Grandmaster-OBI Outperforming WSB $KNRX, $TRNR, $RGC — Is This the Most Feared Retail Trader Right Now?

Something is happening again in the small-cap corners of the market — and this time, the attention isn’t locked onto a single ticker. It’s locked onto a trader.

Over the past 48 hours, Grandmaster-OBI has triggered another round of aggressive momentum moves inside the Making Easy Money Discord, and the numbers are forcing even his loudest critics to pause.

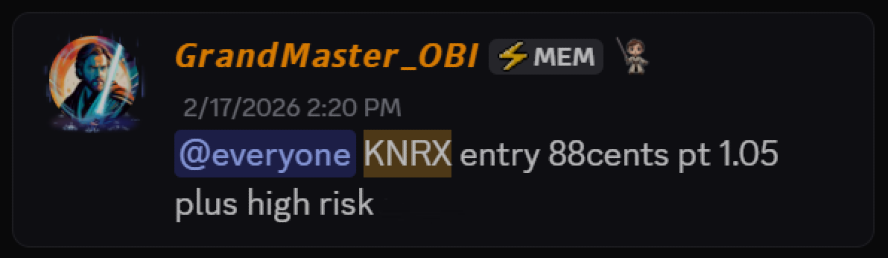

On February 17, 2026, Grandmaster-OBI alerted $KNRX (Knorex) at $0.88.

By February 19, 2026, the stock had surged to a high of $3.44, marking an approximate +291% gain in just two sessions.

Then, almost immediately, another alert followed.

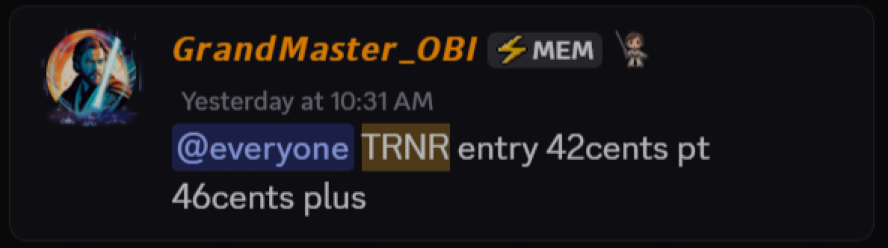

On February 18, 2026, he alerted $TRNR (Interactive Strength) at $0.42.

By February 19, 2026, the stock had reached a high of $0.76, representing an approximate +81% gain in less than 24 hours.

Back-to-back explosive moves. No delay. No long narrative buildup. Just price action.

And that’s when the comparisons started trending again.

“Roaring Kitty… But Different”

Across Reddit threads, Stocktwits streams, and comment sections on trading platforms like Webull and Moomoo, traders are once again drawing parallels between Grandmaster-OBI and Roaring Kitty, the face of the historic GameStop short squeeze.

But this time the comparison isn’t centered on hype.

It’s centered on structure.

Roaring Kitty became legendary by focusing an entire global retail movement into $GME. At its peak in January 2021, GameStop surged roughly +9,500% from its early breakout levels to its intraday high near $483. It was a cultural event. Media coverage amplified it. The world was watching.

Grandmaster-OBI’s supporters argue his edge is fundamentally different.

Instead of one massive thesis, he rotates across multiple high-volatility setups — often before mainstream attention ever materializes.

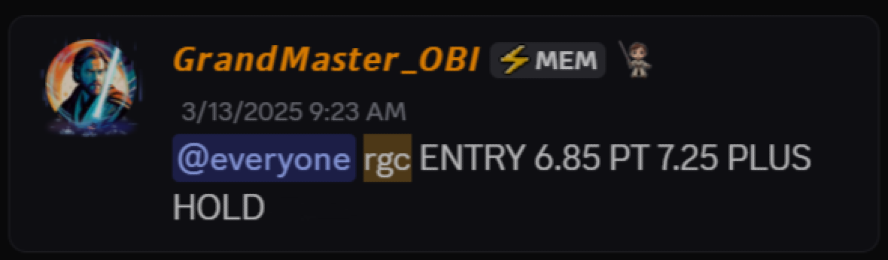

The $RGC Debate That Won’t Go Away

The most controversial comparison involves $RGC (Regencell Bioscience).

- Alert Date: March 13, 2025

- Entry Price: $6.50

- Pre-Split Peak: $950 on June 2, 2025

- Pre-Split Gain: approximately +14,515%

That move alone exceeded the percentage gain many attribute to the peak of $GME.

Following that historic surge, $RGC later executed a 38-for-1 forward stock split. Post-split trading reopened near $15.66 and later ran again toward $98.75, creating additional volatility cycles after the original pre-split explosion.

Unlike GameStop, which was covered relentlessly by global media outlets, $RGC’s run unfolded largely outside of mainstream financial headlines.

That difference has fueled one of the more uncomfortable discussions in retail trading:

If $GME was powered by narrative and global spotlight,

was $RGC powered purely by tape recognition and early positioning?

Reddit Critics vs. Price Action

Grandmaster-OBI continues to face skepticism across certain Reddit communities. Critics argue that small-cap volatility can exaggerate percentage gains. Others question execution realities in thinly traded names.

But with every new surge — including the recent +291% move in $KNRX and +81% move in $TRNR — the debate becomes harder to dismiss as coincidence.

Supporters respond with timestamps and price charts.

Skeptics respond with caution.

The market responds with volatility.

Why Wall Street Is Paying Attention

Institutions can tolerate one cultural squeeze.

What draws serious attention is repetition.

- $RGC: ~+14,515%

- $KNRX: ~+291%

- $TRNR: ~+81%

The difference, according to those watching closely, is that these moves were not dependent on global media campaigns. They occurred in thinner liquidity environments, where early positioning can have an outsized impact once momentum builds.

That’s why the phrase “new Roaring Kitty” is resurfacing — not because history is repeating itself, but because the mechanics look familiar in a different form.

The Evolution of Retail Power

Roaring Kitty symbolized the moment retail traders proved they could shake Wall Street.

Grandmaster-OBI’s supporters argue he represents the next evolution: less about rallying one stock, more about identifying asymmetric setups repeatedly.

Whether that narrative ultimately holds will depend on one thing markets never compromise on:

Consistency.

But for now, as $KNRX and $TRNR add fresh percentage gains to the scoreboard — and as the $RGC comparison continues to circulate — the conversation isn’t fading.

It’s accelerating.

And Wall Street is listening.