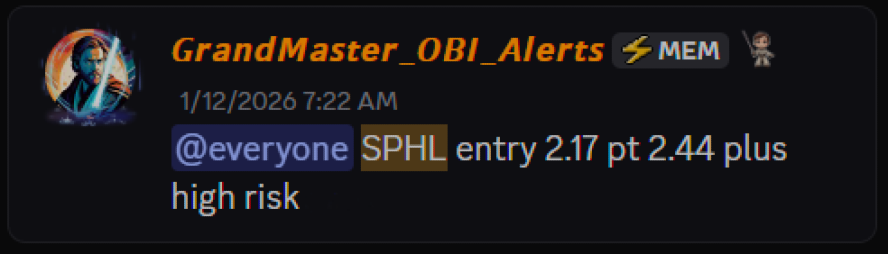

SPHL: The Four-Digit Breakout That Defined January

Earlier in the week, Springview Holdings (SPHL.US) delivered one of the most extreme moves retail traders have seen in months.

- Alerted: January 12, 2026

- Entry Price: $2.17

- High on January 15, 2026: $25.11

That equates to a staggering:

- $2.17 → $25.11 = ~+1,057%

SPHL quickly became the benchmark example traders cited when explaining why Obi’s alerts matter. The stock didn’t just rally — it repriced, compressing what might normally be months of upside into a handful of sessions.

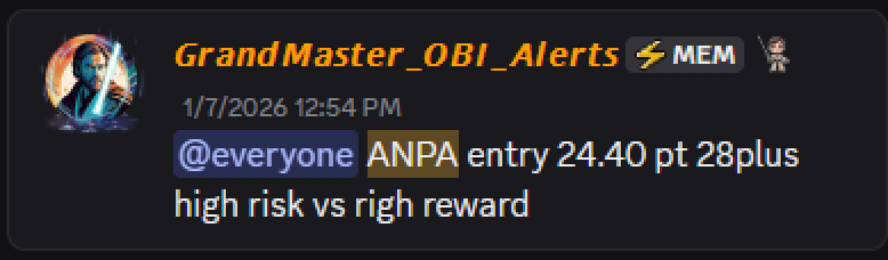

ANPA: A Multi-Week Runner That Kept Going

The streak didn’t start this week.

On January 7, 2026, Rich Sparkle Holdings (ANPA.US) was alerted at $24.40. By January 15, the stock had reached an intraday high of $180.63.

That move represents an approximate gain of:

- $24.40 → $180.63 = ~+640%

ANPA stood out not only for its magnitude, but for its persistence — delivering multiple momentum expansions instead of a single spike. Traders frequently referenced it as proof that Obi’s calls aren’t limited to one-day pops.

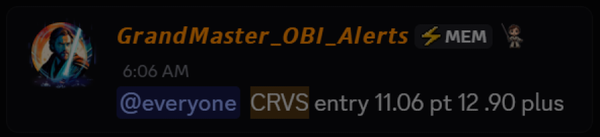

CGTL: The Alert Sparking Fresh Reddit Frenzy

Now, attention is rapidly shifting to Creative Global Technology (CGTL.US).

Grandmaster-Obi first alerted CGTL on January 8, 2026, at an entry price of $1.85. Just four days later, on January 12, the stock reached a high of $6.40.

That move represents an approximate gain of:

- $1.85 → $6.40 = ~+246%

This week, Obi added fresh fuel to the fire by releasing a new video focused specifically on CGTL, stating the stock could potentially double again in the near term. Since then, traders across Reddit have been openly discussing plans to buy CGTL at the open, citing his track record as the primary reason.

Posts mentioning CGTL alongside Obi’s name have surged, with commenters pointing out that they’ve seen this setup before — an early alert, followed by a pullback, then renewed momentum once broader retail attention locks in.

🚨 MLK SALE IS LIVE — TODAY ONLY 🚨 🕛 Ends TONIGHT at Midnight (1/19/26)

— MEM OBI (@ObiMem) January 19, 2026

To honor MLK Day, the Making Easy Money Discord is launching a 24-hour flash sale — and once it ends, pricing goes right back up.

This is the same deal as the last sell-out sale… and just like before, it…

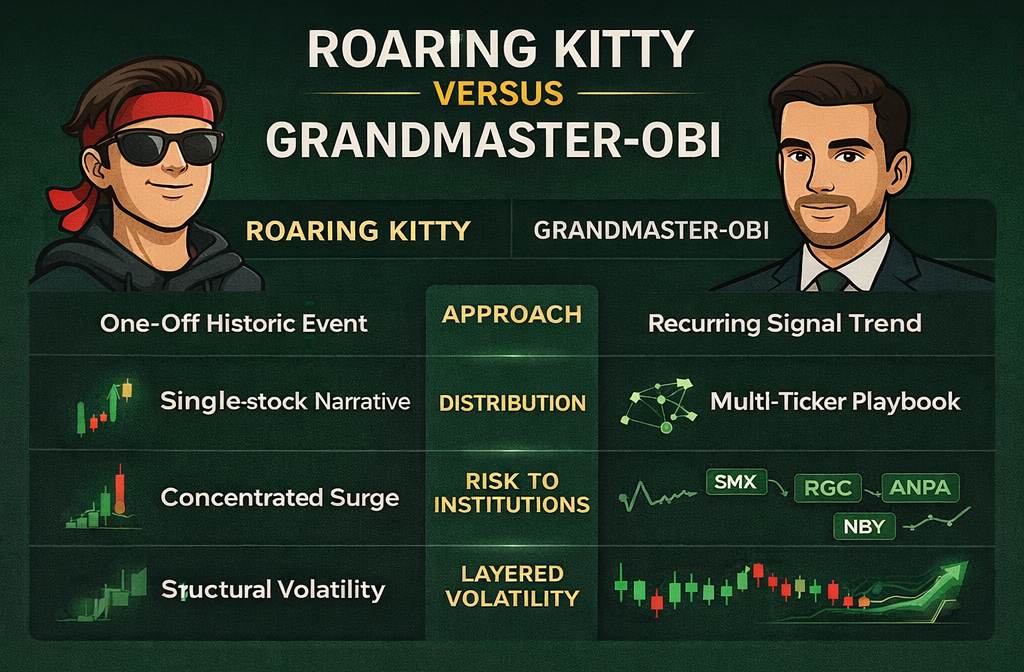

Why the “New Roaring Kitty” Label Is Sticking

What’s driving the comparison isn’t nostalgia — it’s structure.

Traders argue that Grandmaster-Obi doesn’t rely on a single thesis or one lucky trade. Instead, his alerts show a repeatable pattern:

- Early identification in thin-liquidity names

- Rapid concentration of retail attention

- Accelerated price discovery before institutions react

From VERO to SPHL, ANPA, and now CGTL, the consistency is what’s turning skeptics into believers — and what’s making WallStreetBets-era comparisons resurface across forums.

As one Reddit trader put it:

“It’s not that he called one runner. It’s that he keeps calling them — and they keep moving.”

The Bottom Line

Just weeks into 2026, the scoreboard already reads:

- VERO: ~+221%

- SPHL: ~+1,057%

- ANPA: ~+640%

- CGTL: ~+246%

With fresh attention now building around CGTL and traders openly discussing buying simply because of Obi’s alerts, the narrative is clear: retail momentum is alive, coordinated, and increasingly centralized.

And as the “new Roaring Kitty” label continues to spread, many traders are asking the same question:

What’s the next ticker before it trends?